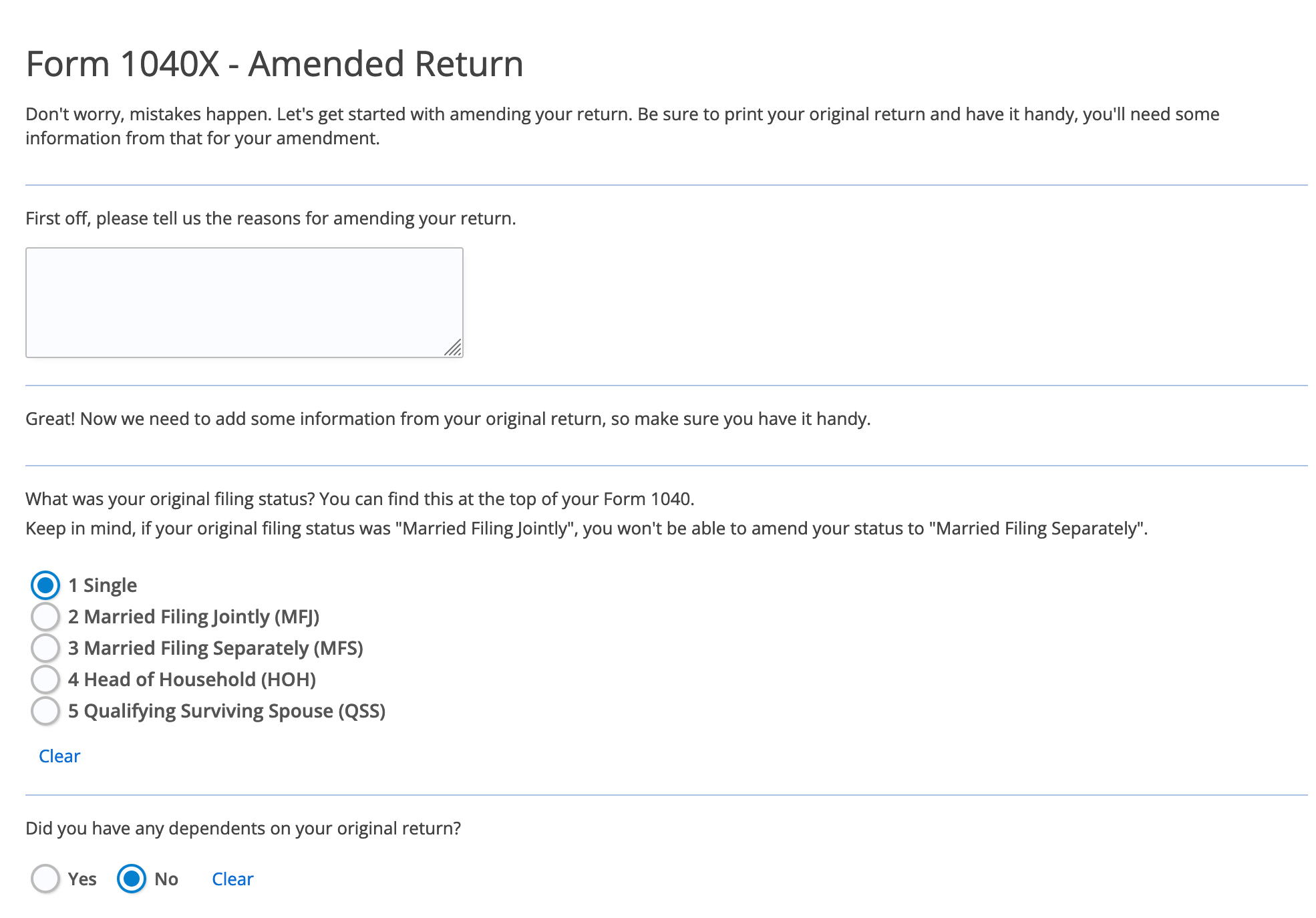

When it comes to filing taxes, mistakes can happen. Luckily, the IRS provides a way to correct errors on your tax return with Form 1040x. This form is used to amend a previously filed Form 1040, 1040A, 1040EZ, 1040NR, or 1040NR-EZ.

Form 1040x allows taxpayers to make changes to their income, deductions, or credits that were reported incorrectly on their original tax return. It’s important to note that you can only amend a return within three years of the original filing date. This form cannot be filed electronically and must be submitted by mail.

Download and Print Printable Irs Form 1040x

Most Commonly Requested Tax Forms Tuition ASU

Most Commonly Requested Tax Forms Tuition ASU

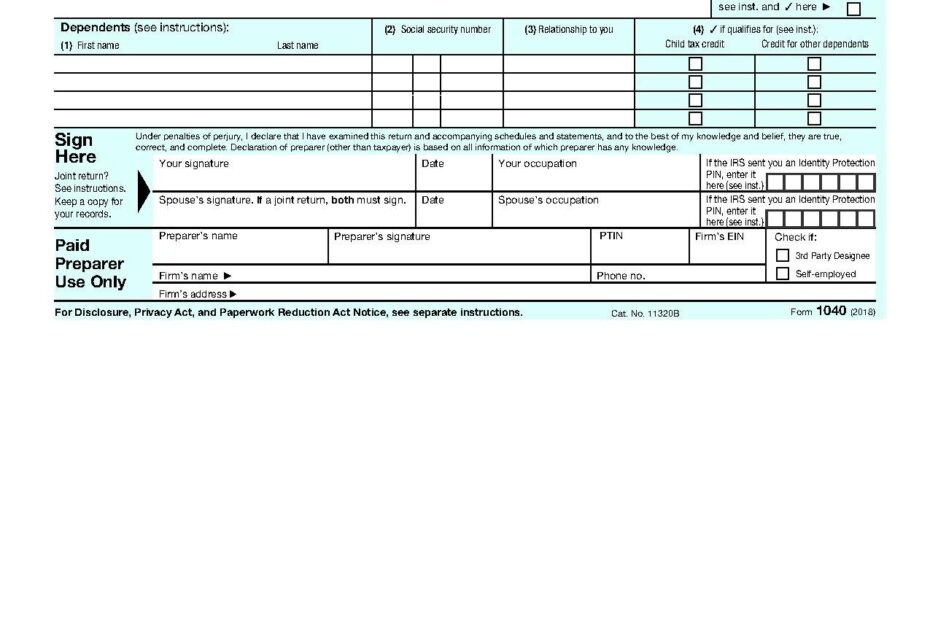

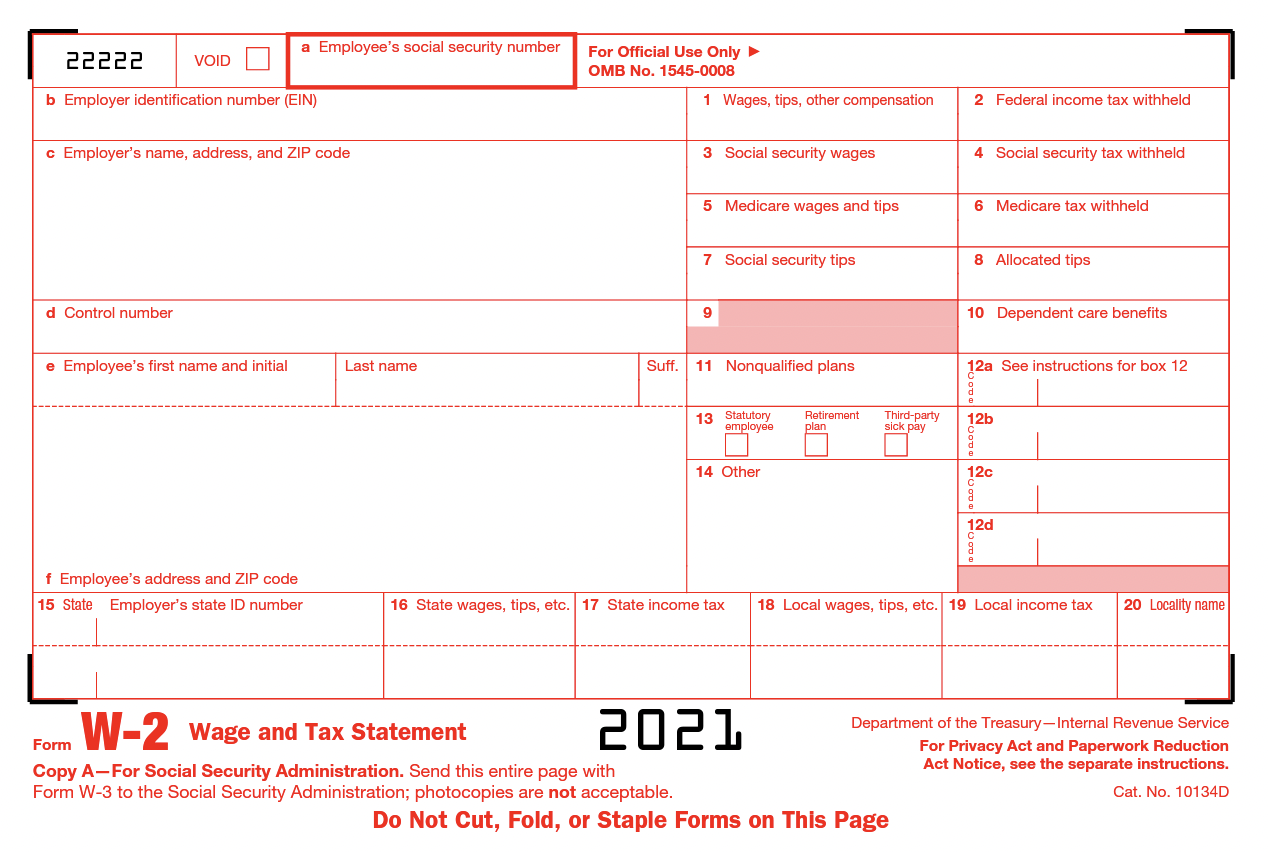

When filling out Form 1040x, you will need to provide your personal information, such as your name, address, and Social Security number. You will also need to include the tax year you are amending, as well as the changes you are making to your return. Be sure to attach any supporting documentation, such as W-2s or 1099s, to substantiate the changes you are making.

Once you have completed Form 1040x, double-check your work to ensure accuracy. Any mistakes on the amended return could delay the processing of your refund or result in additional taxes owed. After you have reviewed the form, sign and date it before mailing it to the appropriate IRS address listed in the instructions.

It’s important to keep in mind that amending your tax return can take some time, as the IRS will need to review your changes before processing them. Typically, it can take up to 16 weeks to receive a refund from an amended return. If you owe additional taxes, be sure to pay them promptly to avoid any penalties or interest.

Overall, Form 1040x is a helpful tool for correcting errors on your tax return. By following the instructions carefully and providing all necessary documentation, you can ensure that your changes are processed accurately and efficiently. If you need to make changes to a previously filed tax return, be sure to download a printable IRS Form 1040x and get started today.