When it comes to filing your taxes, choosing the right form can make a world of difference. The IRS Form 1040EZ is a simplified version of the standard Form 1040, designed for taxpayers with straightforward tax situations. This form is perfect for those who have no dependents, do not itemize deductions, and have a taxable income of less than $100,000.

Many taxpayers prefer the Form 1040EZ because it is easy to understand and complete. It only requires basic information such as income, deductions, and tax credits. Additionally, this form allows you to file electronically or by mail, giving you flexibility in how you choose to submit your tax return.

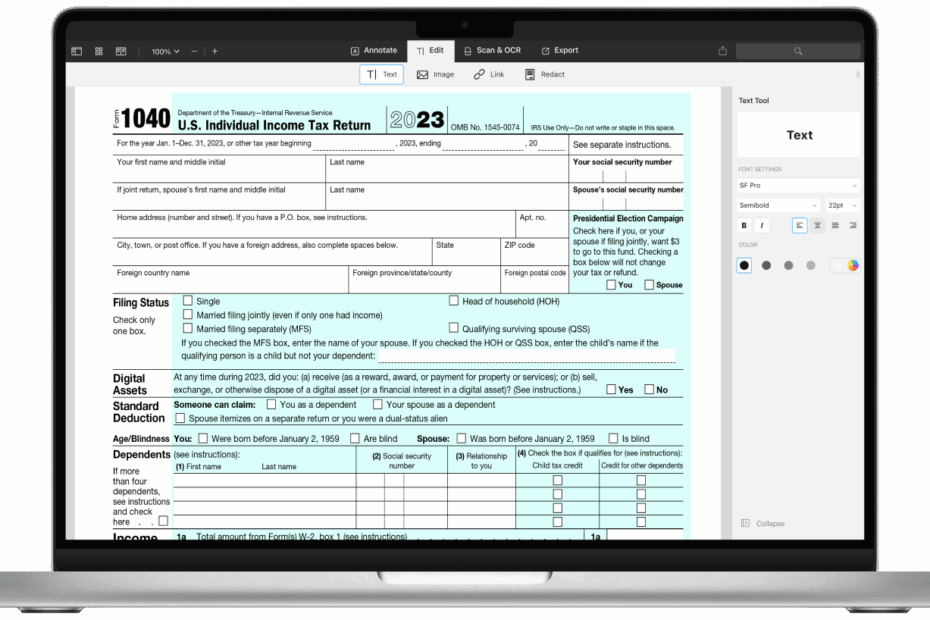

Easily Download and Print Printable Irs Form 1040ez

Free Irs 1040ez Worksheet Download Free Irs 1040ez Worksheet Png Images Free Worksheets On Clipart Library

Free Irs 1040ez Worksheet Download Free Irs 1040ez Worksheet Png Images Free Worksheets On Clipart Library

Printable IRS Form 1040EZ

If you prefer to file your taxes on paper rather than electronically, you can easily access and print the IRS Form 1040EZ from the official IRS website. Simply visit the IRS Forms and Publications page, locate the Form 1040EZ, and download the PDF file. Once you have the form downloaded, you can fill it out manually and mail it to the IRS.

When filling out the Form 1040EZ, be sure to double-check all information to ensure accuracy. Any mistakes or omissions could result in delays in processing your tax return or potential penalties from the IRS. It’s always a good idea to review the instructions provided with the form to ensure you are completing it correctly.

Once you have completed the Form 1040EZ, you can mail it to the IRS along with any required documentation, such as W-2 forms or 1099s. Be sure to keep a copy of your tax return for your records, as well as any supporting documents. If you have any questions or need assistance with filling out the form, consider seeking help from a tax professional or utilizing IRS resources.

In conclusion, the IRS Form 1040EZ is a convenient option for taxpayers with simple tax situations. By accessing the printable form from the IRS website and following the instructions carefully, you can easily file your taxes and potentially receive a refund in a timely manner. Remember to file your taxes on time to avoid any penalties or interest charges from the IRS.