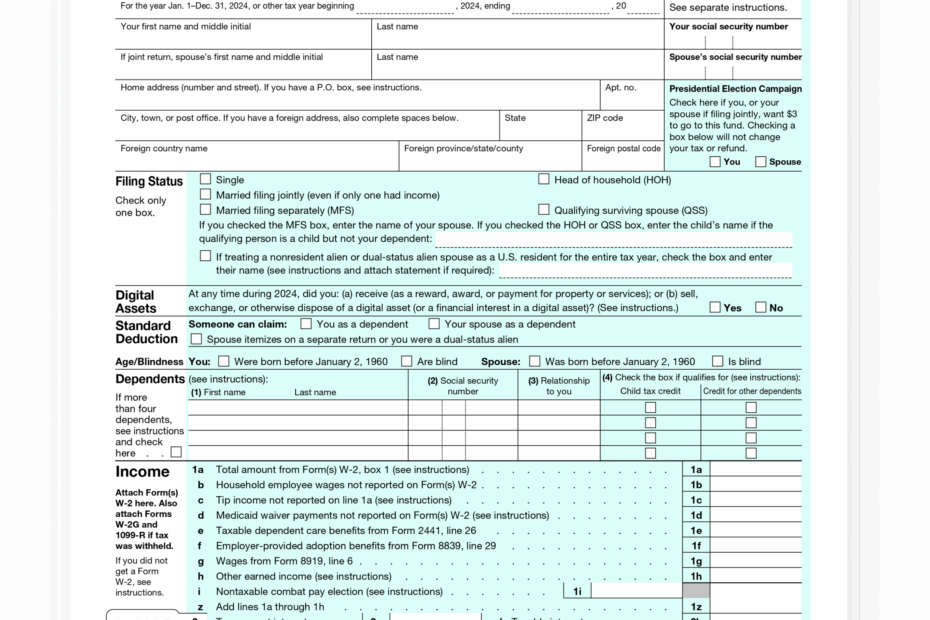

When it comes to filing your taxes, having the right forms on hand is crucial. The IRS Form 1040a is a simplified version of the standard Form 1040, making it easier for individuals with less complex tax situations to file their taxes. This form is ideal for those who do not itemize deductions and have a taxable income of $100,000 or less.

With the convenience of being able to print IRS Form 1040a from the comfort of your own home, you can easily complete and submit your taxes without the need for a tax professional. This form is designed to streamline the tax filing process and make it more accessible to individuals who may not have the resources to hire a professional.

Easily Download and Print Printable Irs Form 1040a

How To Fill Out IRS Form 1040 What Is IRS Form 1040 ES

How To Fill Out IRS Form 1040 What Is IRS Form 1040 ES

Printable IRS Form 1040a

IRS Form 1040a is a two-page document that covers income, deductions, and credits. It is a straightforward form that allows you to report your income, claim deductions, and calculate your tax liability. By filling out this form, you can ensure that you are accurately reporting your income and claiming any credits or deductions that you may be eligible for.

One of the key benefits of using IRS Form 1040a is that it allows you to take advantage of certain tax credits that may not be available if you were to use the standard Form 1040. This can result in a lower tax liability and potentially a larger refund. Additionally, this form is easier to fill out and understand, making the tax filing process less daunting for individuals.

When using the printable version of IRS Form 1040a, be sure to carefully follow the instructions provided by the IRS. Double-check your entries and calculations to avoid any errors that could delay the processing of your tax return. Once you have completed the form, you can submit it either electronically or by mail, depending on your preference.

In conclusion, IRS Form 1040a is a simple and convenient form that is perfect for individuals with straightforward tax situations. By using the printable version of this form, you can easily file your taxes from the comfort of your own home. Be sure to take advantage of this resource to ensure that you are accurately reporting your income and maximizing your tax benefits.