As tax season rolls around each year, many individuals find themselves in need of the necessary forms to file their taxes. One commonly used form is the IRS Form 1040, which is used to report an individual’s income and determine their tax liability. For senior citizens, there is a specific version of this form known as the IRS Form 1040 SR.

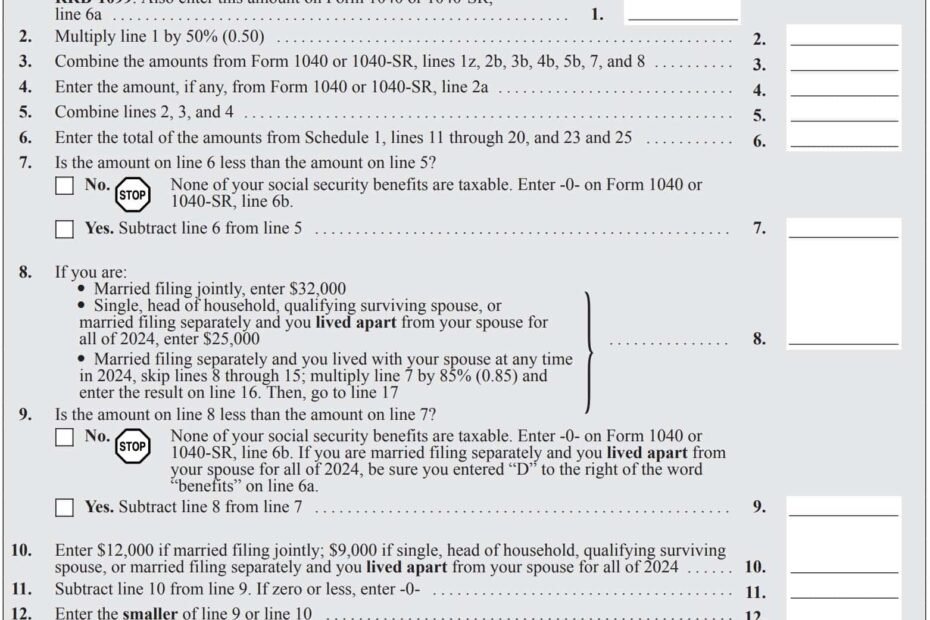

The IRS Form 1040 SR is designed specifically for individuals who are aged 65 or older. This form includes larger text and a more straightforward layout, making it easier for seniors to navigate and understand. It also includes specific lines for reporting additional sources of income that are common among retirees, such as Social Security benefits and retirement account distributions.

Save and Print Printable Irs Form 1040 Sr

Farewell 1040 Postcard We Hardly Knew Ye Current Federal Tax Developments

Farewell 1040 Postcard We Hardly Knew Ye Current Federal Tax Developments

When it comes time to file their taxes, seniors can easily access a printable version of the IRS Form 1040 SR on the official IRS website. This form can be downloaded, filled out, and submitted just like any other tax form. By using the 1040 SR, seniors can ensure that they are accurately reporting their income and taking advantage of any available tax credits or deductions.

One benefit of using the IRS Form 1040 SR is that it allows seniors to claim the standard deduction for taxpayers who are 65 and older. This deduction is higher than the standard deduction for younger individuals, providing seniors with a tax break that reflects their increased medical expenses and other financial needs. By taking advantage of the 1040 SR, seniors can maximize their tax savings and ensure that they are in compliance with the IRS regulations.

In conclusion, the IRS Form 1040 SR is a valuable resource for seniors who are looking to file their taxes accurately and efficiently. By using this form, seniors can take advantage of the specific benefits available to older taxpayers and ensure that they are meeting their tax obligations. With a printable version of the form readily available online, seniors can easily access and complete the 1040 SR without any hassle.