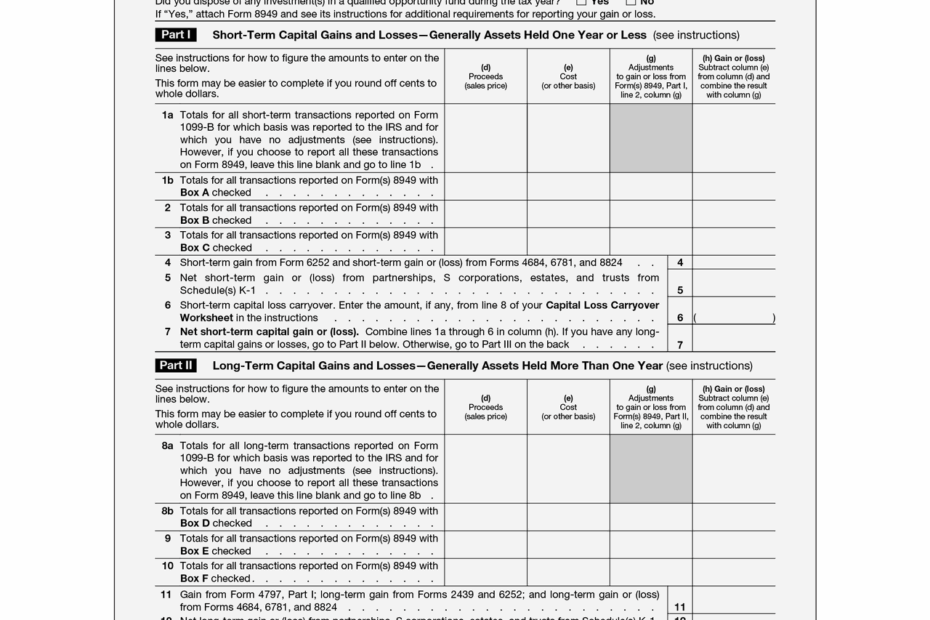

When it comes to filing your taxes, one of the most important forms to consider is the IRS Form 1040 Schedule D. This form is used to report capital gains and losses from investment activities. It is essential for taxpayers who have sold stocks, bonds, or other investments during the tax year to accurately report these transactions on Schedule D.

It is important to note that Schedule D is not a standalone form and must be filed along with your Form 1040 when reporting capital gains and losses. It is crucial to accurately complete Schedule D to avoid any potential issues with the IRS and ensure that you are paying the correct amount of taxes on your investment income.

Printable Irs Form 1040 Schedule D

Printable Irs Form 1040 Schedule D

Save and Print Printable Irs Form 1040 Schedule D

Instructions For Filling Out Form 1040 Schedule D Pilot Blog

Instructions For Filling Out Form 1040 Schedule D Pilot Blog

When filling out Schedule D, taxpayers will need to provide details on each investment transaction, including the date of purchase, date of sale, purchase price, sale price, and any associated expenses. Additionally, taxpayers will need to calculate their net capital gain or loss for the tax year and report this amount on their Form 1040.

For those who prefer to fill out their tax forms by hand, printable IRS Form 1040 Schedule D can be easily found on the IRS website or through tax preparation software. Having a printable version of Schedule D on hand can help taxpayers ensure that they are accurately reporting their investment income and avoiding any potential errors on their tax return.

It is important to keep in mind that Schedule D can be complex, especially for those with multiple investment transactions throughout the year. Seeking the assistance of a tax professional or using tax software can help ensure that you are accurately reporting your capital gains and losses on Schedule D and avoiding any potential issues with the IRS.

Overall, understanding and accurately completing IRS Form 1040 Schedule D is essential for taxpayers who have investment income. By taking the time to properly report your capital gains and losses, you can ensure that you are compliant with IRS regulations and avoid any potential penalties or audits.