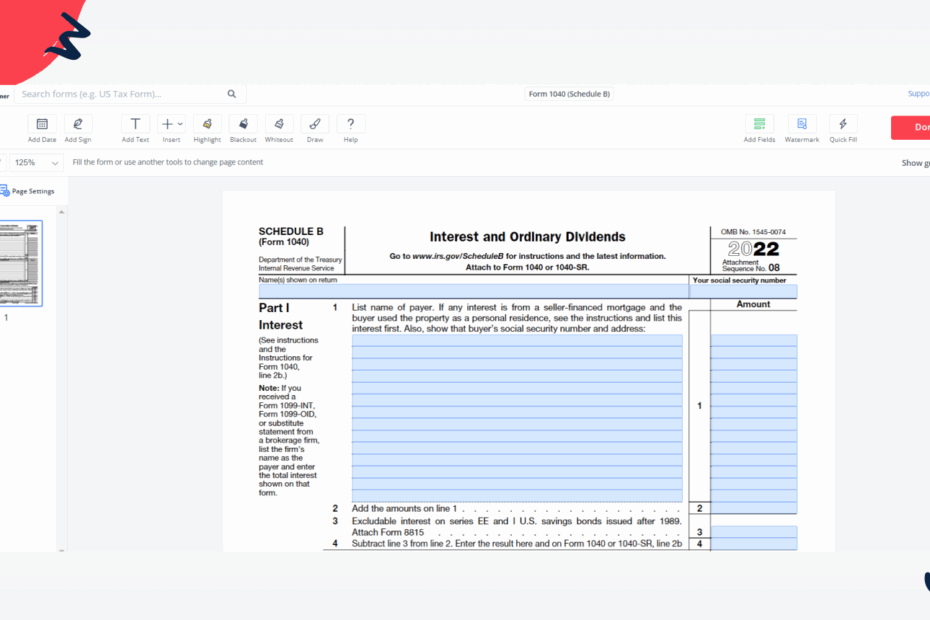

When it comes to filing your taxes, it’s important to make sure you have all the necessary forms in order to accurately report your income and deductions. One such form that may be required is IRS Form 1040 Schedule B, which is used to report interest and ordinary dividends.

For individuals who earn interest and dividends from investments, banks, or other financial institutions, Schedule B is essential for reporting this income to the IRS. It helps ensure that all taxable income is properly accounted for and that any associated tax liabilities are paid in full.

Printable Irs Form 1040 Schedule B

Printable Irs Form 1040 Schedule B

Download and Print Printable Irs Form 1040 Schedule B

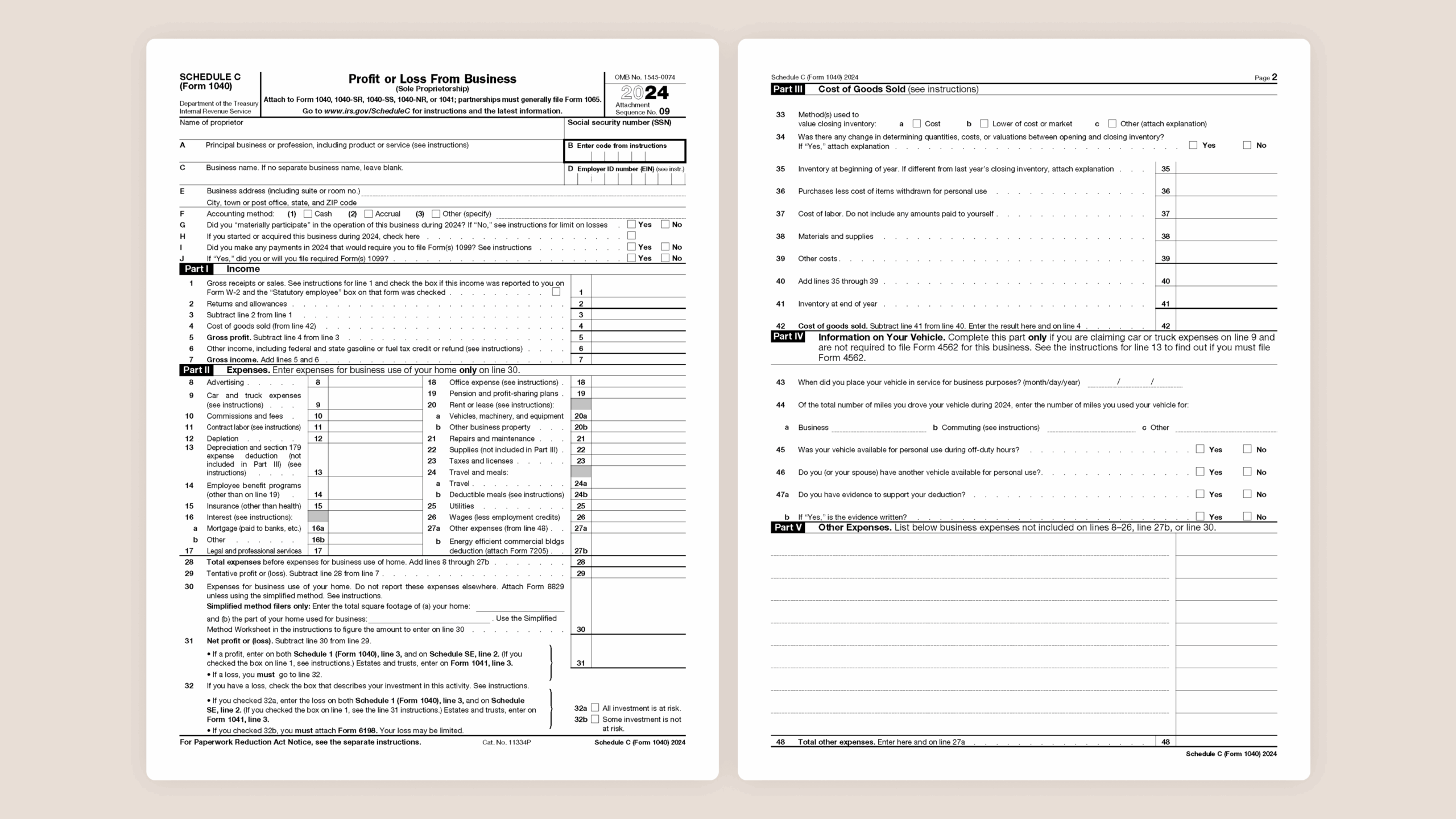

Understanding The Schedule C Tax Form

Understanding The Schedule C Tax Form

When filling out Schedule B, it’s important to carefully follow the instructions provided by the IRS to ensure accuracy. You will need to report the name of each payer, the amount of interest or dividends received, and any related tax withholding. Once completed, you will attach Schedule B to your Form 1040 when filing your taxes.

It’s worth noting that not everyone will need to file Schedule B. If your interest income is below a certain threshold or if you didn’t receive any dividends during the tax year, you may not be required to file this form. However, it’s always best to consult with a tax professional or the IRS to determine your specific filing requirements.

For those who do need to file Schedule B, there are printable versions available on the IRS website. These forms can be easily downloaded and printed for your convenience. Be sure to double-check that you are using the most up-to-date version of the form to avoid any errors or delays in processing your tax return.

Overall, IRS Form 1040 Schedule B plays a crucial role in accurately reporting interest and dividend income to the IRS. By following the instructions provided and ensuring that all relevant information is reported correctly, you can help avoid any potential issues with your tax return. If you have any questions or need assistance with filling out Schedule B, don’t hesitate to seek guidance from a tax professional or the IRS.