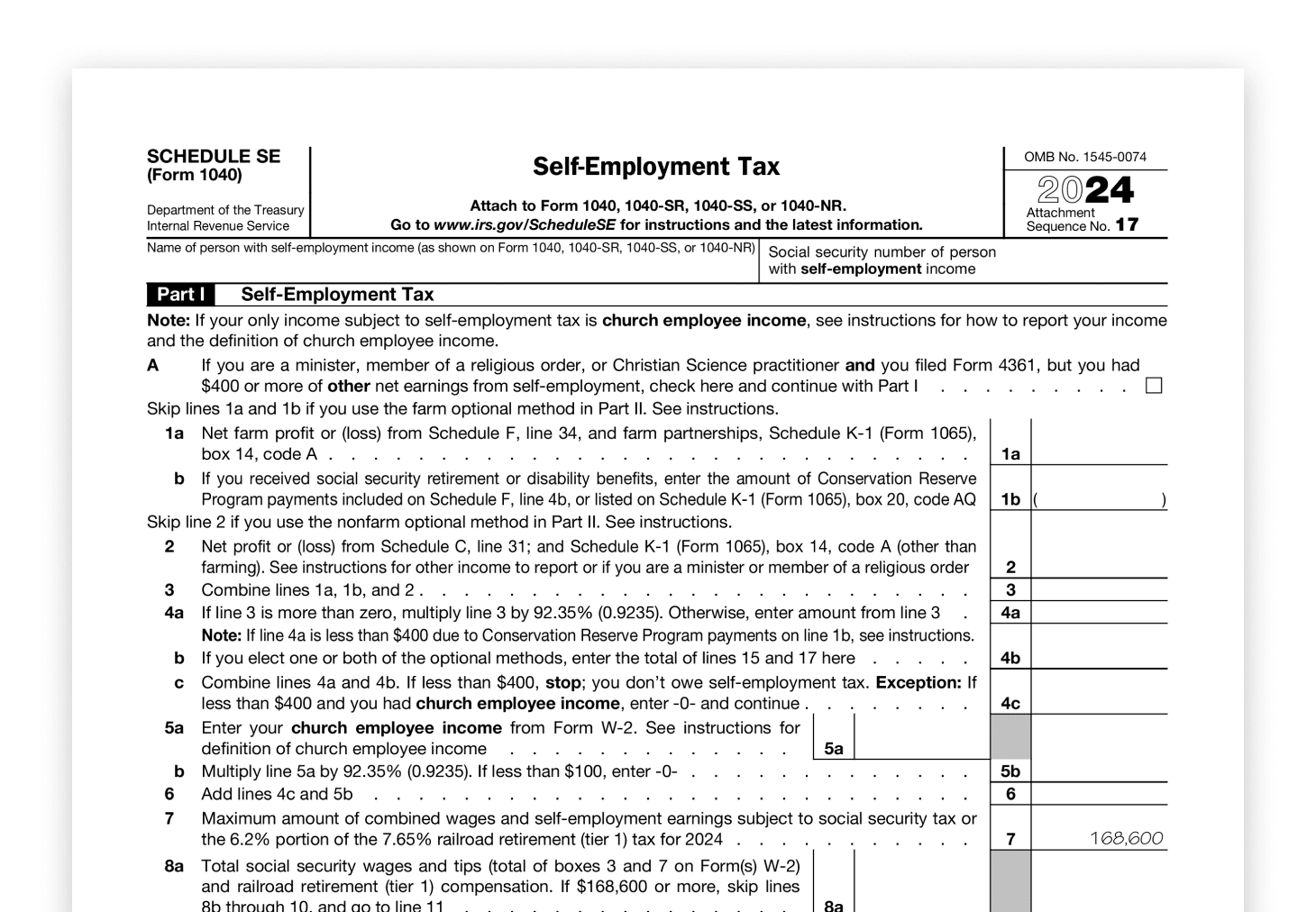

When it comes to filing your taxes, it’s important to make sure you are taking advantage of all the deductions and credits available to you. One way to do this is by using IRS Form 1040 Schedule A, also known as the Itemized Deductions form. This form allows you to deduct various expenses such as medical and dental expenses, state and local taxes, mortgage interest, and charitable contributions.

By itemizing your deductions using Schedule A, you may be able to lower your taxable income and ultimately reduce the amount of tax you owe. It’s important to carefully review the form and ensure you are including all eligible expenses to maximize your tax savings.

Printable Irs Form 1040 Schedule A

Printable Irs Form 1040 Schedule A

Download and Print Printable Irs Form 1040 Schedule A

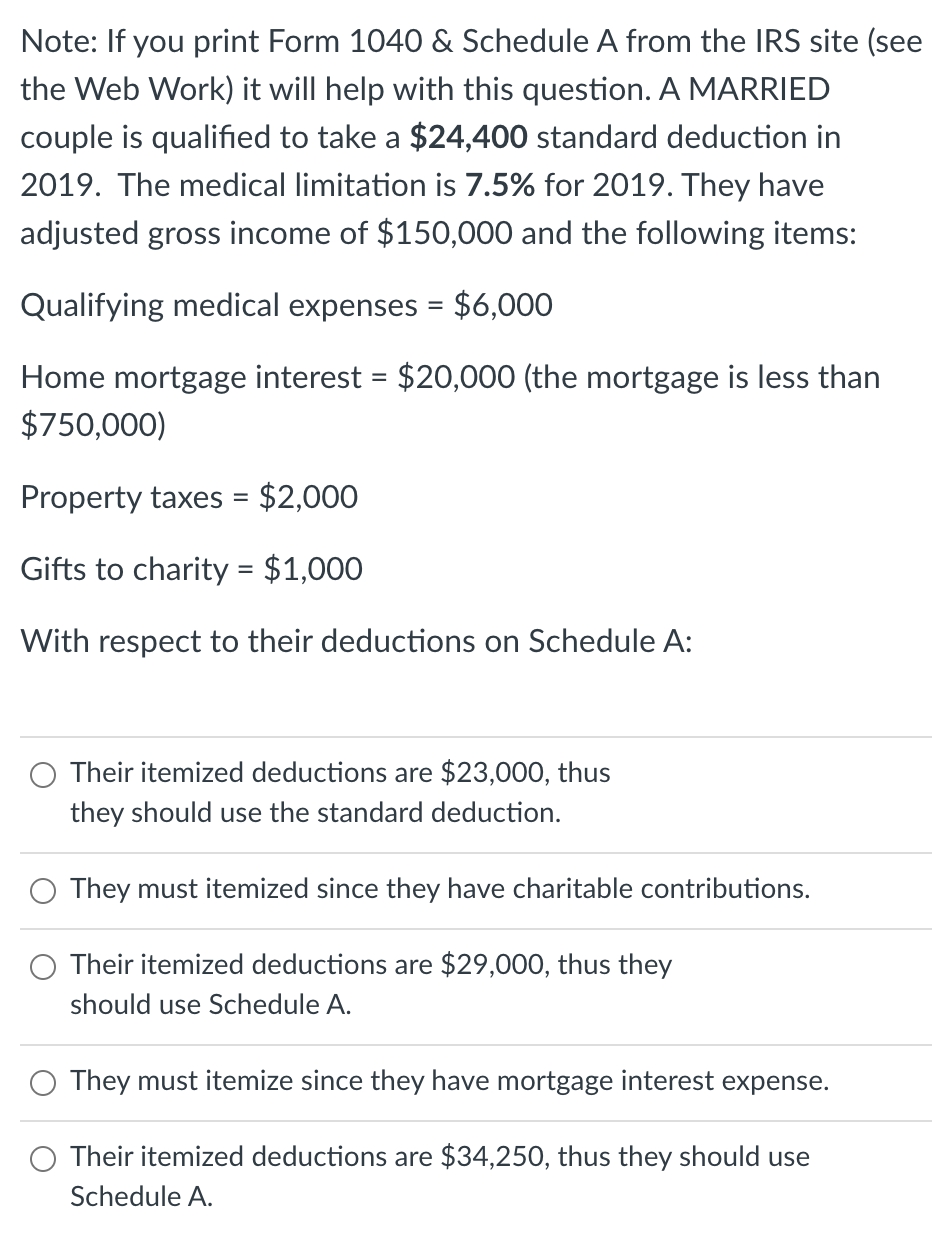

Solved Note If You Print Form 1040 U0026 Schedule A From The Chegg Worksheets Library

Solved Note If You Print Form 1040 U0026 Schedule A From The Chegg Worksheets Library

When filling out IRS Form 1040 Schedule A, it’s important to gather all relevant documentation to support your deductions. This may include receipts, invoices, and other proof of expenses. Additionally, you’ll need to carefully follow the instructions provided on the form to ensure accurate reporting.

It’s worth noting that not everyone will benefit from using Schedule A to itemize deductions. For some taxpayers, taking the standard deduction may be a more advantageous option. It’s important to compare the two methods and choose the one that results in the greatest tax savings for your individual situation.

Overall, IRS Form 1040 Schedule A can be a valuable tool for reducing your tax liability and maximizing your deductions. By carefully reviewing the form, gathering necessary documentation, and accurately reporting your expenses, you can ensure you are taking full advantage of all available tax benefits.

So, if you believe that itemizing your deductions using IRS Form 1040 Schedule A is the right choice for you, be sure to download a printable version of the form from the IRS website or consult with a tax professional for assistance. With the proper information and guidance, you can navigate the tax filing process with confidence and potentially save money on your taxes.