As the tax deadline approaches, many individuals and businesses may find themselves in need of extra time to file their tax returns. The Internal Revenue Service (IRS) allows taxpayers to request an extension to file their taxes, giving them an additional six months to submit their forms. One way to request an extension is by filling out the IRS Extension Form 2025.

Form 2025 is a simple document that taxpayers can use to request an extension to file their tax return. By submitting this form, individuals and businesses can avoid late filing penalties and have more time to gather the necessary documents and information needed to accurately complete their tax return.

Printable Irs Extension Form 2025

Printable Irs Extension Form 2025

Save and Print Printable Irs Extension Form 2025

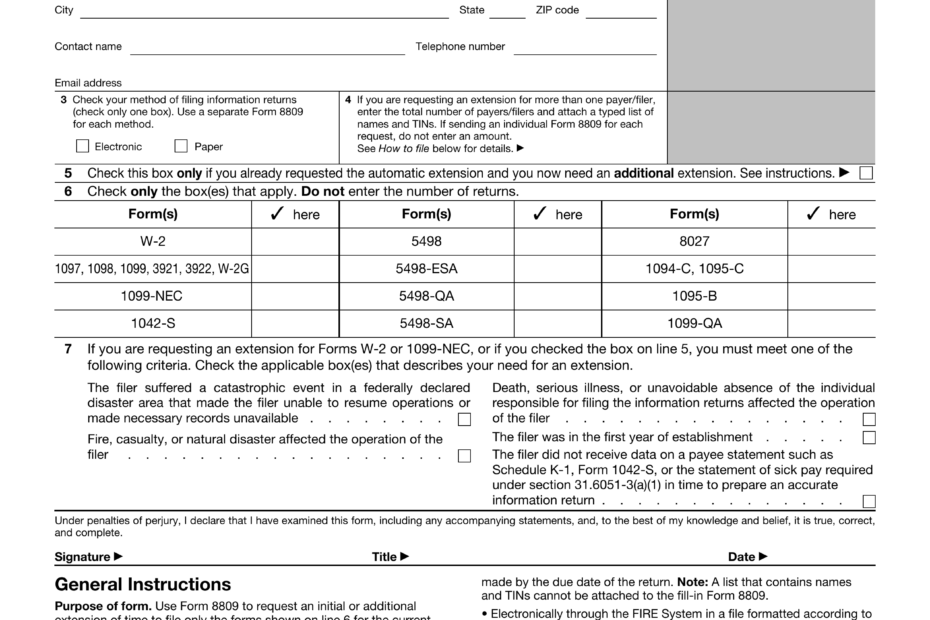

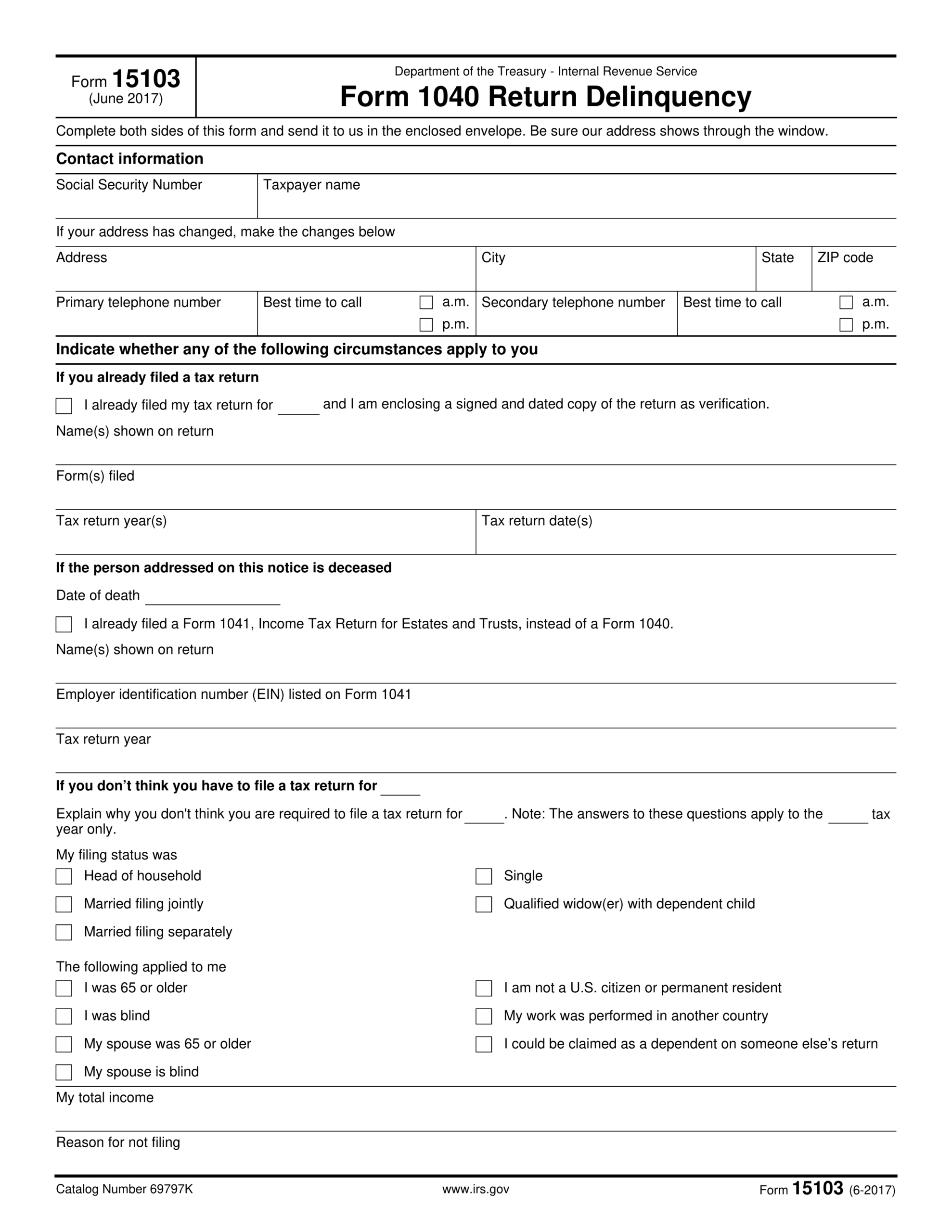

3 11 212 Applications For Extension Of Time To File Internal

3 11 212 Applications For Extension Of Time To File Internal

When filling out Form 2025, taxpayers will need to provide their name, address, Social Security number or employer identification number, estimated tax liability, and the total amount of tax paid. It’s important to fill out this form accurately and submit it before the tax deadline to avoid any penalties or interest charges.

Once the IRS receives Form 2025, they will grant an automatic six-month extension to file the tax return. However, it’s important to note that this extension only applies to filing the tax return, not to paying any taxes owed. Taxpayers are still required to estimate their tax liability and pay any taxes owed by the original tax deadline to avoid interest charges.

Form 2025 can be easily found on the IRS website and can be filled out electronically or printed and mailed to the IRS. It’s a straightforward process that can provide taxpayers with the extra time they need to accurately complete their tax return without facing any unnecessary penalties.

In conclusion, if you find yourself needing extra time to file your tax return, consider filling out the IRS Extension Form 2025. By submitting this form, you can avoid late filing penalties and have the peace of mind knowing that you have more time to gather all the necessary information to accurately complete your tax return.