As a taxpayer, it is important to stay on top of your estimated tax payments throughout the year to avoid any penalties or surprises come tax time. The IRS provides various forms for individuals and businesses to calculate and submit their estimated tax payments. These forms are essential for accurately reporting and paying your taxes on time.

One convenient option for taxpayers is to use printable IRS estimated tax forms, which can be easily downloaded and filled out online. This allows for a more organized approach to managing your estimated tax payments and ensures that you are meeting your tax obligations throughout the year.

Printable Irs Estimated Tax Forms

Printable Irs Estimated Tax Forms

Download and Print Printable Irs Estimated Tax Forms

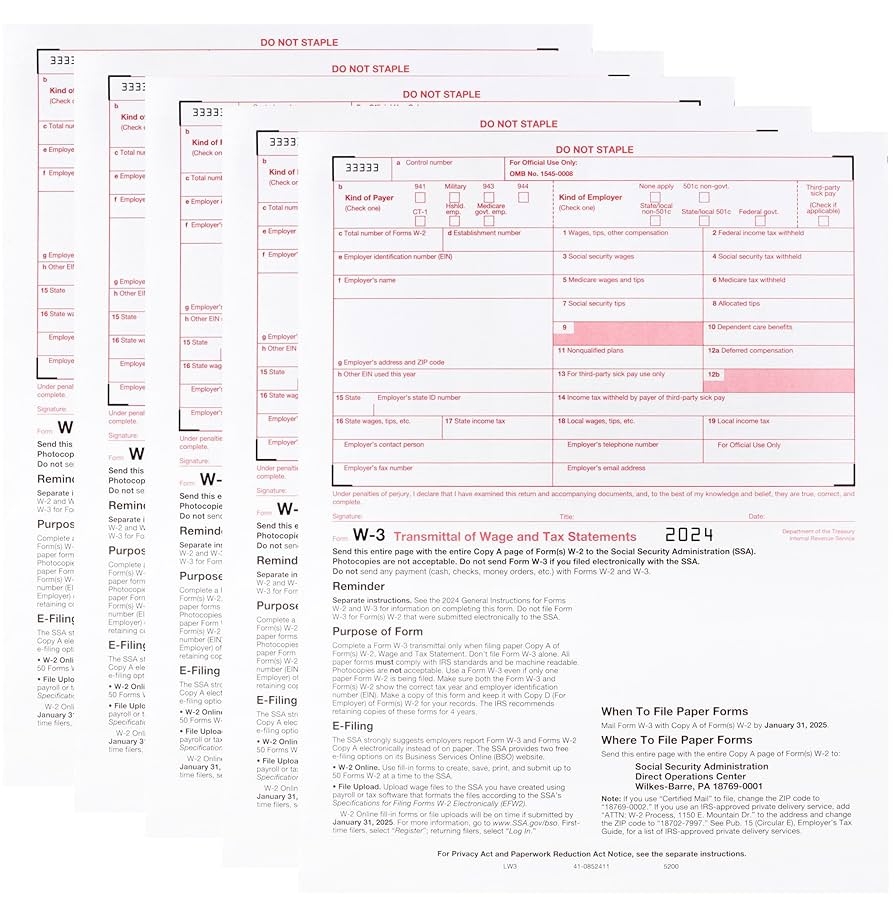

Free Printable 2024 W 3 Transmittal Forms Pack Of 10 IRS Approved Laser Forms For W 2 Submission Irs Forms 2024

Free Printable 2024 W 3 Transmittal Forms Pack Of 10 IRS Approved Laser Forms For W 2 Submission Irs Forms 2024

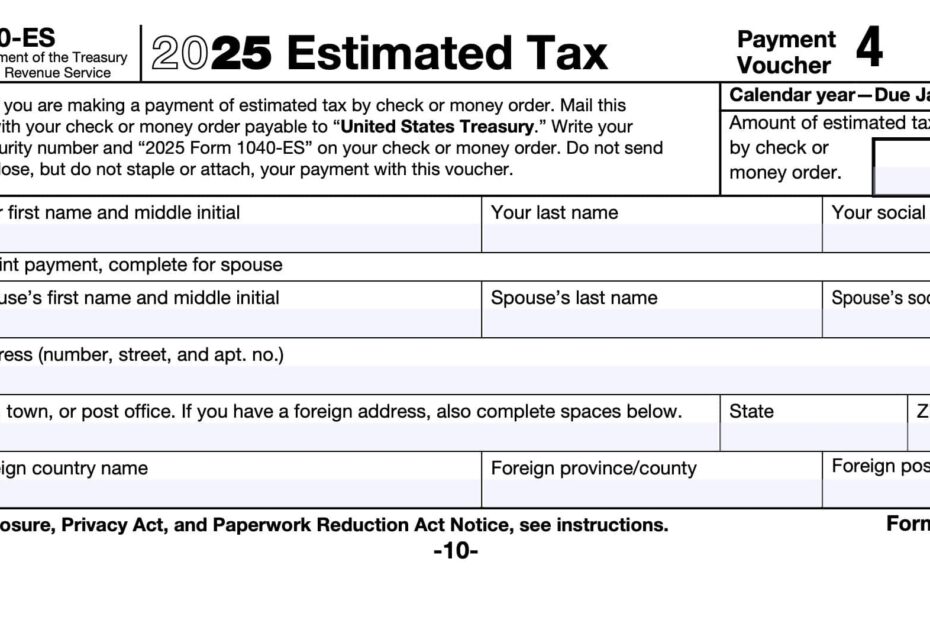

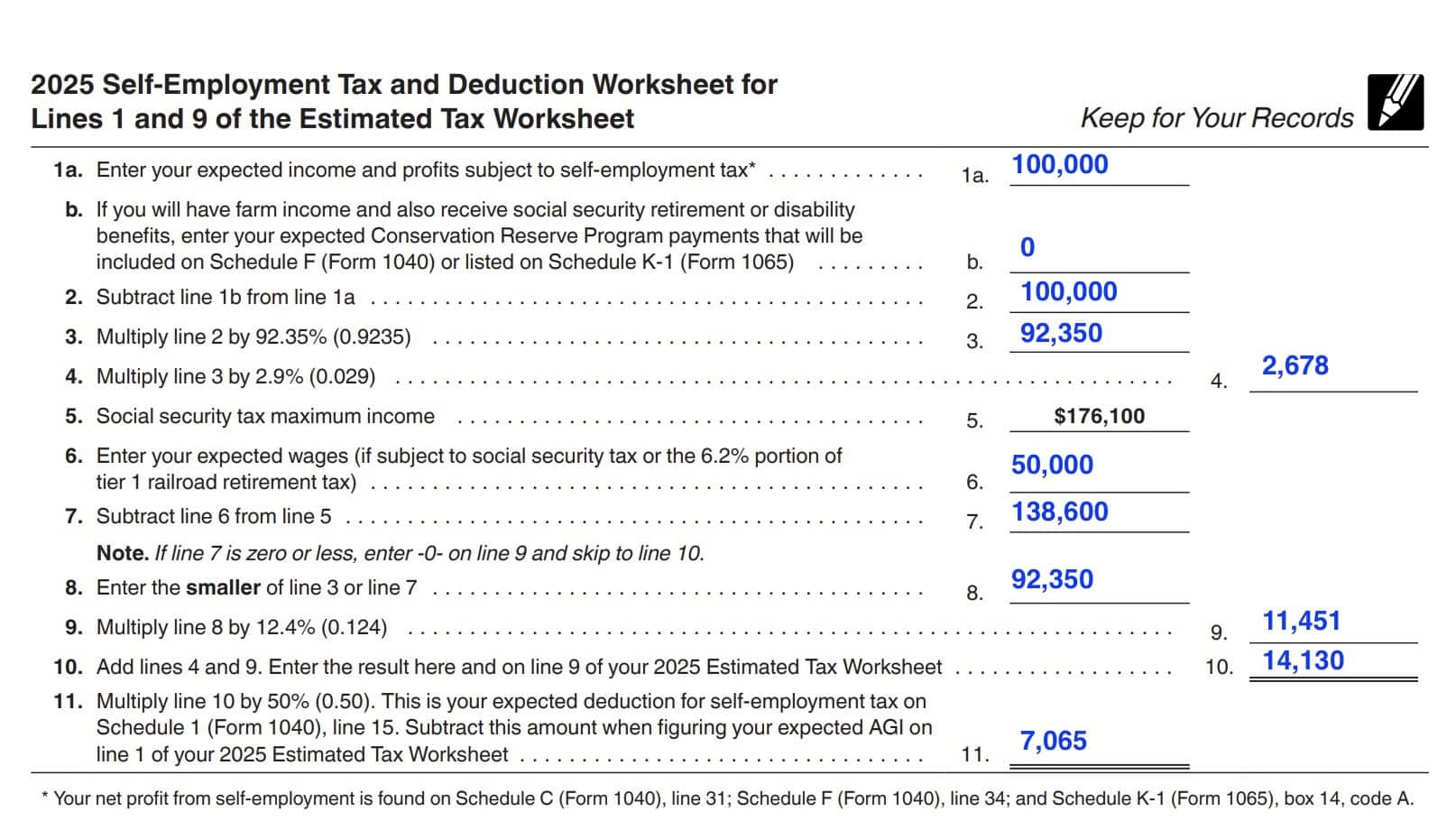

When it comes to printable IRS estimated tax forms, there are several options available depending on your filing status and income sources. For individuals, Form 1040-ES is commonly used to calculate and submit estimated tax payments. This form includes worksheets to help you determine the correct amount to pay based on your income, deductions, and credits.

For businesses, Form 1120-W is used to calculate estimated tax payments for corporations, while Form 1065 is used for partnerships. These forms provide a detailed breakdown of income, deductions, and credits to help businesses accurately report and pay their estimated taxes throughout the year.

Using printable IRS estimated tax forms can help simplify the process of calculating and submitting your estimated tax payments. By keeping accurate records and staying organized, you can avoid any penalties or interest charges for underpayment of taxes. It is important to review these forms regularly and adjust your payments as needed to avoid any surprises at tax time.

In conclusion, printable IRS estimated tax forms are a valuable resource for individuals and businesses to stay compliant with their tax obligations throughout the year. By using these forms to calculate and submit your estimated tax payments, you can avoid any penalties or interest charges and ensure that you are accurately reporting your income and deductions. Stay on top of your tax payments by utilizing printable IRS estimated tax forms for a more organized and stress-free tax season.