Are you a senior citizen looking to file your taxes? The IRS has created a special form just for you – the 1040 SR form. This form is specifically designed for taxpayers aged 65 and older, making it easier for seniors to report their income and deductions.

With the 1040 SR form, seniors can easily navigate through the tax filing process and ensure they are taking advantage of all available tax benefits. This form includes larger print and more straightforward instructions, making it a user-friendly option for older taxpayers.

Easily Download and Print Printable Irs 1040 Sr Form

How To Fill Out IRS Form 1040 With Pictures WikiHow Worksheets Library

How To Fill Out IRS Form 1040 With Pictures WikiHow Worksheets Library

Benefits of the 1040 SR Form

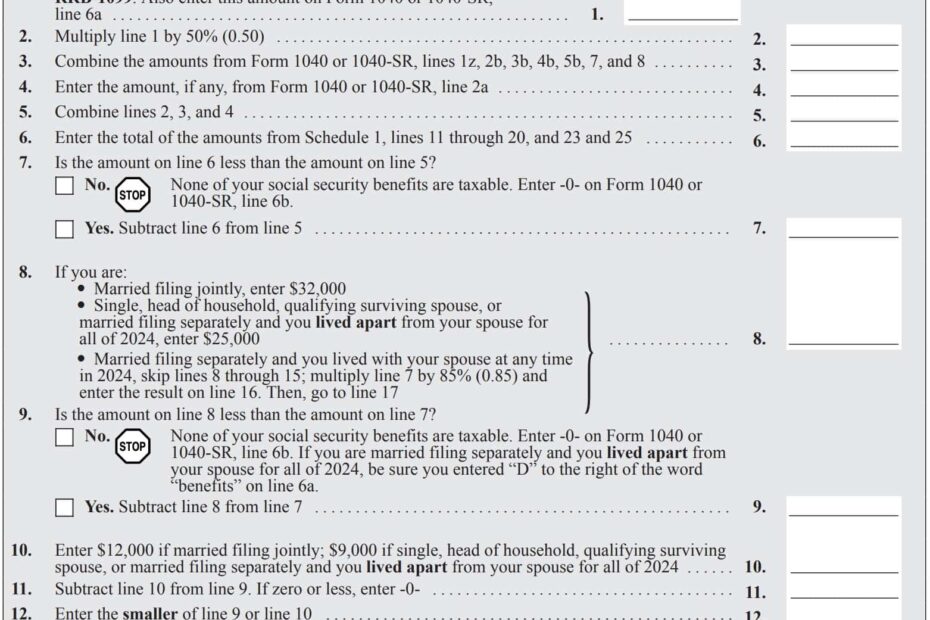

One of the main benefits of the 1040 SR form is that it allows seniors to report their income from various sources, including retirement accounts, social security benefits, and investments. This form also includes specific deductions and credits that are relevant to seniors, such as medical expenses and charitable donations.

Additionally, the 1040 SR form provides a clear breakdown of income and deductions, making it easier for seniors to calculate their tax liability and ensure they are not missing out on any potential tax savings. This form is designed to simplify the tax filing process for seniors, allowing them to file their taxes with confidence.

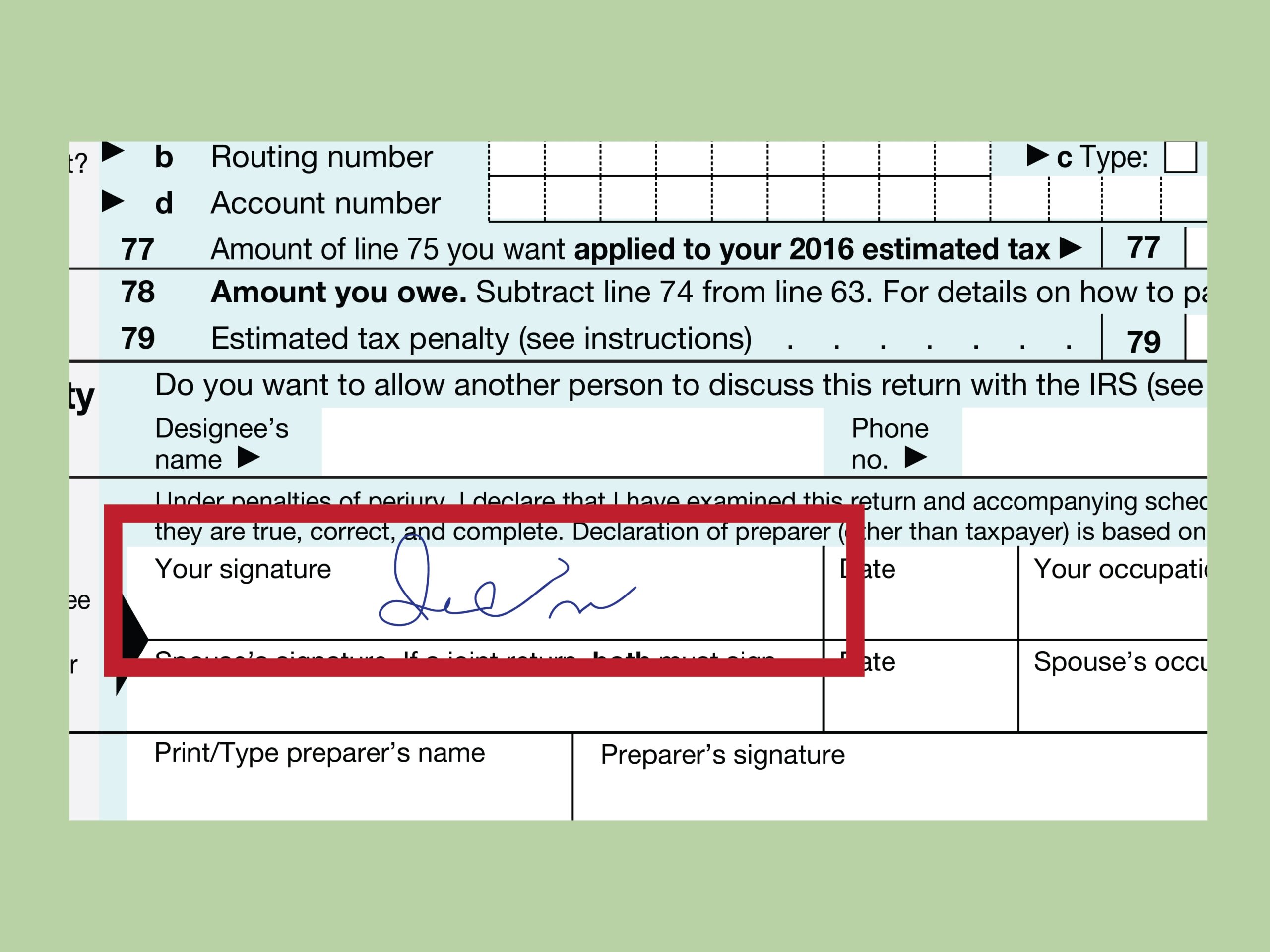

Seniors can easily access the printable IRS 1040 SR form online or at their local IRS office. By using this form, seniors can ensure they are accurately reporting their income and deductions, ultimately reducing the risk of errors on their tax return.

Overall, the IRS 1040 SR form is a valuable tool for seniors looking to file their taxes accurately and efficiently. By using this form, seniors can take advantage of all available tax benefits and credits, ultimately reducing their tax liability and maximizing their potential tax refund.

So, if you are a senior citizen looking to file your taxes, be sure to check out the printable IRS 1040 SR form. This user-friendly form will make the tax filing process a breeze, allowing you to file your taxes with ease and confidence.