One of the most common types of income that individuals report on their tax returns is interest income. This can come from a variety of sources, such as savings accounts, certificates of deposit, bonds, or other investments. It is important to accurately report this income on your tax return to avoid any penalties or audits from the IRS.

Interest income is typically reported on Form 1099-INT, which is issued by banks and other financial institutions to individuals who have earned more than $10 in interest during the tax year. This form details the amount of interest earned, any taxes withheld, and other relevant information that you will need to report on your tax return.

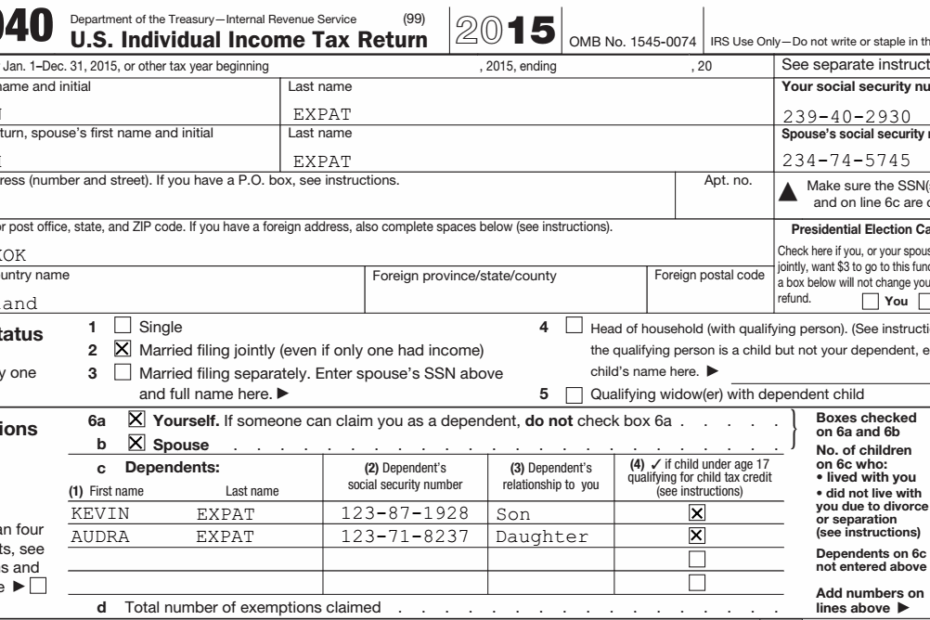

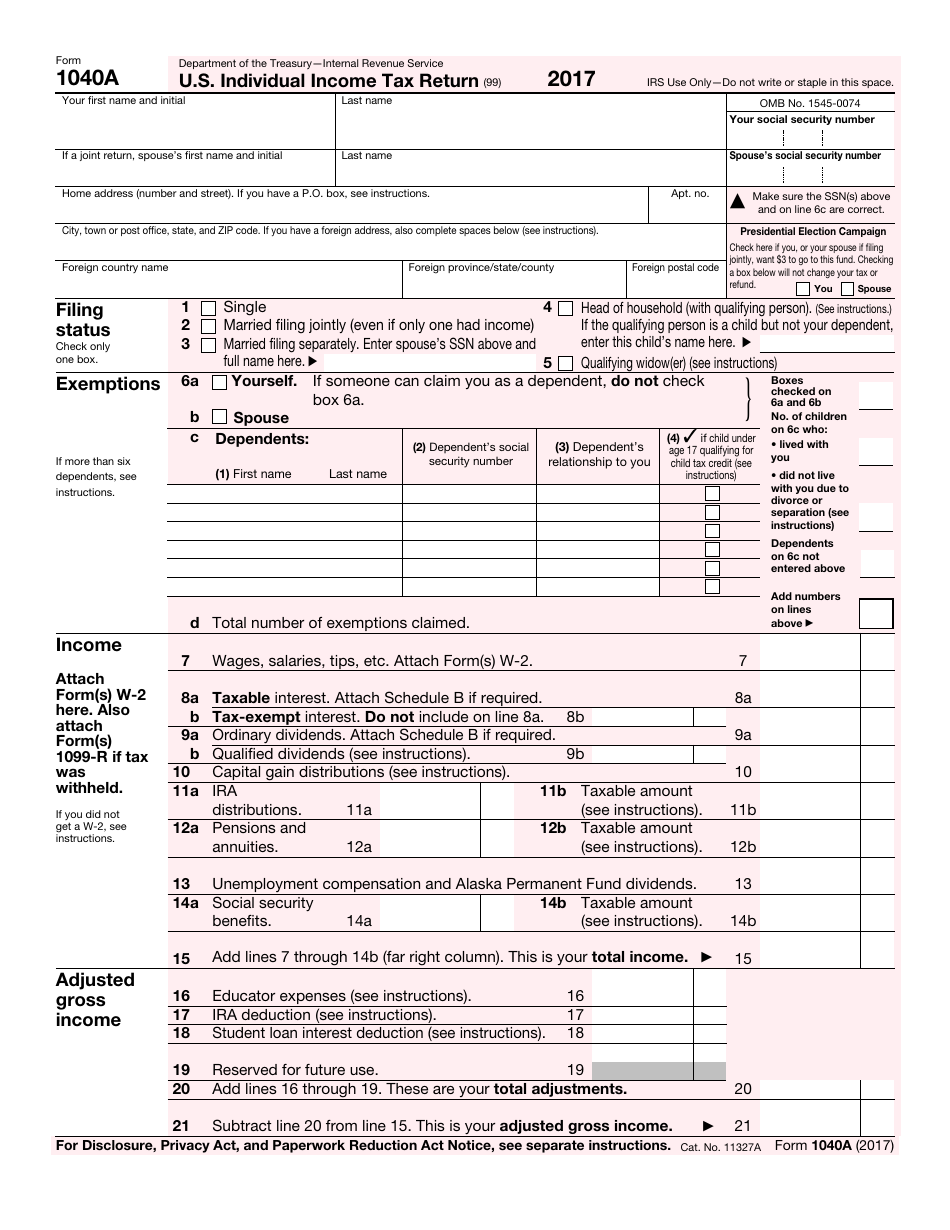

Printable Interest Income Tax Form

Printable Interest Income Tax Form

Save and Print Printable Interest Income Tax Form

Printable Interest Income Tax Form

For those who prefer to file their taxes manually or simply like to have a hard copy of their tax forms, printable versions of Form 1099-INT are readily available online. These forms can be easily downloaded, printed, and filled out with your interest income information.

When filling out your printable interest income tax form, be sure to double-check all the information you enter, including the amounts of interest earned and taxes withheld. Any discrepancies could lead to delays in processing your return or even trigger an audit by the IRS.

Once you have completed your printable interest income tax form, you can include it with your other tax documents when filing your return. Remember to keep a copy for your records in case you need to refer back to it in the future.

By accurately reporting your interest income on your tax return, you can ensure that you are in compliance with IRS regulations and avoid any potential penalties. Whether you choose to file electronically or use printable forms, it is important to take the time to accurately report all sources of income to avoid any issues with the IRS.

Overall, printable interest income tax forms provide a convenient option for individuals who prefer to file their taxes manually or simply want to have a hard copy of their tax documents. By following the instructions carefully and accurately reporting your interest income, you can ensure a smooth tax filing process and avoid any potential issues with the IRS.