As tax season approaches, it’s important to have all the necessary information at your fingertips to ensure you file your taxes accurately and on time. One key tool that can help you calculate your tax liability is the income tax table for the year 2017. This table provides a breakdown of tax rates based on your income level, allowing you to determine how much you owe to the government.

Understanding the income tax table for 2017 can help you plan your finances more effectively and avoid any surprises when it comes time to file your taxes. By knowing the tax rates that apply to your income bracket, you can make informed decisions about deductions, credits, and other tax-saving strategies that can help reduce your tax bill.

Printable Income Tax Table For 2017

Printable Income Tax Table For 2017

Quickly Access and Print Printable Income Tax Table For 2017

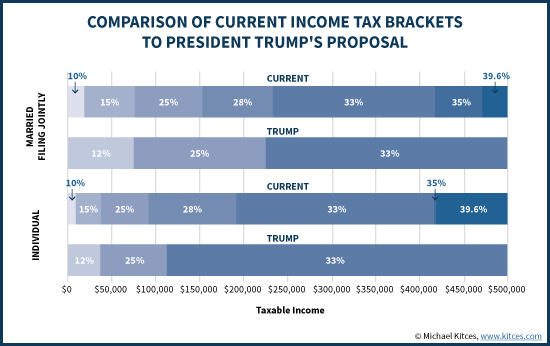

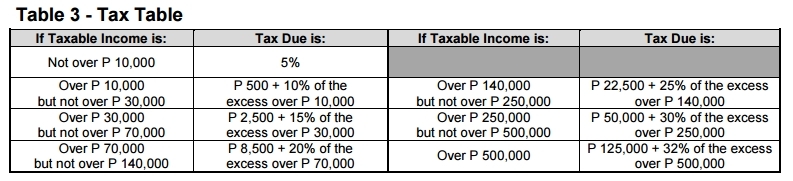

When using the income tax table for 2017, it’s important to note that the tax rates are marginal, meaning that different portions of your income are taxed at different rates. This progressive tax system is designed to ensure that higher-income individuals pay a larger percentage of their income in taxes compared to those with lower incomes. By consulting the tax table, you can determine how much tax you owe based on your taxable income.

For example, if your taxable income falls within the range of $38,701 to $93,700, the tax rate is 15%. If your income exceeds $93,700 but is less than $195,450, the tax rate increases to 25%. By referencing the income tax table for 2017, you can easily calculate your tax liability and ensure that you are paying the correct amount to the IRS.

As you prepare to file your taxes for the year 2017, be sure to consult the printable income tax table to help guide you through the process. This valuable tool can provide you with the information you need to accurately calculate your tax liability and avoid any costly errors. By understanding how the tax rates apply to your income level, you can take control of your finances and make informed decisions that will benefit you in the long run.

In conclusion, the income tax table for 2017 is a valuable resource that can help you navigate the complex world of taxes with confidence. By utilizing this tool, you can ensure that you are paying the correct amount of tax based on your income level and avoid any potential penalties or fines. Make sure to reference the printable income tax table for 2017 as you prepare to file your taxes this year.