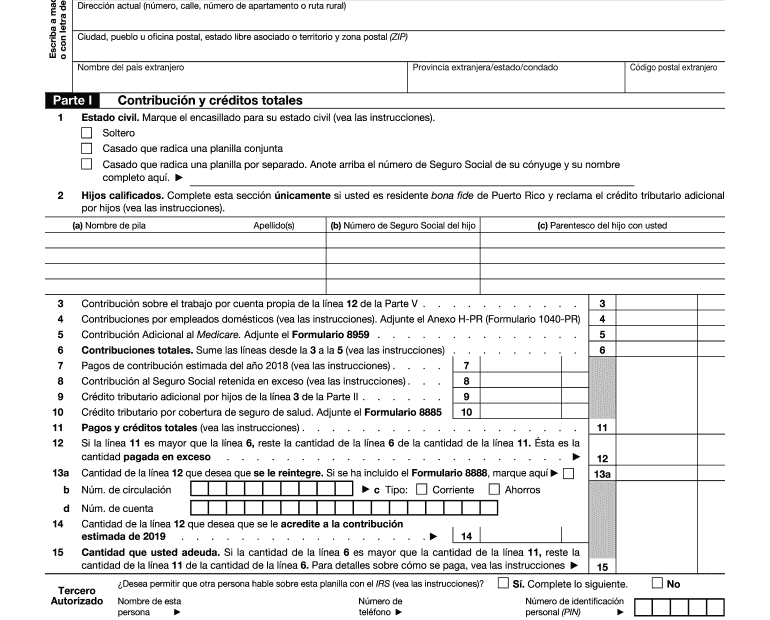

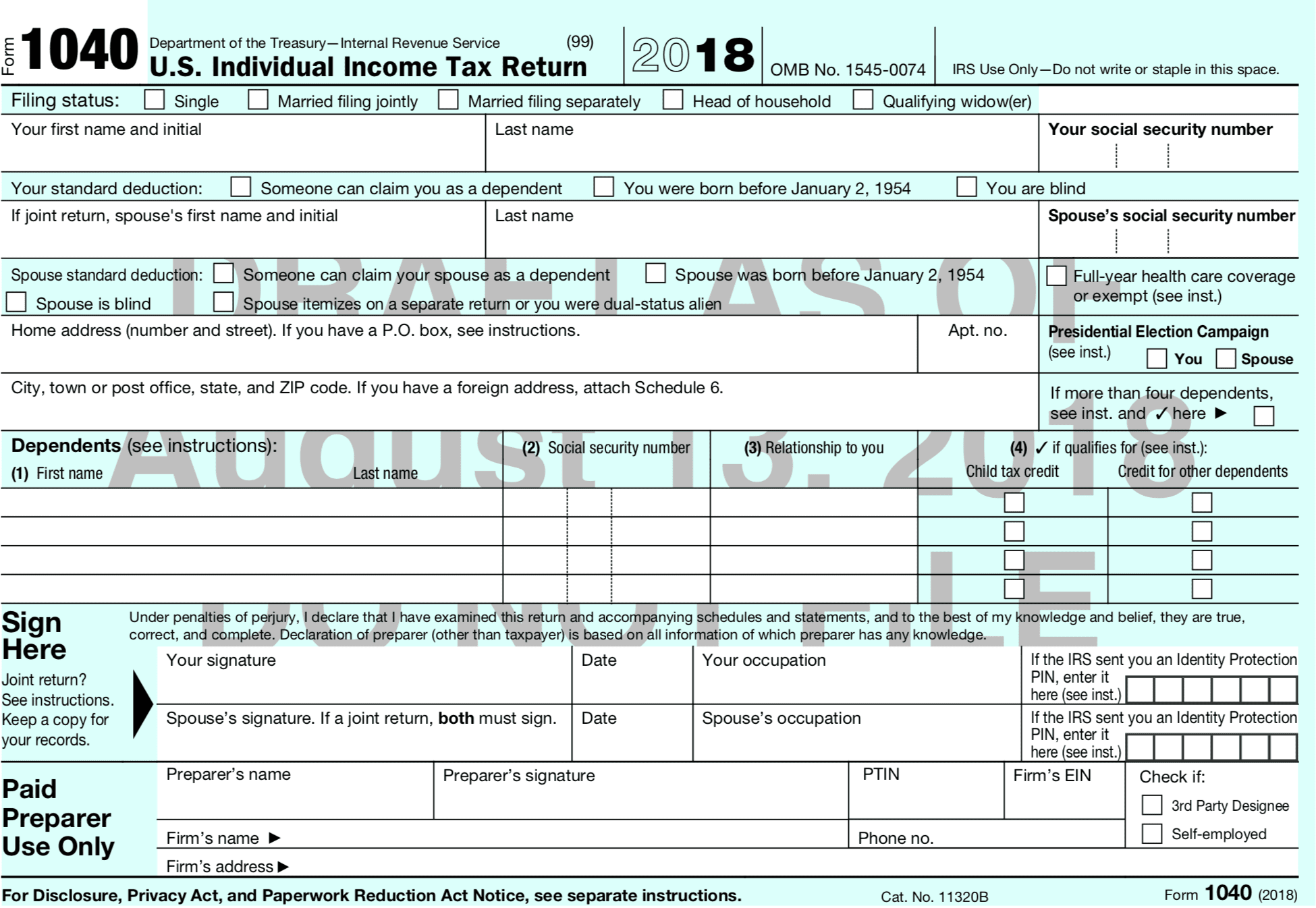

As tax season approaches, many individuals and businesses are gearing up to file their income tax returns. One of the most important steps in this process is obtaining the necessary forms to accurately report your income and deductions. For those looking for a simplified version of the tax forms, the Printable Income Tax Forms 2018 Short Form can be a convenient option.

These short forms are designed to make the tax filing process easier for individuals with straightforward tax situations. They typically include the most commonly used tax schedules and forms, making it easier for taxpayers to report their income and claim deductions without the need for extensive calculations or paperwork.

Printable Income Tax Forms 2018 Short Form

Printable Income Tax Forms 2018 Short Form

Download and Print Printable Income Tax Forms 2018 Short Form

When using the Printable Income Tax Forms 2018 Short Form, taxpayers will need to gather their income statements, such as W-2s and 1099s, as well as any documentation for deductions they plan to claim. This information will be used to fill out the various sections of the form, including income, deductions, credits, and any taxes owed or refunded.

It is important to ensure that all information provided on the short form is accurate and up to date. Any errors or discrepancies could result in delays in processing your tax return or even potential audits by the IRS. Therefore, it is recommended to double-check all entries before submitting the form.

Once the Printable Income Tax Forms 2018 Short Form is completed, taxpayers can either file their taxes electronically or mail the forms to the IRS. Electronic filing is often faster and more secure, with the option to receive a direct deposit of any refunds owed. However, some individuals may prefer to mail in their forms for various reasons, such as personal preference or lack of internet access.

In conclusion, the Printable Income Tax Forms 2018 Short Form can be a convenient option for individuals looking to simplify their tax filing process. By gathering the necessary documentation and carefully completing the form, taxpayers can accurately report their income and claim deductions without the need for extensive calculations. Whether filing electronically or by mail, it is important to ensure all information is accurate to avoid any potential issues with the IRS.