As a self-employed individual, filing your income taxes can be a daunting task. With numerous forms to fill out and deadlines to meet, it’s important to stay organized and informed. In order to make the process easier for yourself, it’s crucial to have access to printable income tax forms for the year 2018.

Printable income tax forms are readily available online, allowing you to easily access and download the necessary documents to file your taxes. This convenient option saves you time and effort, making it simpler to complete your tax return accurately.

Printable Income Tax Forms 2018 For Self Employed

Printable Income Tax Forms 2018 For Self Employed

Quickly Access and Print Printable Income Tax Forms 2018 For Self Employed

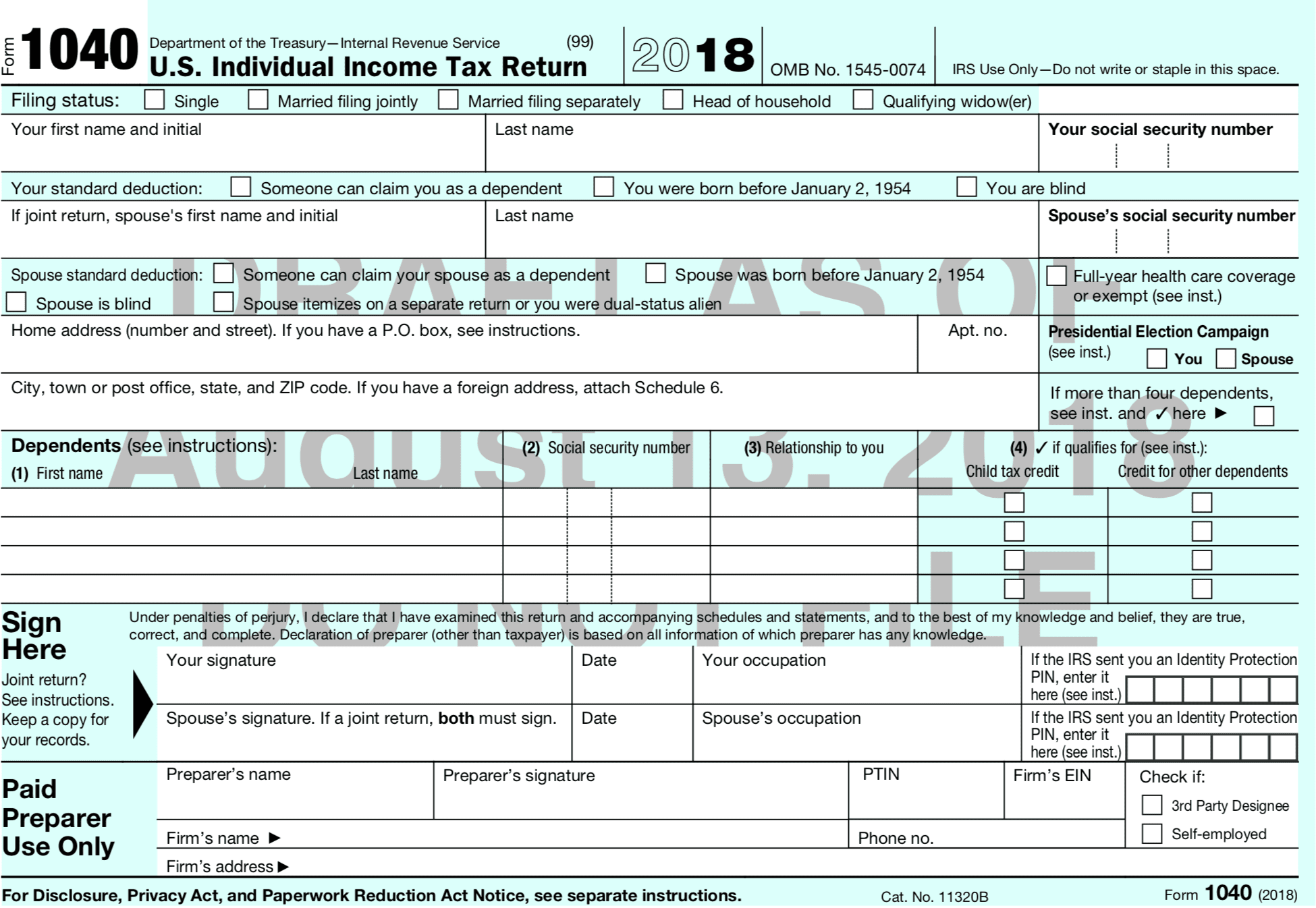

When it comes to filing taxes as a self-employed individual, there are specific forms that you will need to complete. These forms include the Schedule C, which is used to report income or loss from a business you operated or a profession you practiced as a sole proprietor. Additionally, Form 1040 is required for reporting your total income, deductions, and credits.

Other forms that self-employed individuals may need to fill out include Form 8829 for claiming home office deductions, Form 4562 for depreciation and amortization, and Form 1099-MISC for reporting payments made to independent contractors. Having these forms readily available in printable format makes it easier to stay organized and ensure that you are accurately reporting your income and expenses.

By utilizing printable income tax forms for the year 2018, self-employed individuals can simplify the tax filing process and ensure that they meet all necessary requirements. It’s important to stay informed about the specific forms you need to fill out and deadlines you need to meet in order to avoid penalties or fines. With the right tools and resources, filing your taxes as a self-employed individual can be a manageable task.

Take advantage of printable income tax forms for 2018 to streamline the process of filing your taxes as a self-employed individual. By staying organized and informed, you can ensure that you accurately report your income and expenses and meet all necessary requirements. Don’t wait until the last minute – start gathering your documents and filling out the necessary forms today!