As tax season approaches, many individuals and businesses are gearing up to file their taxes for the year 2014. One of the essential tools needed for this process is the income tax forms. These forms are crucial for accurately reporting income, deductions, and credits to ensure compliance with tax laws.

While some may opt to file their taxes online, others prefer the traditional method of filling out physical forms. For those who fall into the latter category, printable income tax forms for the year 2014 are readily available for download on the IRS website. These forms provide a convenient way to organize and submit tax information without the need for specialized software.

Printable Income Tax Forms 2014

Printable Income Tax Forms 2014

Quickly Access and Print Printable Income Tax Forms 2014

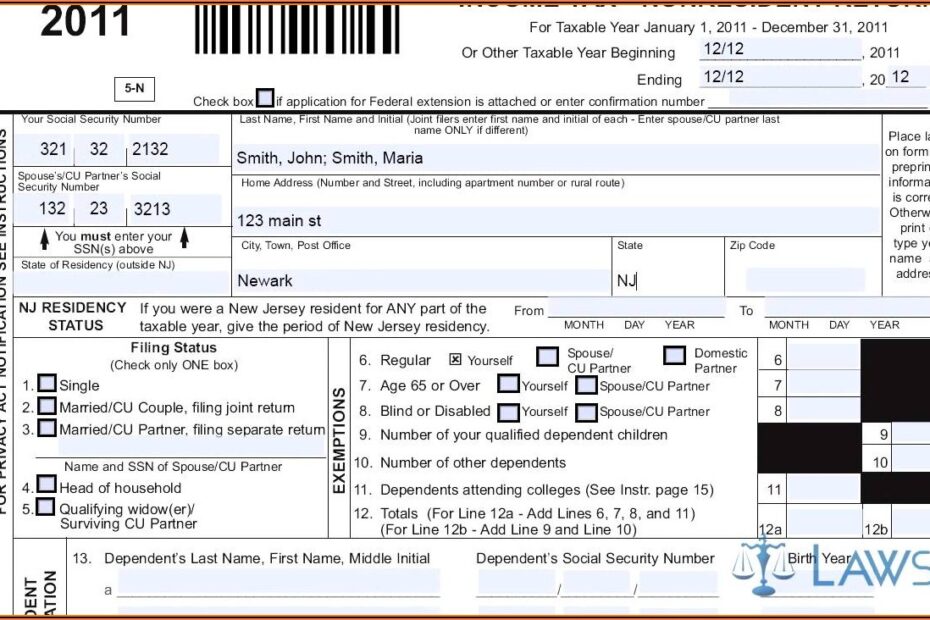

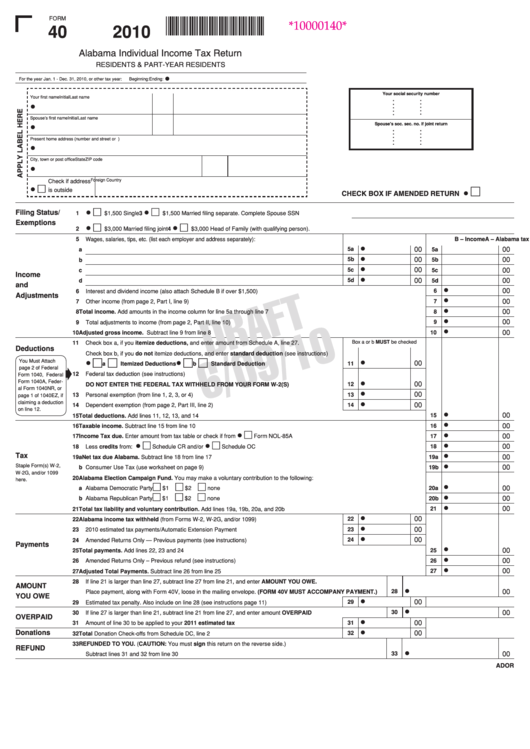

When it comes to printable income tax forms for the year 2014, there are several options to choose from depending on your filing status and specific tax situation. The most common forms include the 1040, 1040A, and 1040EZ. Each form caters to different types of taxpayers, from individuals with simple tax returns to those with more complex financial situations.

In addition to the basic forms, there are also various schedules and worksheets that may be required to accompany your tax return. These supplemental forms cover a range of topics such as self-employment income, capital gains, and rental income. It’s essential to review your financial records carefully to determine which forms are necessary for your specific tax filing needs.

Before filling out the printable income tax forms for the year 2014, it’s crucial to gather all relevant documentation, including W-2s, 1099s, and receipts for deductible expenses. Having this information readily available will streamline the filing process and help prevent errors or omissions on your tax return. Once you have all the necessary paperwork in hand, you can begin filling out the forms accurately and thoroughly.

In conclusion, printable income tax forms for the year 2014 offer a convenient and accessible way to file your taxes for that specific tax year. Whether you prefer to file electronically or on paper, having the right forms and documentation is essential to ensure compliance with tax laws and regulations. By utilizing these printable forms, you can effectively report your income, deductions, and credits to the IRS and fulfill your tax obligations for the year 2014.