As tax season approaches, many individuals are scrambling to gather their financial documents and prepare their income tax returns. One important aspect of this process is obtaining the necessary tax forms to report your income and deductions accurately to the IRS. In 2013, the IRS provided printable income tax forms that taxpayers could easily access and fill out to fulfill their tax obligations.

Printable income tax forms for the year 2013 were crucial for individuals and businesses to report their income, deductions, and tax credits accurately. These forms were essential in ensuring compliance with tax laws and regulations and avoiding penalties for incorrect or incomplete information. Taxpayers could easily download these forms from the IRS website or obtain them from local tax offices.

Printable Income Tax Forms 2013

Printable Income Tax Forms 2013

Easily Download and Print Printable Income Tax Forms 2013

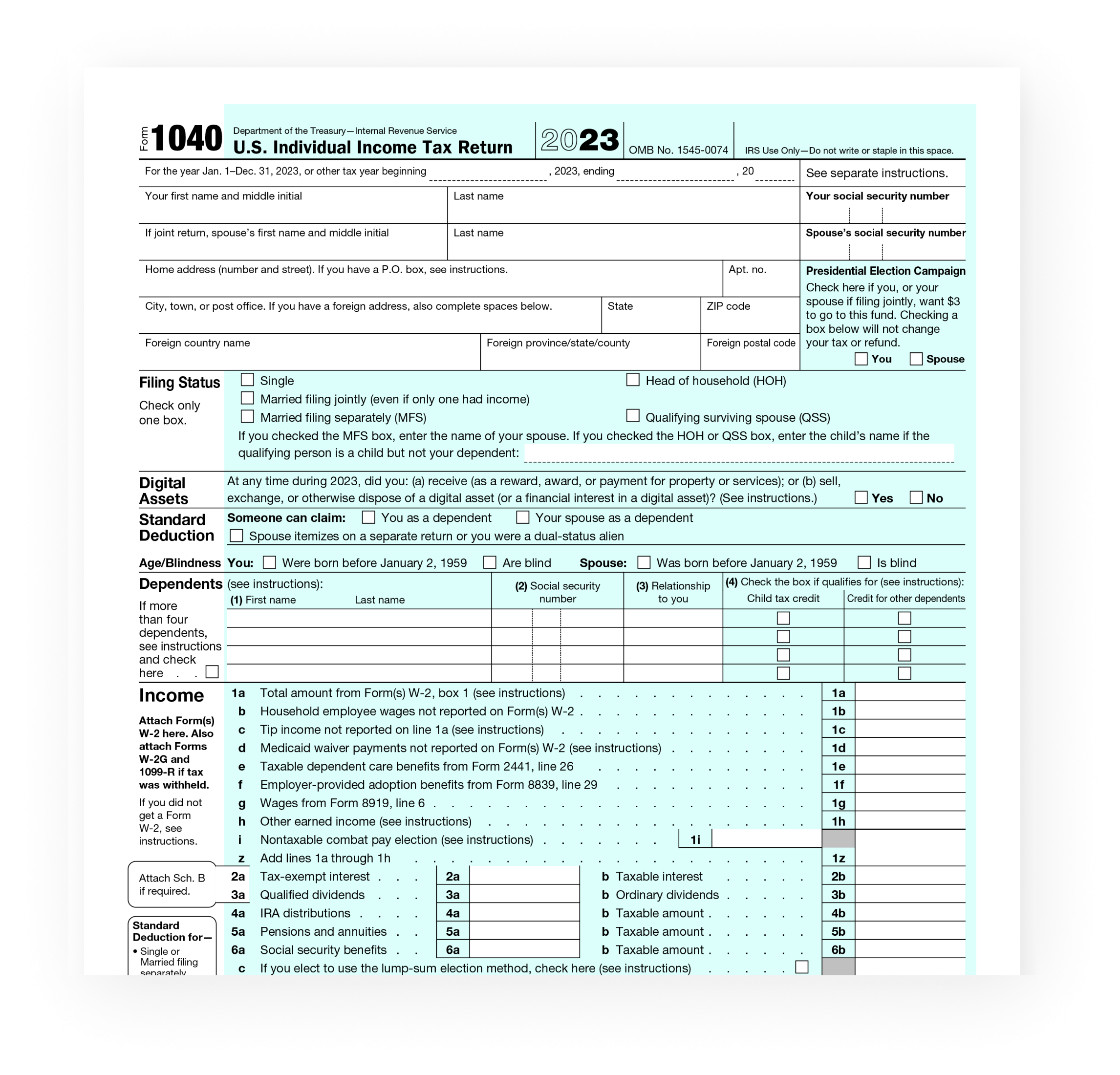

One of the most commonly used forms for individual taxpayers in 2013 was the Form 1040, which served as the main tax return document. This form required taxpayers to report their income, deductions, and credits for the year. Additionally, there were various schedules and worksheets that taxpayers could use to provide additional information or calculate specific tax credits or deductions.

Businesses also relied on printable income tax forms in 2013 to report their income and expenses accurately. Forms such as the Form 1120 for corporations and the Form 1065 for partnerships were essential in fulfilling their tax obligations. These forms required detailed information about the business’s financial activities and were crucial in determining the amount of tax owed.

Overall, printable income tax forms for the year 2013 played a crucial role in helping taxpayers fulfill their tax obligations accurately and efficiently. These forms provided a structured format for reporting income, deductions, and credits, and helped individuals and businesses avoid potential errors or omissions in their tax returns. By using these forms, taxpayers could ensure compliance with tax laws and regulations and minimize the risk of facing penalties for non-compliance.

In conclusion, obtaining and using printable income tax forms for the year 2013 was essential for individuals and businesses to accurately report their financial information to the IRS. These forms provided a structured format for reporting income, deductions, and credits, and helped taxpayers fulfill their tax obligations efficiently. By utilizing these forms, taxpayers could ensure compliance with tax laws and regulations and avoid potential penalties for incorrect or incomplete information.