As tax season approaches, many Americans begin to gather their financial documents in preparation for filing their taxes. One of the most common forms used to report income and deductions is the IRS Form 1040. This form is used by individuals to report their annual income and calculate how much tax they owe to the government or how much of a refund they are entitled to.

Printable Income Tax Form 1040 is an essential document that every taxpayer must fill out accurately and submit to the IRS by the annual deadline. This form requires detailed information about your income, deductions, credits, and tax liability, making it crucial to understand how to properly fill it out to avoid any errors or penalties.

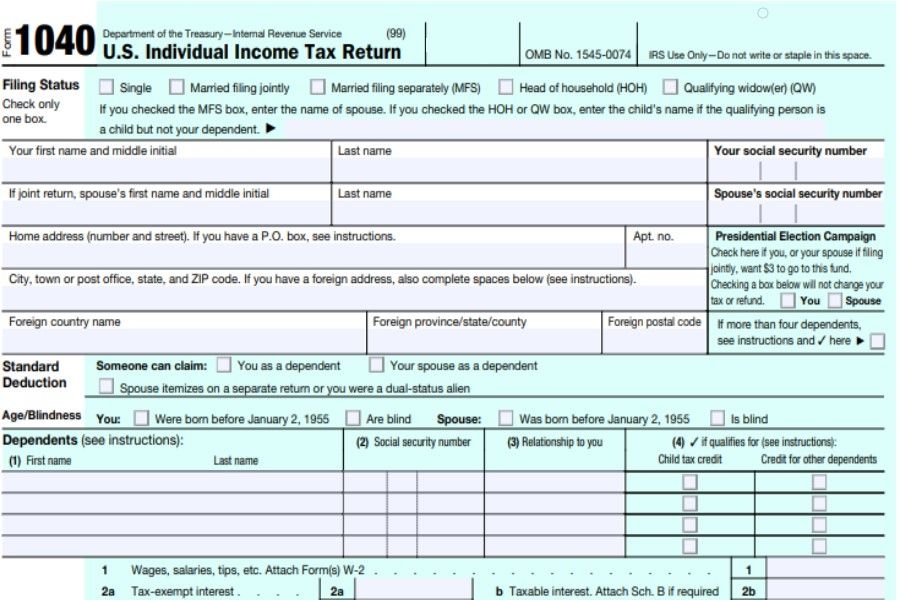

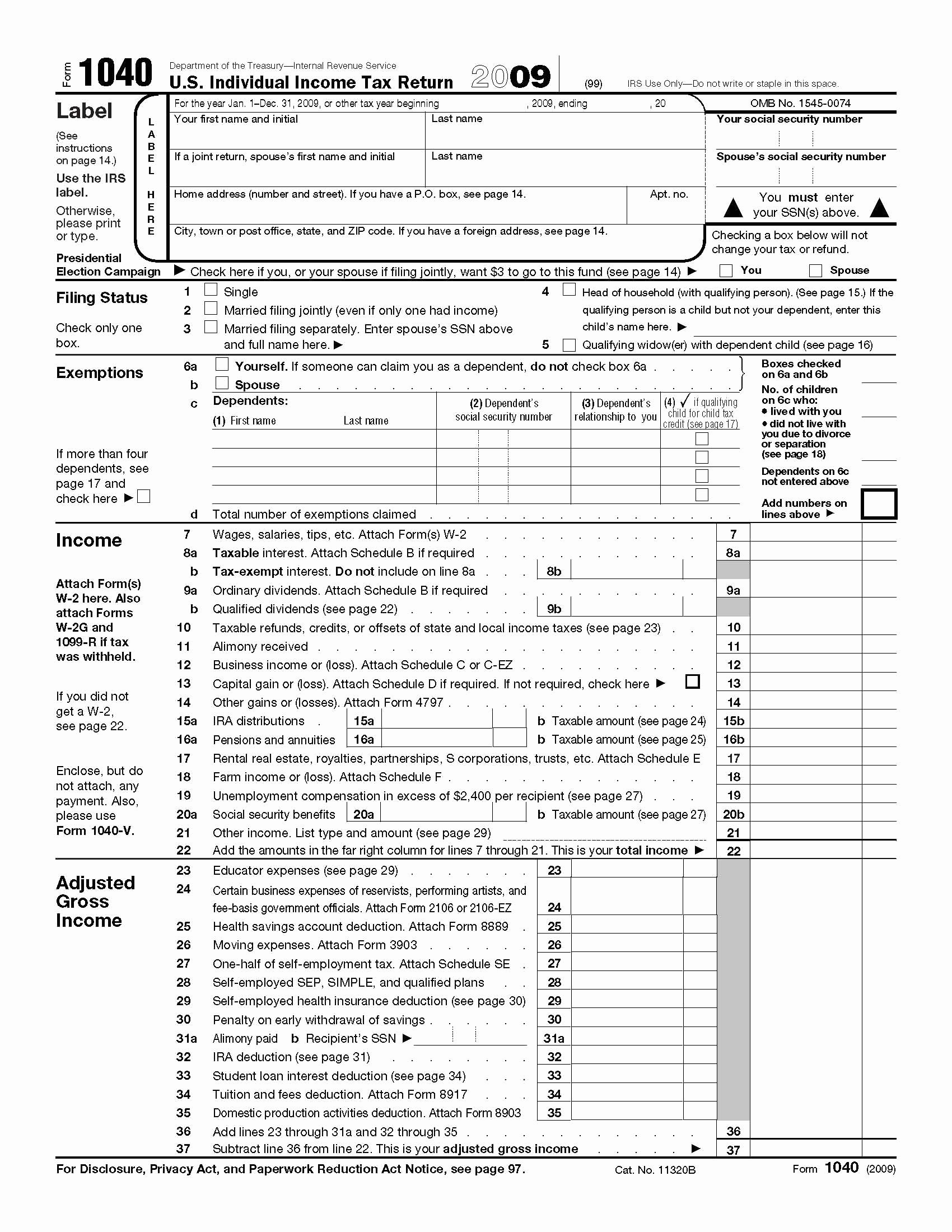

Printable Income Tax Form 1040

Printable Income Tax Form 1040

Get and Print Printable Income Tax Form 1040

Printable Income Tax Form 1040

The Printable Income Tax Form 1040 is divided into several sections, each requiring specific information about your financial situation. These sections include personal information, income, deductions, credits, and tax liability. It is important to carefully review each section and ensure that all information is accurate and up to date.

When filling out the Printable Income Tax Form 1040, you will need to gather documents such as W-2s, 1099s, and receipts for deductions. These documents will help you accurately report your income and deductions, which will ultimately determine your tax liability or refund amount. It is crucial to keep all these documents organized and easily accessible to streamline the filing process.

Once you have completed the Printable Income Tax Form 1040, you can choose to file it electronically or mail it to the IRS. Electronic filing is the preferred method as it is faster, more secure, and reduces the chances of errors. However, if you prefer to file by mail, ensure that you send it to the correct address and include all necessary documents.

In conclusion, the Printable Income Tax Form 1040 is a vital document that every taxpayer must fill out accurately to avoid any penalties or issues with the IRS. By understanding the different sections of the form and gathering all necessary documents, you can ensure a smooth and hassle-free tax filing process. Remember to file your taxes on time and seek assistance from a tax professional if needed.