When tax season rolls around, it’s important to have all the necessary forms ready to file your taxes accurately and on time. In Illinois, residents are required to file state income taxes in addition to federal taxes. Fortunately, the Illinois Department of Revenue provides printable income tax forms that make it easy for taxpayers to report their income and deductions.

Whether you’re a full-time employee, self-employed individual, or business owner, having access to printable Illinois income tax forms can simplify the tax filing process. These forms are available online on the Illinois Department of Revenue website and can be easily downloaded and printed for your convenience.

Printable Illinois Income Tax Forms

Printable Illinois Income Tax Forms

Quickly Access and Print Printable Illinois Income Tax Forms

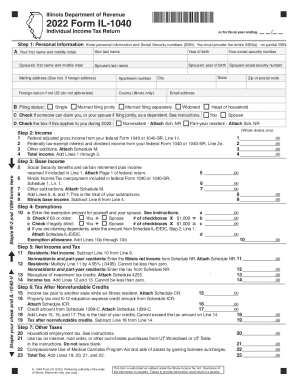

One of the most commonly used forms is the IL-1040, which is used by individuals to report their income, deductions, and credits for the tax year. This form allows taxpayers to calculate their state income tax liability and determine if they owe additional taxes or are entitled to a refund. Additionally, there are specific forms available for different types of income, such as rental income, capital gains, and retirement income.

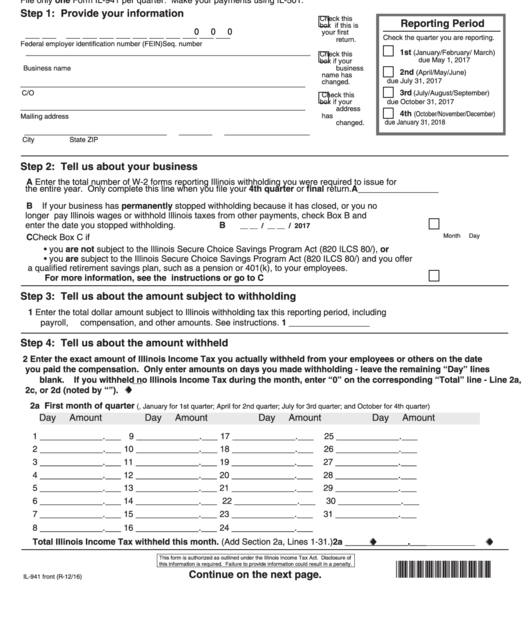

For business owners, the Illinois Department of Revenue also provides printable forms for reporting business income, deductions, and credits. Whether you’re a sole proprietor, partnership, or corporation, there are specific forms tailored to your business structure. These forms are essential for accurately reporting your business income and ensuring compliance with Illinois tax laws.

It’s important to note that the Illinois Department of Revenue updates its forms annually to reflect any changes in tax laws or regulations. Therefore, it’s crucial to download the most recent version of the forms to ensure accurate reporting and avoid any potential penalties or audits. By utilizing printable Illinois income tax forms, taxpayers can streamline the tax filing process and ensure that their taxes are filed correctly and on time.

In conclusion, having access to printable Illinois income tax forms is essential for residents and business owners to fulfill their tax obligations. These forms simplify the tax filing process and allow taxpayers to accurately report their income, deductions, and credits. By staying up to date with the latest forms and regulations, taxpayers can ensure compliance with Illinois tax laws and avoid any potential issues with their tax filings.