Printable Form W 4p is an important tax document that allows employees to indicate their tax withholding preferences to their employer. By filling out this form accurately, employees can ensure that the right amount of taxes is withheld from their paychecks, avoiding any potential surprises come tax season.

It is crucial for employees to review and update their Form W 4p regularly, especially when there are changes in their personal or financial situations. This form helps determine the correct amount of federal income tax to withhold from an employee’s paycheck based on their filing status, number of dependents, and other factors.

Quickly Access and Print Printable Form W 4p

Tax Time 10 Most Common IRS Forms Explained

Tax Time 10 Most Common IRS Forms Explained

Printable Form W 4p

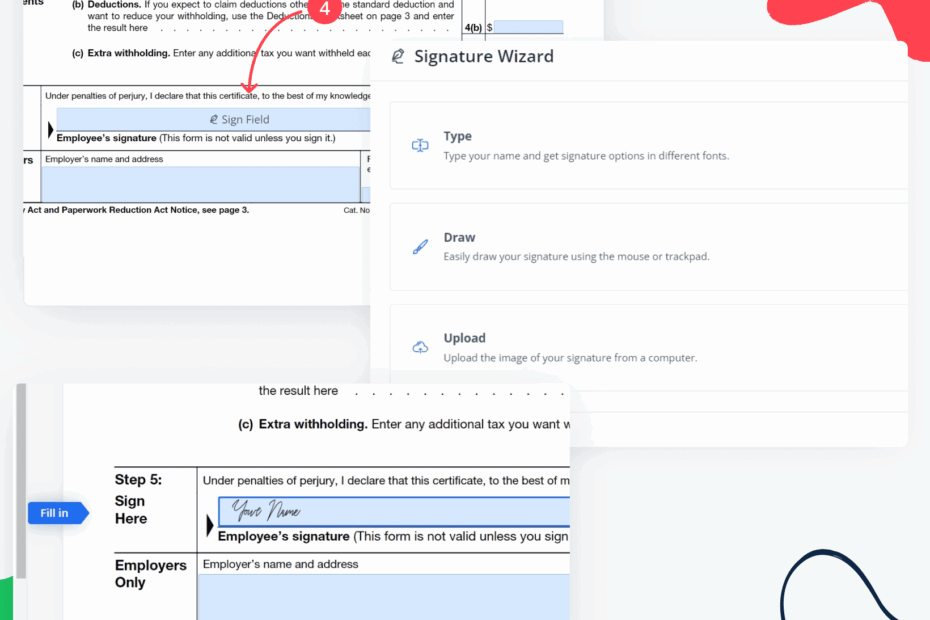

When filling out a Printable Form W 4p, employees will need to provide information such as their name, address, Social Security number, filing status, and the number of allowances they are claiming. Employees can also choose to have additional amounts withheld from their paycheck to cover other income not subject to withholding.

Employees can download a printable Form W 4p from the IRS website or obtain a physical copy from their employer. It is important to fill out this form accurately to avoid underpayment or overpayment of taxes throughout the year.

Once the form is completed, employees should submit it to their employer for processing. Employers will use the information provided on the Form W 4p to calculate the correct amount of federal income tax to withhold from each paycheck.

Employees should keep a copy of their completed Form W 4p for their records and review it annually or whenever there are significant changes in their financial situation. By keeping this form up to date, employees can ensure that they are not paying more or less in taxes than necessary.

In conclusion, Printable Form W 4p is a vital document for employees to communicate their tax withholding preferences to their employer. By accurately completing this form and keeping it up to date, employees can ensure that the right amount of federal income tax is withheld from their paychecks. It is important for employees to understand the significance of this form and make any necessary updates as needed.