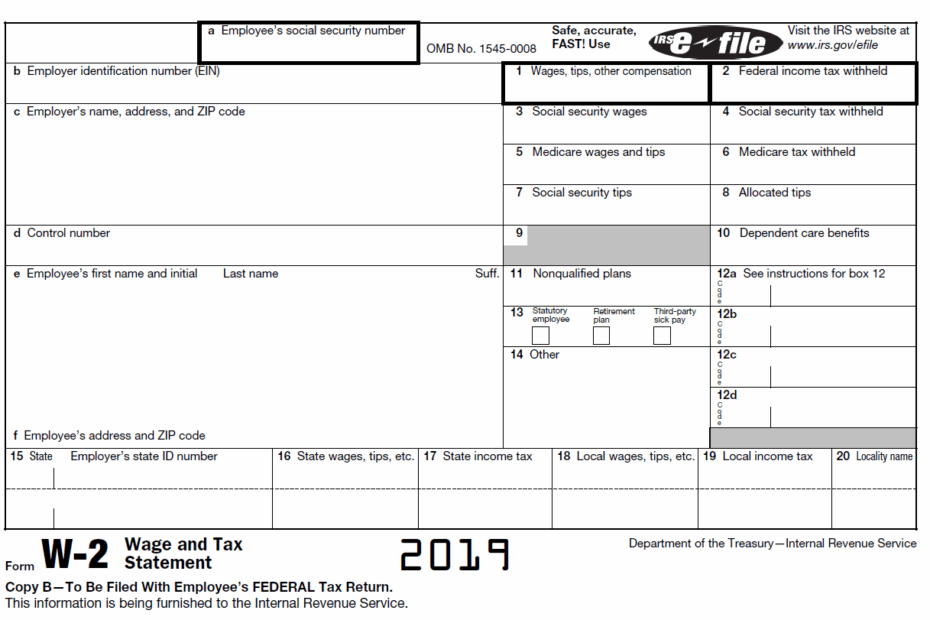

Printable Form W-2 is a crucial document that employers provide to their employees at the end of each year. It contains important information about the employee’s earnings, taxes withheld, and other relevant details for filing their tax returns. This form is essential for employees to accurately report their income and ensure compliance with tax laws.

Employers are required by law to provide employees with Form W-2 by January 31st each year. This form is used by employees to report their income and taxes paid to the IRS. It is important for employees to carefully review their Form W-2 for accuracy and report any discrepancies to their employer as soon as possible.

Quickly Access and Print Printable Form W-2

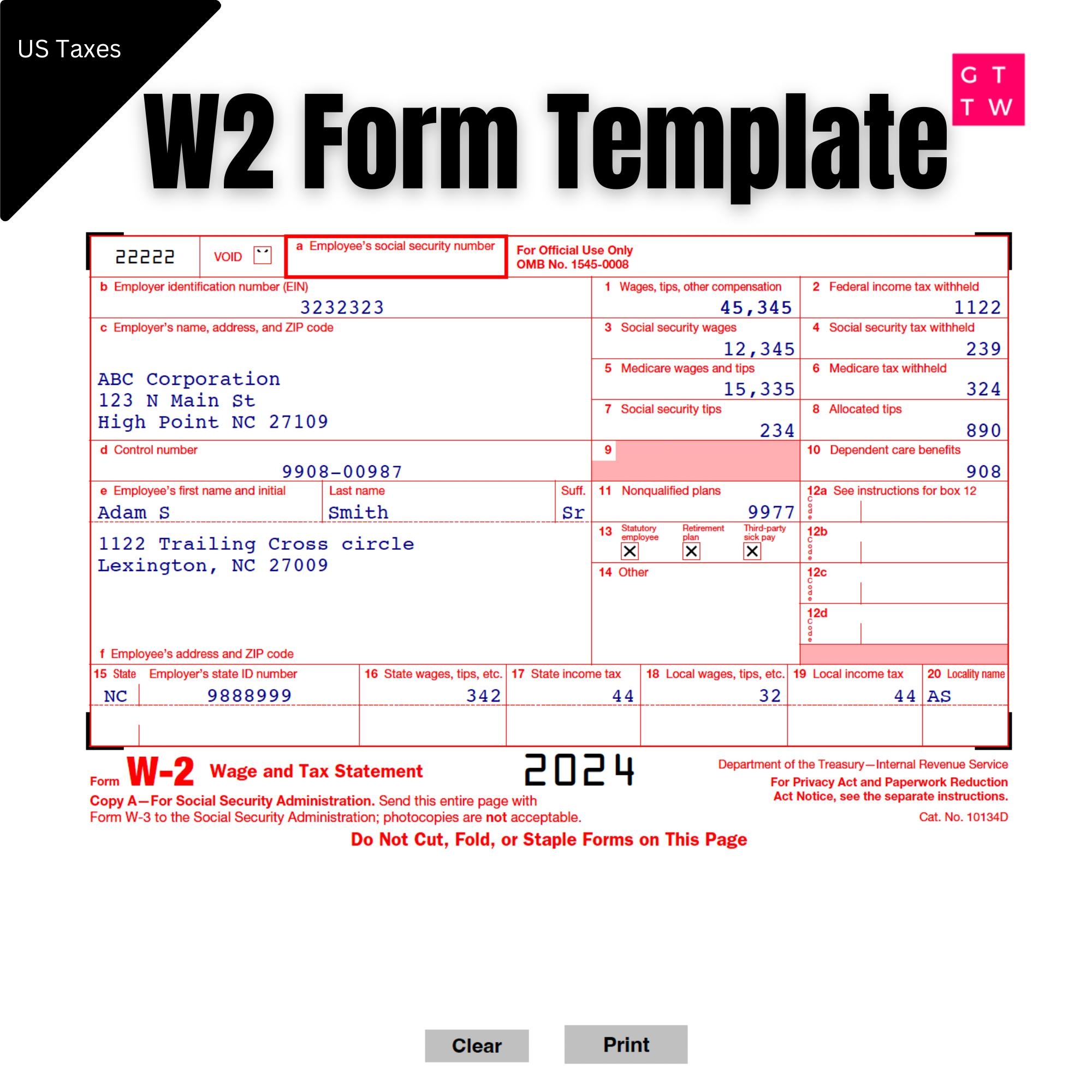

W2 Form IRS 2025 Fillable PDF With Print And Clear Buttons Generate W2 Quickly Digital Download Etsy

W2 Form IRS 2025 Fillable PDF With Print And Clear Buttons Generate W2 Quickly Digital Download Etsy

Printable Form W-2 typically includes the employee’s name, address, Social Security number, wages earned, taxes withheld, and other relevant information. Employees can use this form to file their federal and state income tax returns. It is important to keep Form W-2 in a safe place and retain it for at least three years for tax purposes.

Employees can easily access and print their Form W-2 online through their employer’s payroll system or through a third-party provider. Many employers offer electronic delivery of Form W-2 to employees, making it convenient and eco-friendly. Employees can also request a paper copy of their Form W-2 if needed.

Printable Form W-2 is a vital document for employees to accurately report their income and taxes paid during the year. It is important for employees to review their Form W-2 carefully and ensure that all information is correct. By filing their tax returns accurately and on time, employees can avoid penalties and ensure compliance with tax laws.

In conclusion, Printable Form W-2 is a necessary document for employees to report their income and taxes paid each year. Employers are required to provide employees with Form W-2 by January 31st, and employees should review this form carefully for accuracy. By keeping track of their Form W-2 and filing their tax returns accurately, employees can stay compliant with tax laws and avoid potential issues with the IRS.