When it comes to dealing with the IRS, having the right forms on hand is essential. One such form that you may need is IRS Form 211. This form is used to report a tax fraud or tax evasion to the IRS. It allows individuals to provide information about potential tax cheats and help the IRS investigate and prosecute these individuals.

Form 211 is an important tool in helping the IRS ensure tax compliance and fairness in the tax system. By reporting suspected tax fraud, individuals can help the IRS recover billions of dollars in unpaid taxes each year. This form can be a powerful weapon in the fight against tax evasion and fraud.

Download and Print Printable Form 211 Irs

3 11 3 Individual Income Tax Returns Internal Revenue Service

3 11 3 Individual Income Tax Returns Internal Revenue Service

Printable Form 211 IRS

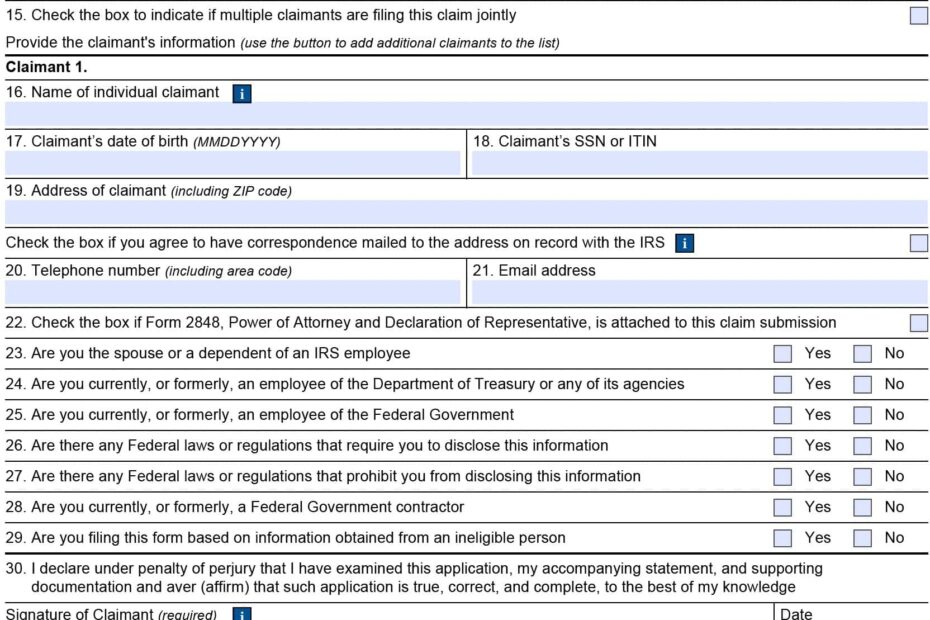

Form 211 is available for download on the IRS website. It is a simple one-page form that requires basic information about the individual reporting the tax fraud, as well as details about the suspected tax cheat. The form can be completed online and then printed out for submission to the IRS.

When filling out Form 211, it is important to provide as much detail as possible about the suspected tax evasion or fraud. This includes information about the individual or business committing the fraud, the type of fraud being committed, and any evidence or documentation that supports the claim. The more information provided, the better equipped the IRS will be to investigate the matter.

Once the form is completed, it can be submitted to the IRS through the appropriate channels. The IRS takes all reports of tax fraud seriously and will investigate each claim thoroughly. By reporting suspected tax fraud, individuals are not only helping to ensure tax compliance but also contributing to the overall integrity of the tax system.

In conclusion, IRS Form 211 is a valuable tool for reporting tax fraud and evasion. By providing detailed information about suspected tax cheats, individuals can help the IRS recover unpaid taxes and maintain fairness in the tax system. If you suspect someone of committing tax fraud, don’t hesitate to fill out Form 211 and submit it to the IRS. Your action could make a significant impact in the fight against tax evasion.