Filing your federal income taxes can be a daunting task, but having the right forms can make the process much easier. In 2016, the IRS provided a variety of printable federal income tax forms to help individuals and businesses accurately report their earnings and deductions.

Whether you are a W-2 employee, self-employed individual, or business owner, having access to the correct tax forms is crucial for staying compliant with federal tax laws. By using the printable federal income tax forms for 2016, you can ensure that you are accurately reporting your financial information and avoiding potential penalties.

Printable Federal Income Tax Forms 2016

Printable Federal Income Tax Forms 2016

Save and Print Printable Federal Income Tax Forms 2016

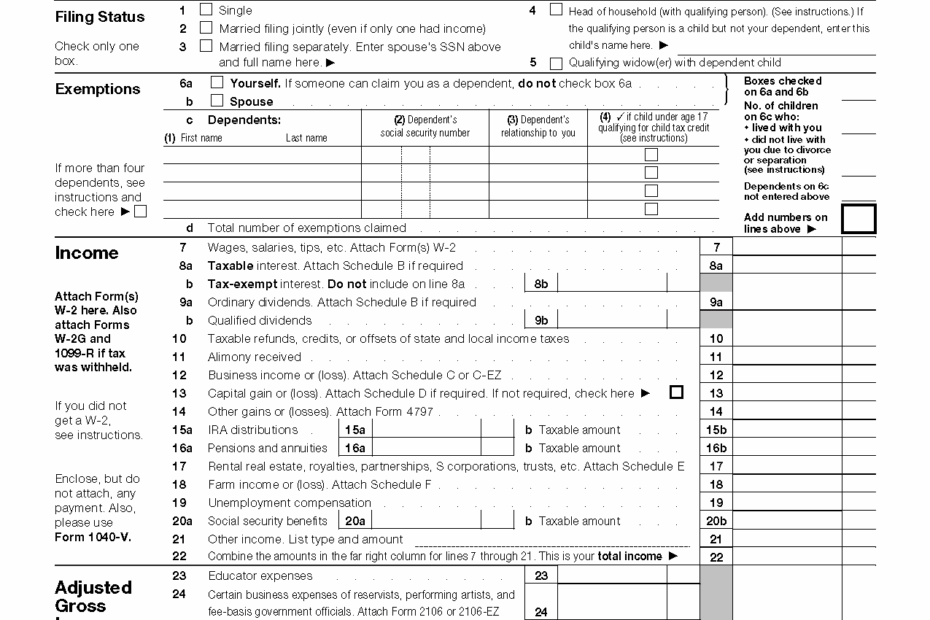

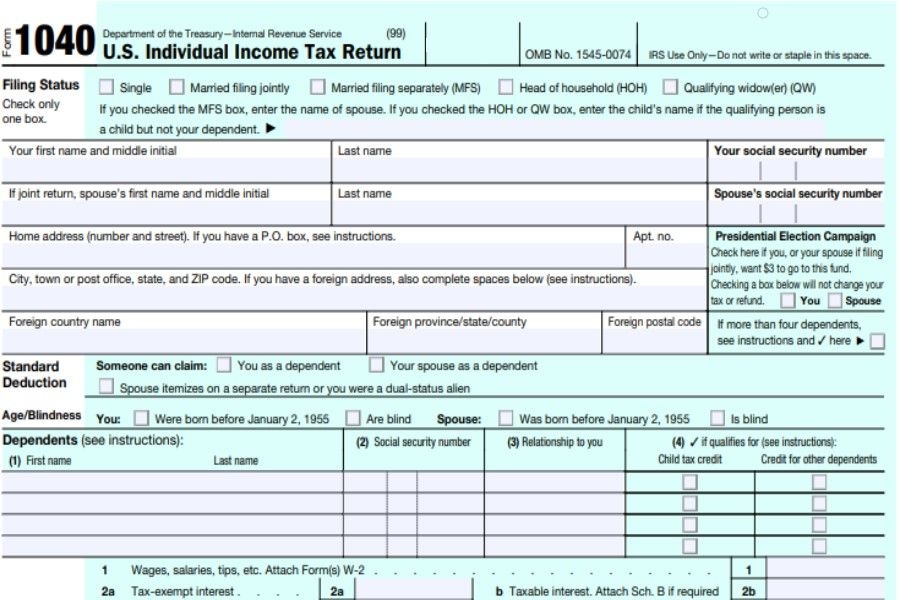

When it comes to filing your federal income taxes for the year 2016, there are several key forms that you may need to complete. These forms include the 1040, 1040A, and 1040EZ, which are used by individuals to report their income, deductions, and credits. Additionally, businesses may need to file forms such as the 1065, 1120, or 1120S, depending on their legal structure.

One of the benefits of using printable federal income tax forms is that they are easily accessible and can be filled out at your convenience. You can download the forms from the IRS website, print them out, and complete them at your own pace. This can be especially helpful for individuals who prefer to file their taxes on paper rather than electronically.

It is important to note that while the IRS provides printable federal income tax forms for 2016, you may also need to gather additional documentation such as W-2s, 1099s, and receipts to support your tax return. By being organized and thorough in your record-keeping, you can ensure that your tax filing process goes smoothly and accurately.

In conclusion, having access to printable federal income tax forms for 2016 can simplify the tax filing process and help you avoid potential errors. By using the correct forms and supporting documentation, you can accurately report your financial information and fulfill your tax obligations. Whether you file your taxes independently or seek professional assistance, having the right forms is essential for a successful tax season.