As tax season approaches, many Americans are starting to gather their documents and prepare to file their federal income taxes. One important aspect of this process is having the necessary forms to accurately report income, deductions, and credits to the IRS. Fortunately, the IRS provides printable federal income tax forms that can be easily accessed and filled out by taxpayers.

These forms are essential for individuals and businesses to report their financial information to the government and ensure compliance with tax laws. By having access to printable federal income tax forms, taxpayers can accurately report their income, claim deductions and credits, and calculate their tax liability.

Printable Federal Income Tax Forms

Printable Federal Income Tax Forms

Download and Print Printable Federal Income Tax Forms

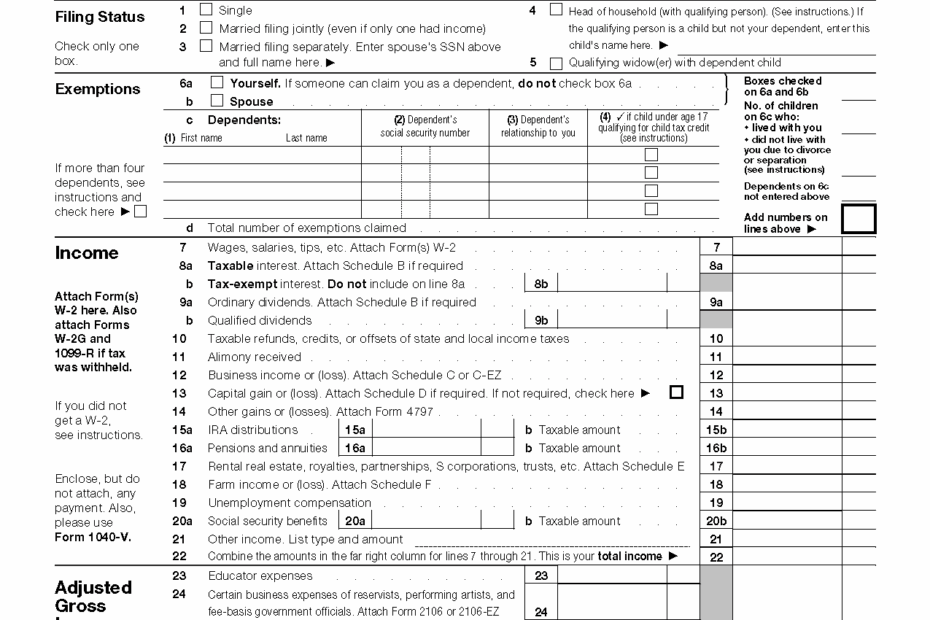

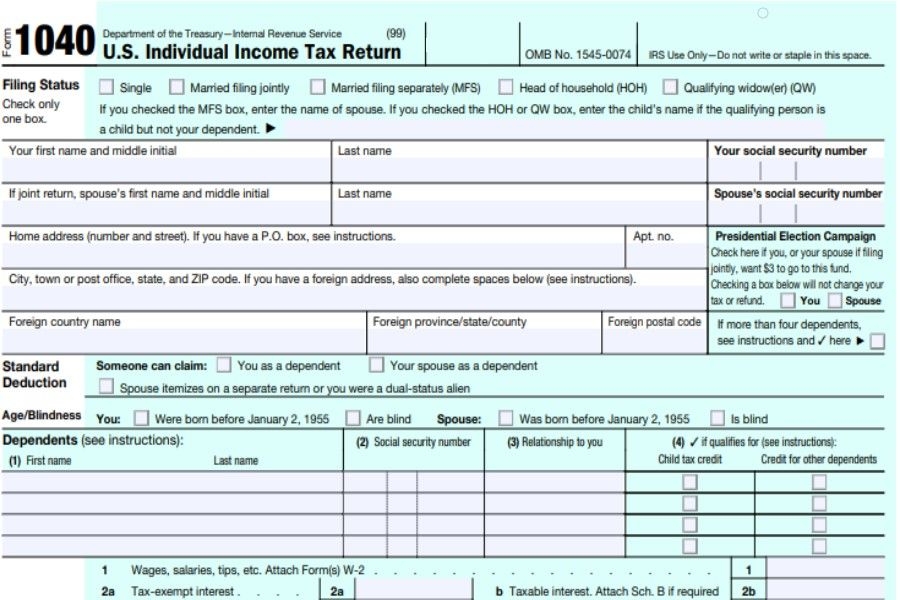

One of the most commonly used federal income tax forms is the 1040 form, which is used by individuals to report their income, deductions, and credits. This form is available in a printable format on the IRS website, making it easy for taxpayers to download and complete. Additionally, there are various schedules and worksheets that may need to accompany the 1040 form, all of which can be found online.

In addition to the 1040 form, there are other forms that may be required depending on an individual’s financial situation. This includes forms for reporting self-employment income, capital gains, rental income, and more. By having access to printable federal income tax forms, taxpayers can ensure they are reporting all income and deductions accurately.

Overall, printable federal income tax forms are a valuable resource for taxpayers as they navigate the tax filing process. By having these forms readily available, individuals and businesses can accurately report their financial information to the IRS and avoid penalties for non-compliance. As tax season approaches, it is important for taxpayers to gather the necessary forms and start preparing their tax returns to meet the filing deadline.

Take advantage of the convenience of printable federal income tax forms to ensure a smooth and accurate tax filing process. By utilizing these resources, taxpayers can navigate the complexities of the tax system and fulfill their obligations to the government.