Keeping track of your finances is essential for managing your money effectively. One tool that can help you stay organized is a checking account ledger. This document allows you to record all your transactions, including deposits, withdrawals, and checks written. While digital options are available, some people prefer a printable checking account ledger that they can fill out by hand.

With a printable checking account ledger, you can easily monitor your spending and ensure that you have enough funds to cover your expenses. It provides a visual representation of your financial activities and helps you identify any discrepancies in your account. By recording every transaction, you can also detect any fraudulent activity and protect yourself from potential financial risks.

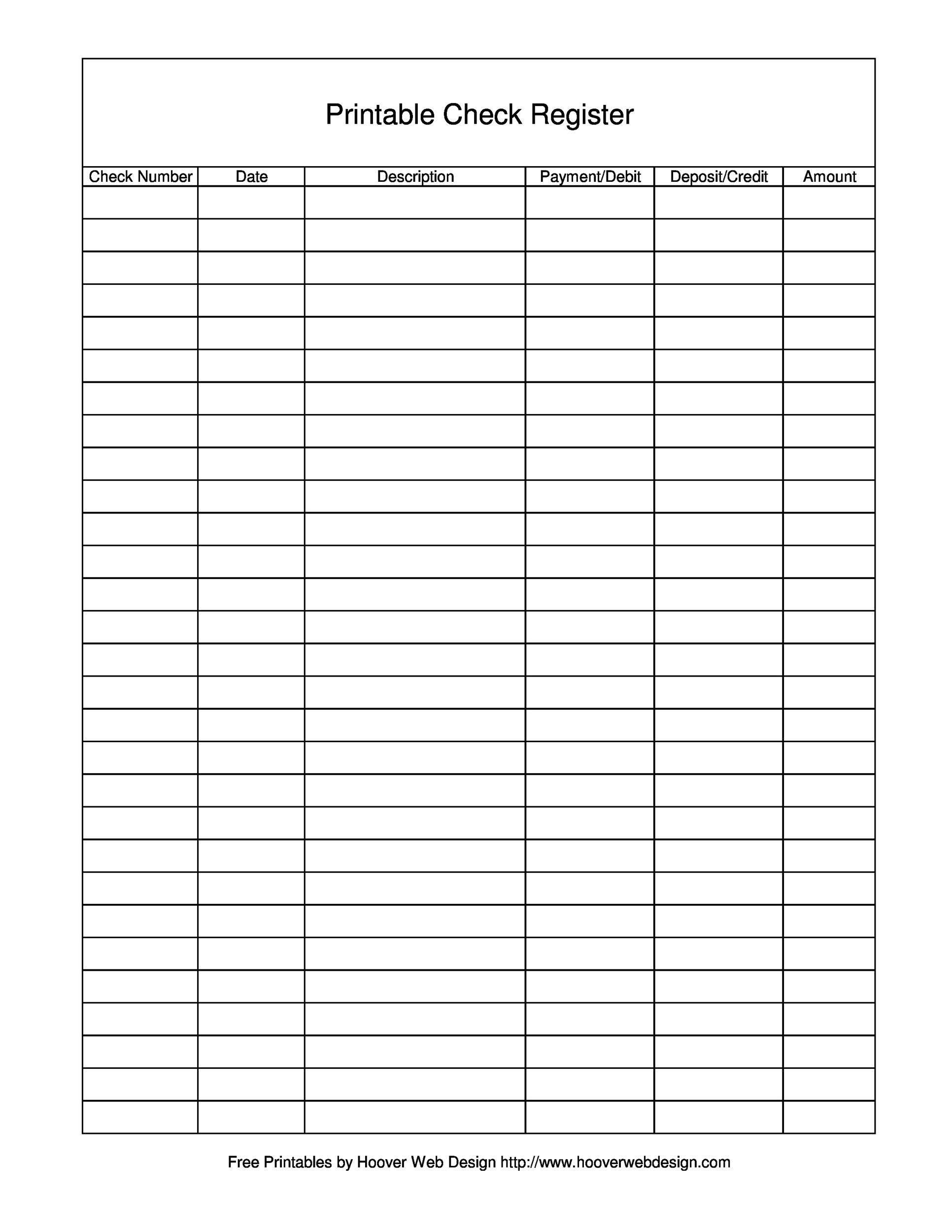

Printable Checking Account Ledger

Printable Checking Account Ledger

Save and Print Printable Checking Account Ledger

Using a printable checking account ledger is simple and straightforward. You can easily download a template online or create your own format that suits your needs. Once you have the ledger in hand, all you need to do is fill in the necessary information for each transaction, such as the date, description, amount, and balance. Regularly updating your ledger will give you a clear picture of your financial health and allow you to make informed decisions about your money.

One of the benefits of using a printable checking account ledger is that it provides a tangible record of your financial history. Unlike digital platforms that may be prone to technical glitches or hacking incidents, a paper ledger is secure and reliable. You can keep it in a safe place and refer back to it whenever needed. Additionally, having a physical document can be particularly helpful during tax season or when applying for loans.

In conclusion, a printable checking account ledger is a valuable tool for managing your finances effectively. Whether you prefer a digital or paper-based system, keeping track of your transactions is crucial for staying on top of your money. By using a ledger, you can track your spending, detect any errors or discrepancies, and make informed financial decisions. So why not give it a try and see how it can help you take control of your finances?