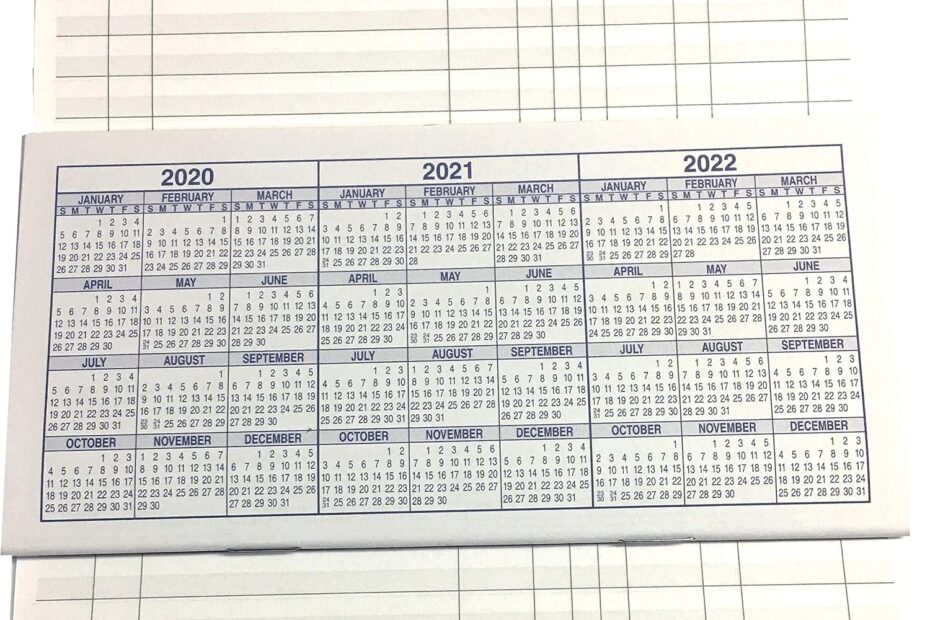

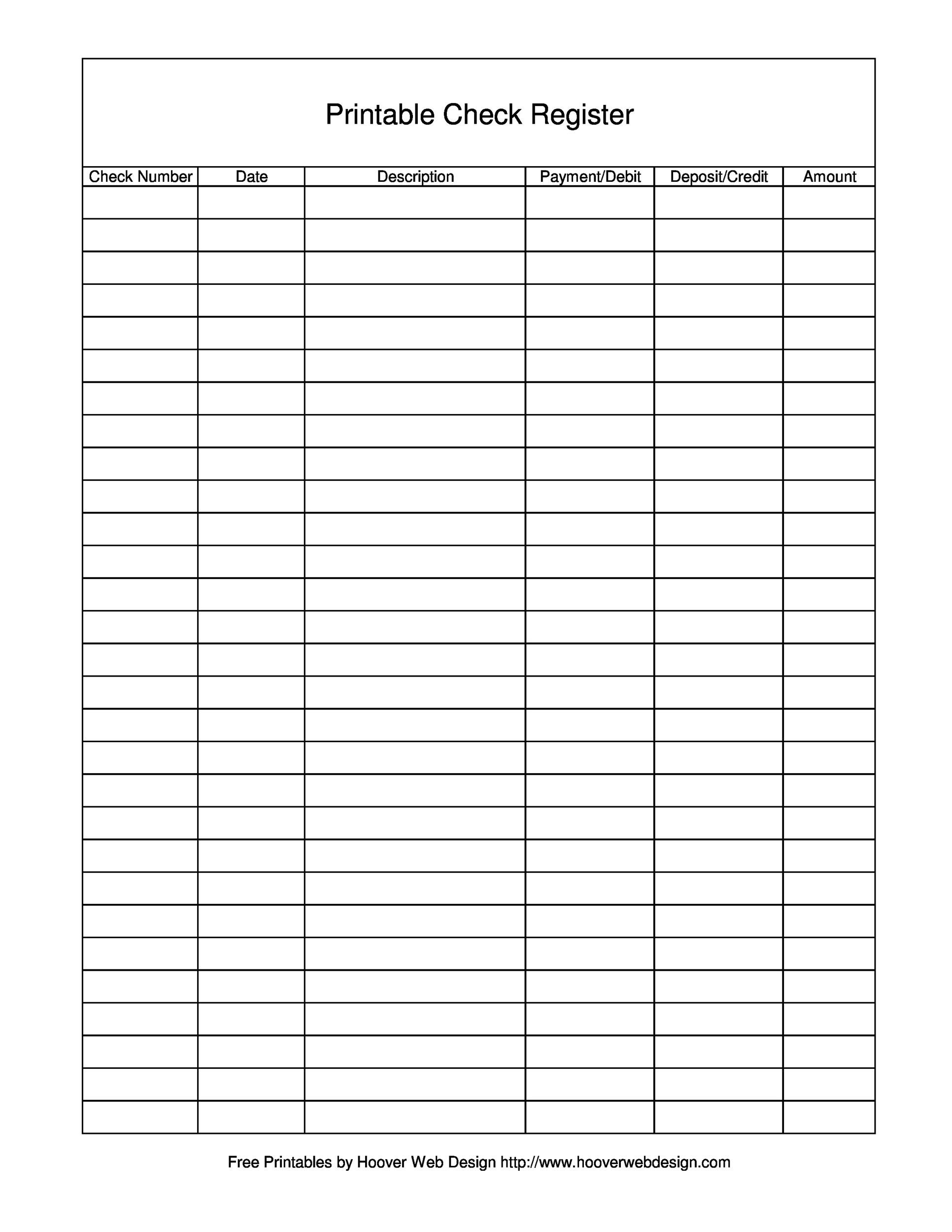

Keeping track of your expenses and income is essential for managing your finances effectively. One way to do this is by using a check register calendar. This tool allows you to record all your financial transactions in one place, making it easier to track your spending and ensure that you stay within your budget.

A printable check register calendar provides a convenient way to organize your finances. You can easily print out a template and fill in the details of each transaction, such as the date, description, amount, and category. This allows you to see at a glance where your money is going and identify any areas where you may need to cut back.

Printable Check Register Calendar

Printable Check Register Calendar

Get and Print Printable Check Register Calendar

Using a check register calendar can also help you avoid overdrawing your account or missing important payments. By keeping a record of all your transactions, you can ensure that you have enough funds to cover your expenses and avoid costly overdraft fees. Additionally, you can use the calendar to set reminders for upcoming bills or payments, ensuring that you never miss a due date.

Another benefit of using a printable check register calendar is that it can help you track your financial goals. Whether you are saving for a vacation, a new car, or a down payment on a house, having a clear picture of your finances can help you stay on track and make informed decisions about your spending. By regularly updating your check register calendar, you can monitor your progress towards your goals and make adjustments as needed.

In conclusion, a printable check register calendar is a valuable tool for managing your finances and staying on top of your expenses. By using this tool to track your transactions, set reminders, and monitor your financial goals, you can take control of your money and make smarter decisions about how you spend and save. So why not give it a try and see how it can help you achieve financial success?