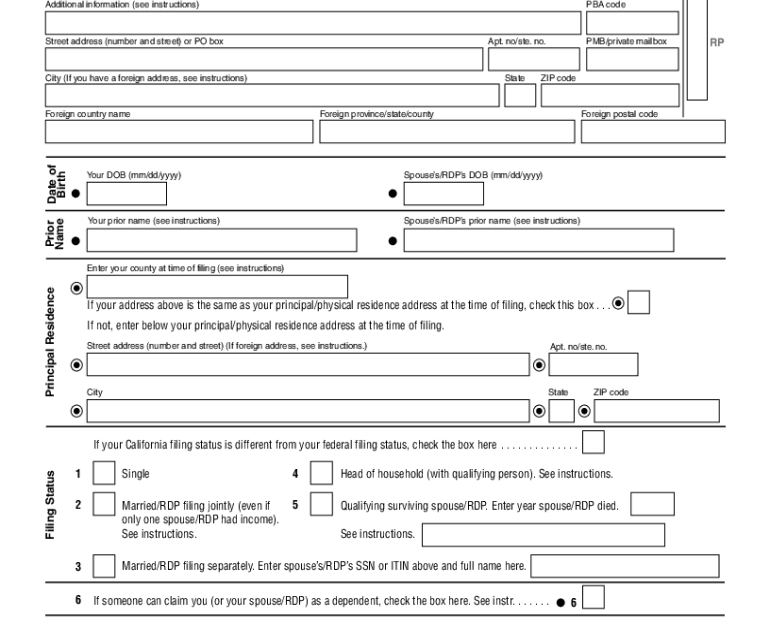

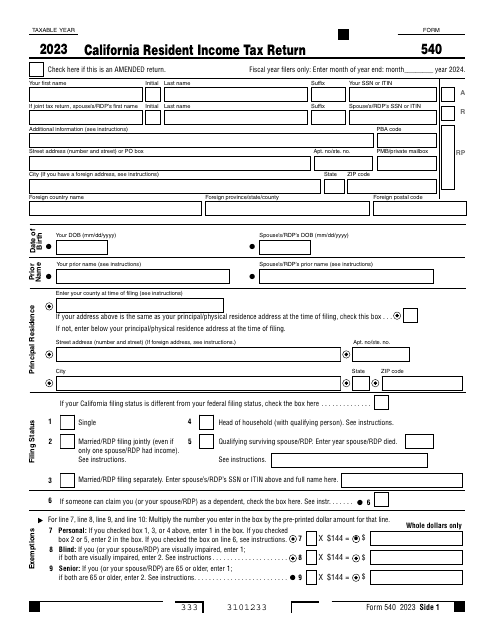

Are you a resident of California looking to file your income tax return? Look no further than the Printable Ca Form 540 Resident Income Tax Return Pdf Formswift. This form is designed to help you easily report your income, deductions, credits, and more to the California Franchise Tax Board.

With this printable form, you can accurately document your financial information and ensure that you are meeting all of your tax obligations. Whether you are a full-time employee, self-employed, or have other sources of income, this form will guide you through the process of filing your state taxes.

Printable Ca Form 540 Resident Income Tax Return Pdf Formswift

Printable Ca Form 540 Resident Income Tax Return Pdf Formswift

Save and Print Printable Ca Form 540 Resident Income Tax Return Pdf Formswift

Completing the Ca Form 540 Resident Income Tax Return Pdf Formswift is simple and straightforward. You can easily download the form online, fill it out electronically or by hand, and then submit it to the California Franchise Tax Board. This form is essential for all California residents who need to file their state income taxes.

When filling out the form, be sure to accurately report all of your income, including wages, interest, dividends, and any other sources of income. You should also document any deductions or credits you may be eligible for, such as mortgage interest, charitable contributions, or education expenses. By providing accurate information on the form, you can avoid potential audits or penalties from the tax authorities.

After completing the Ca Form 540 Resident Income Tax Return Pdf Formswift, be sure to review it carefully for any errors or omissions. Once you are confident that all of the information is accurate, you can submit the form to the California Franchise Tax Board either electronically or by mail. Remember to keep a copy of the form for your records, as well as any supporting documentation that may be required.

In conclusion, the Printable Ca Form 540 Resident Income Tax Return Pdf Formswift is an essential tool for California residents who need to file their state income taxes. By accurately reporting your income, deductions, and credits on this form, you can ensure that you are meeting your tax obligations and avoiding potential penalties. Download the form today and get started on filing your state taxes!