Managing your finances can be a daunting task, especially when it comes to keeping track of your expenses and payments. One useful tool to help you stay organized is a printable blank check register. This simple document allows you to record all of your transactions in one place, making it easier to track your spending and balance your accounts.

Whether you prefer to keep a physical paper record or use a digital format, having a blank check register can help you stay on top of your finances and avoid any unexpected surprises. By keeping track of every check you write, deposit you make, and debit card transaction you complete, you can ensure that your finances are in order and avoid any overdraft fees or missed payments.

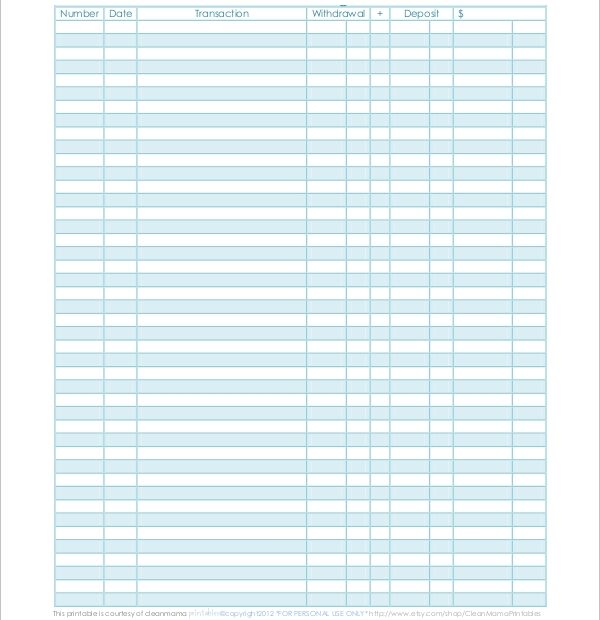

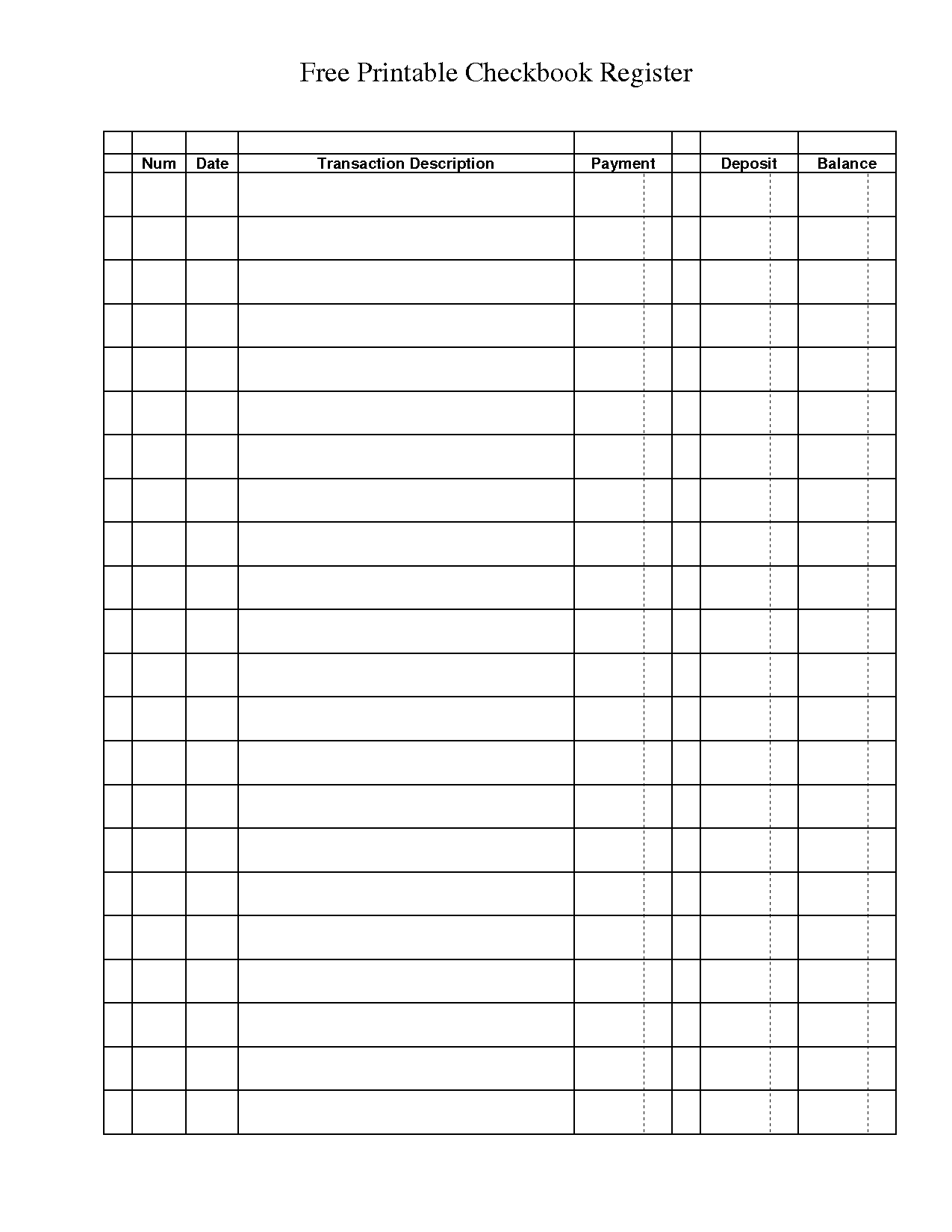

Printable Blank Check Register

Printable Blank Check Register

Easily Download and Print Printable Blank Check Register

Printable Blank Check Register

A printable blank check register is a convenient tool that you can use to keep track of your finances. You can easily find templates online that you can customize to suit your needs. Simply download the template, print it out, and start recording your transactions. You can fill in the date, check number, payee, amount, and any notes or memos related to the transaction.

Having a physical copy of your check register can be especially helpful if you prefer to have a tangible record of your finances. You can easily carry it with you in your wallet or purse and update it whenever you make a transaction. This way, you can always have an up-to-date record of your expenses and payments.

Using a printable blank check register can also help you identify any discrepancies in your account. By comparing your register to your bank statement, you can quickly spot any errors or unauthorized charges. This can help you catch any fraudulent activity early and take steps to protect your finances.

In conclusion, a printable blank check register is a valuable tool for managing your finances and staying organized. Whether you prefer a physical paper record or a digital format, having a check register can help you track your expenses, balance your accounts, and avoid any financial mishaps. By using a blank check register, you can take control of your finances and ensure that your money is being managed effectively.