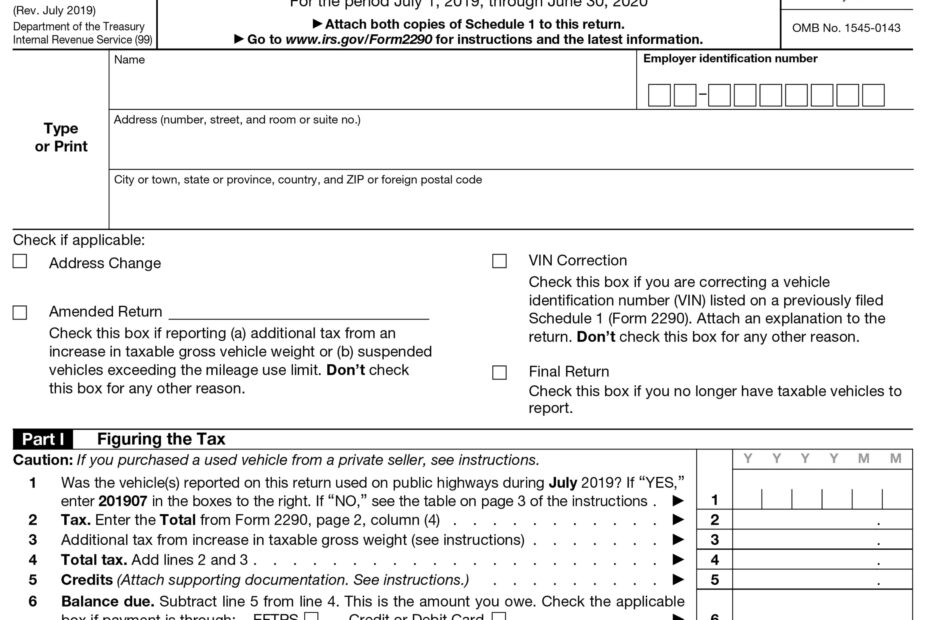

When it comes to filing taxes for your heavy vehicle, the 2290 IRS Form is an important document to have. This form is used to report and pay the Heavy Highway Vehicle Use Tax, which is required for vehicles with a gross weight of 55,000 pounds or more. Filing this form is essential for staying in compliance with IRS regulations and avoiding penalties.

While filling out the 2290 IRS Form may seem daunting, there are resources available to make the process easier. One such resource is the printable version of the form, which allows you to fill it out manually and submit it to the IRS. This can be especially helpful for those who prefer to have a physical copy of their tax documents.

Get and Print Printable 2290 Irs Form

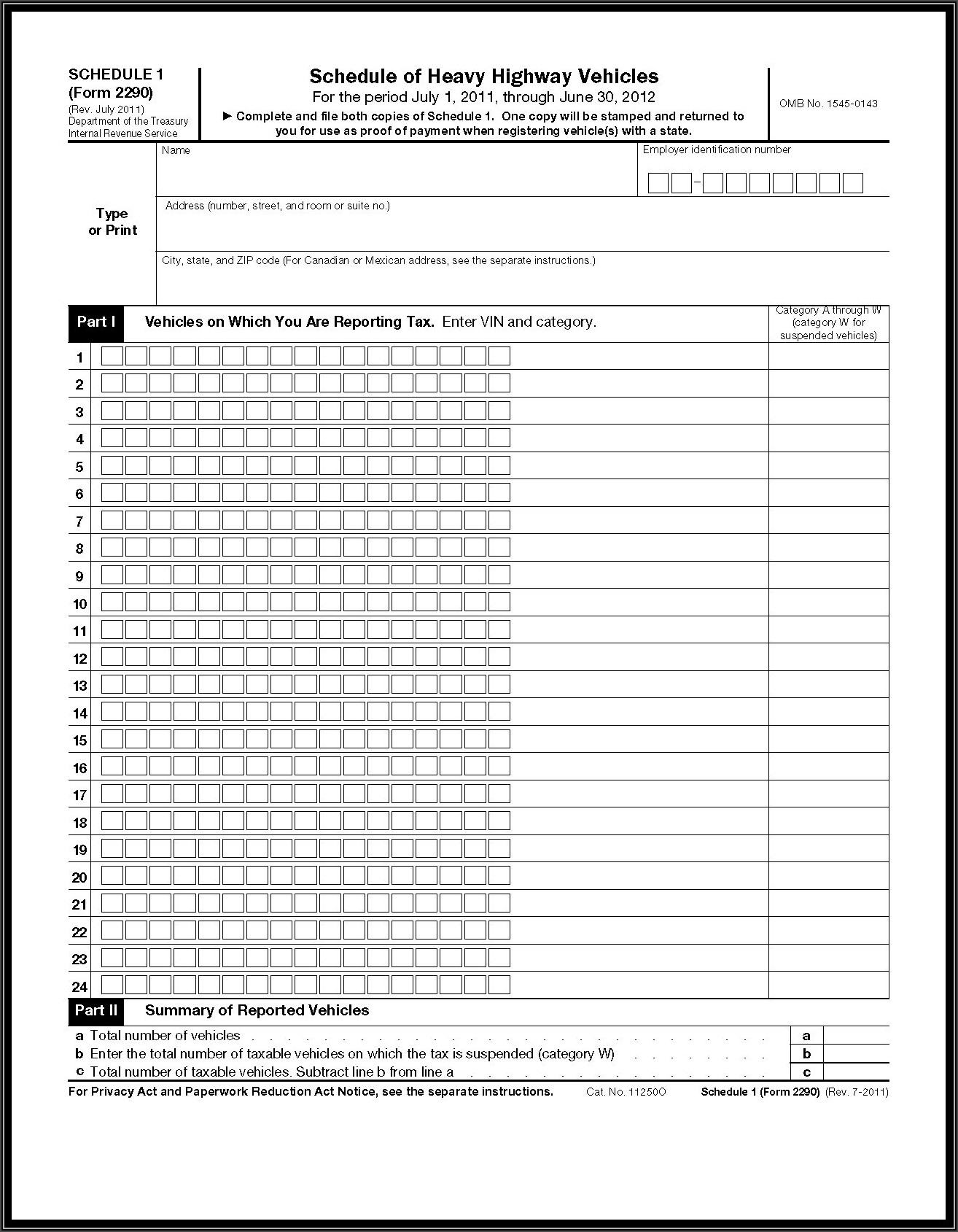

Printable 2290 IRS Form is easily accessible online and can be downloaded and printed for free. This form includes all the necessary fields for reporting your vehicle information, calculating the tax due, and making payments. Having a printed copy of the form can also serve as a helpful reference for keeping track of your tax records.

It is important to accurately fill out the 2290 IRS Form to avoid any delays or errors in processing. Make sure to provide all the required information, including your vehicle details, mileage use limit, and tax payment details. Double-check your entries before submitting the form to ensure accuracy.

Once you have completed the Printable 2290 IRS Form, you can mail it to the IRS along with your payment or use the e-file option for faster processing. Whichever method you choose, be sure to keep a copy of the form for your records. This will come in handy in case you need to reference it in the future or if you are audited by the IRS.

In conclusion, the Printable 2290 IRS Form is a valuable tool for reporting and paying the Heavy Highway Vehicle Use Tax. By utilizing this form, you can ensure compliance with IRS regulations and avoid penalties. Make sure to fill out the form accurately and keep a copy for your records to stay organized and prepared for tax season.