As tax season approaches, it’s important to stay informed about any changes to tax forms and regulations. One essential document for individuals filing taxes is the IRS Form 1040. This form is used to report income, deductions, and credits to calculate the amount of tax owed or refund due to the taxpayer.

For the year 2025, the IRS has made updates to the Form 1040 to reflect any changes in tax laws or procedures. It’s crucial for taxpayers to be aware of these updates and to have access to a printable version of the form for their convenience.

Get and Print Printable 2025 Irs Form 1040

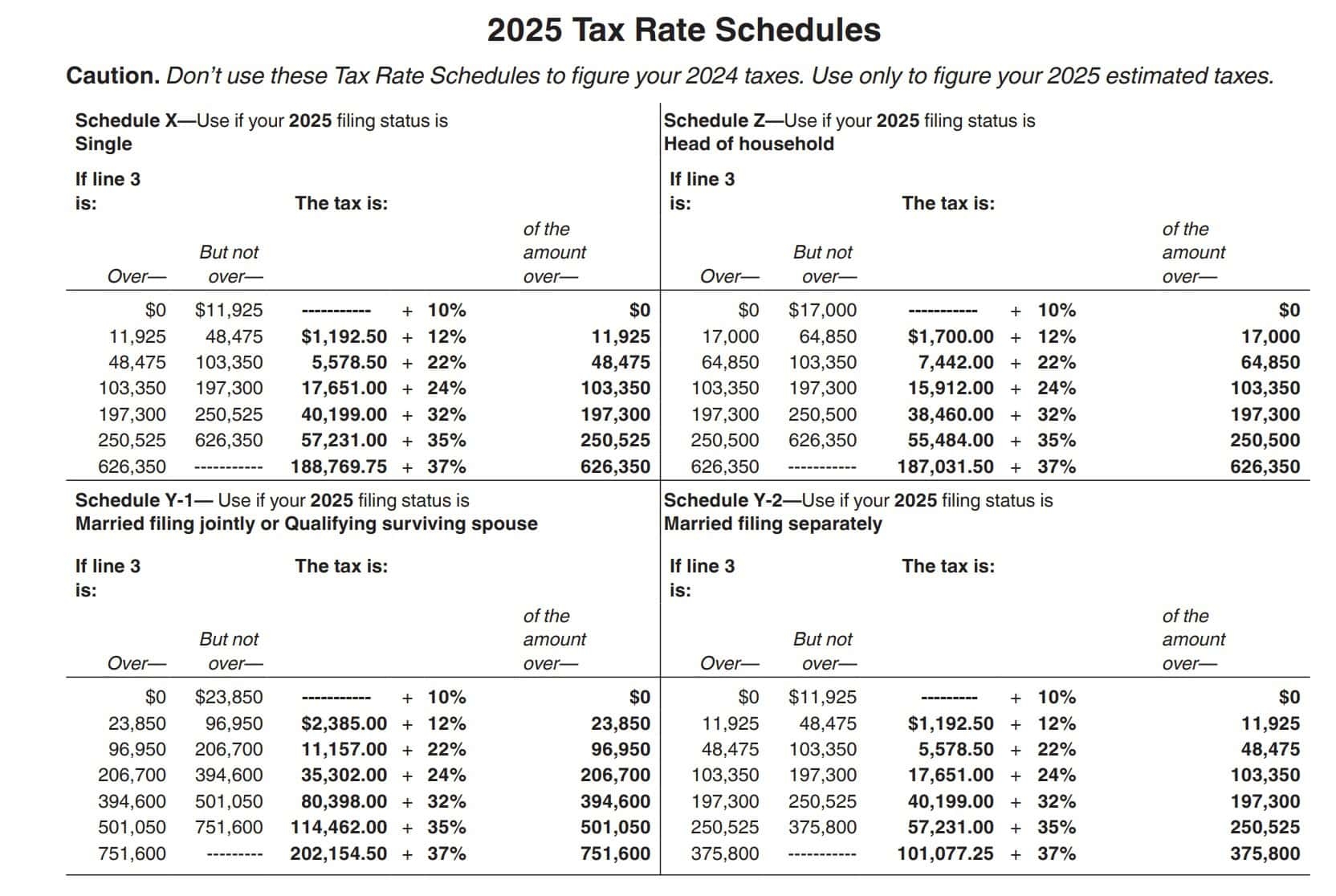

IRS Form 1040 ES Instructions Estimated Tax Payments

IRS Form 1040 ES Instructions Estimated Tax Payments

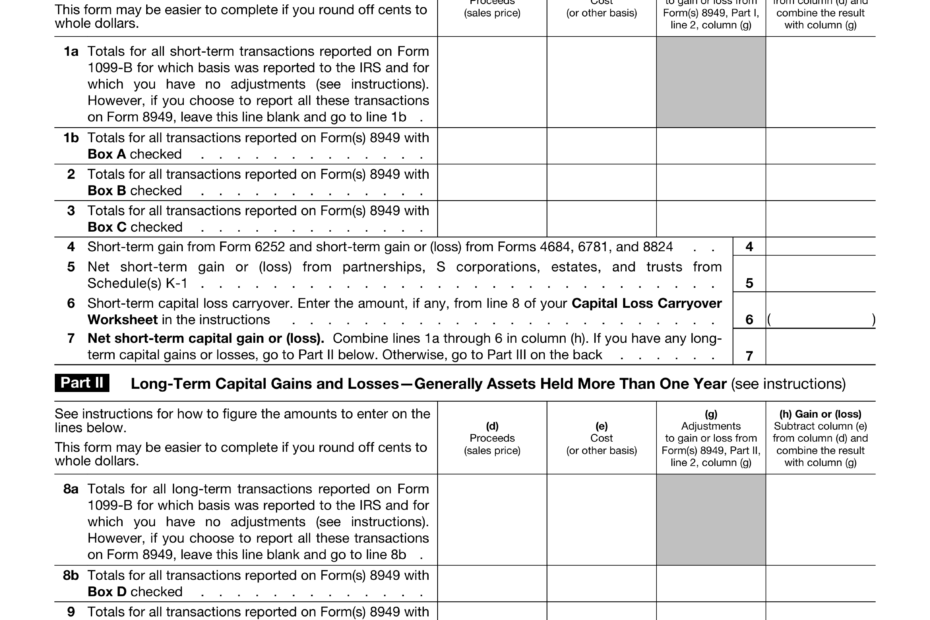

The 2025 IRS Form 1040 is available for download on the IRS website or through various online tax preparation services. This form includes sections for personal information, income reporting, deductions, and credits. Taxpayers must accurately fill out each section to ensure their tax return is processed correctly.

When using the printable 2025 IRS Form 1040, taxpayers should double-check their calculations and ensure all necessary documentation is attached. Any errors or missing information could result in delays in processing or potential audits by the IRS. It’s always advisable to review the form with a tax professional or use tax software to help with accuracy.

As tax laws can be complex and subject to change, it’s important to stay informed and up-to-date with the latest IRS forms and regulations. By utilizing the printable 2025 IRS Form 1040, taxpayers can easily prepare and file their taxes accurately and on time.

In conclusion, the printable 2025 IRS Form 1040 is a vital document for individuals to report their income and calculate their tax liability. By being aware of any updates or changes to the form, taxpayers can effectively file their taxes and avoid any penalties or issues with the IRS. It’s recommended to download the form from a reliable source and seek assistance if needed to ensure a smooth tax-filing process.