Filing taxes can be a daunting task, but having the necessary forms ready can make the process much smoother. In the United States, federal income tax forms are essential for individuals and businesses to report their earnings and calculate the amount of taxes owed to the government. With the tax season approaching, it’s crucial to have access to the latest forms to ensure accurate and timely filing.

Fortunately, the Internal Revenue Service (IRS) provides printable 2020 federal income tax forms on their official website. These forms are available for download in PDF format, making it convenient for taxpayers to fill them out electronically or print them for manual completion. Whether you’re an individual taxpayer, self-employed individual, or business owner, there are specific forms tailored to your needs.

Printable 2020 Federal Income Tax Forms

Printable 2020 Federal Income Tax Forms

Download and Print Printable 2020 Federal Income Tax Forms

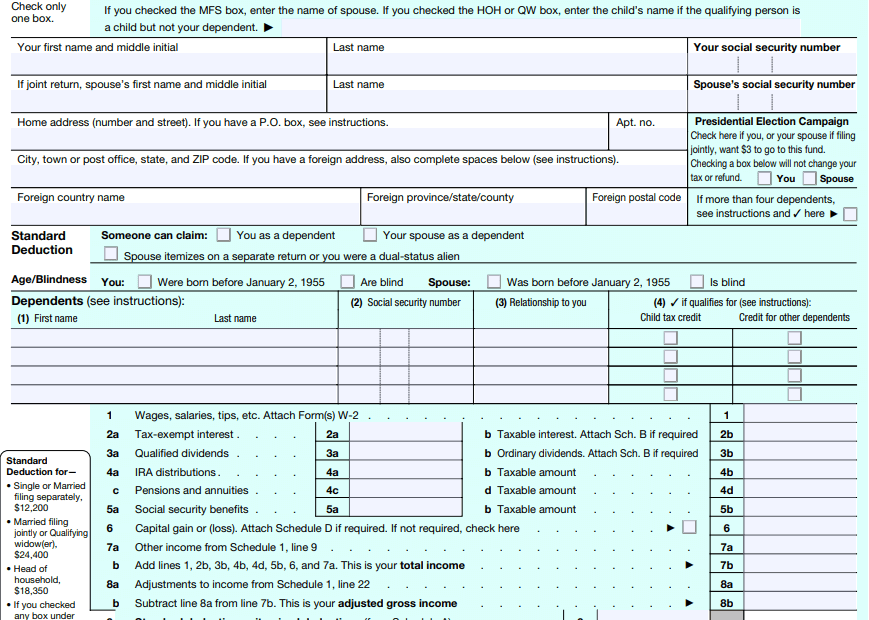

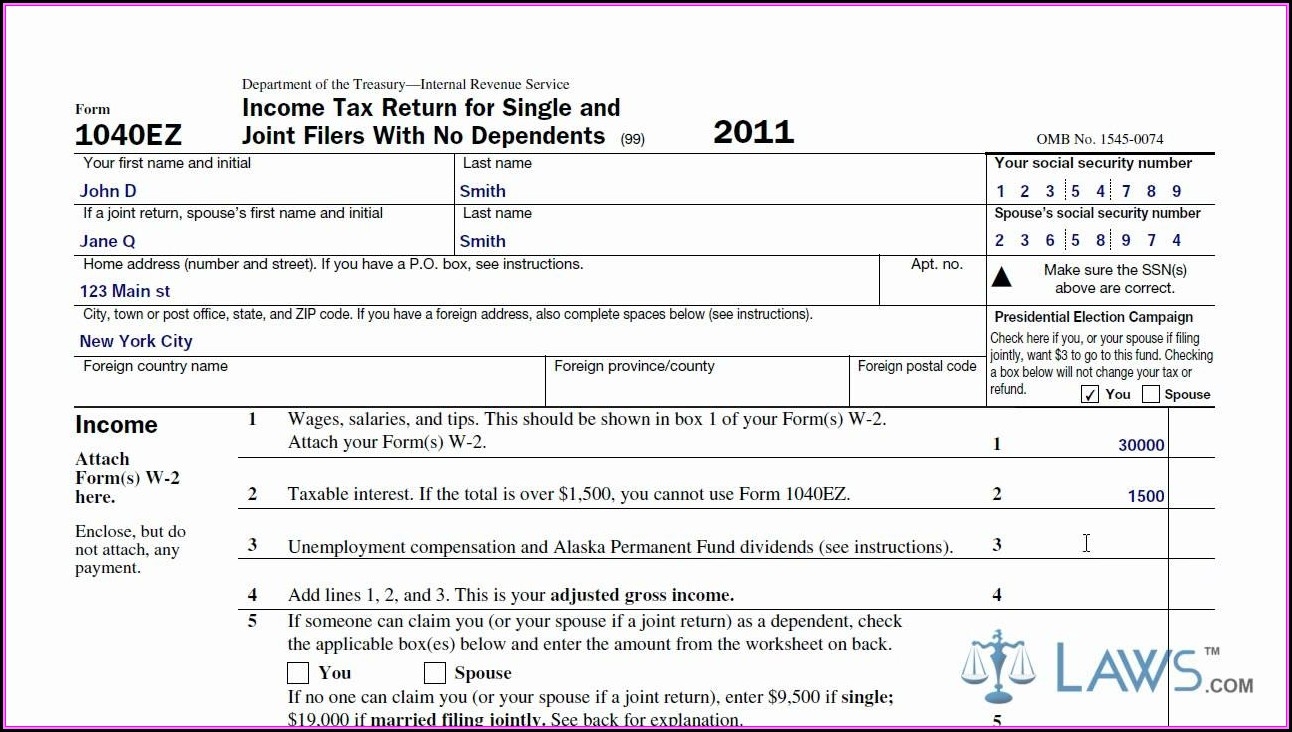

One of the most commonly used forms is the Form 1040, which is used by individuals to report their income, deductions, and credits. Additionally, there are various schedules and worksheets that may need to be filled out depending on your specific tax situation. It’s essential to carefully review the instructions provided with each form to ensure accurate reporting.

For self-employed individuals and small business owners, forms such as Schedule C (Profit or Loss from Business) and Form 1099-MISC (Miscellaneous Income) are crucial for reporting income earned from freelance work or independent contracting. These forms help calculate the net profit or loss from your business activities and determine the amount of self-employment tax owed.

As tax laws and regulations are subject to change each year, it’s important to use the most up-to-date forms for filing your taxes. The IRS updates their forms annually to reflect any changes in tax laws, deductions, or credits. By downloading and using the printable 2020 federal income tax forms, you can ensure compliance with current tax requirements and avoid potential penalties for incorrect filing.

In conclusion, having access to printable 2020 federal income tax forms is essential for a smooth and accurate tax filing process. Whether you’re an individual taxpayer or a small business owner, these forms provide the necessary tools to report your income, deductions, and credits effectively. Make sure to visit the IRS website to download the latest forms and stay informed about any changes in tax laws for the upcoming tax season.