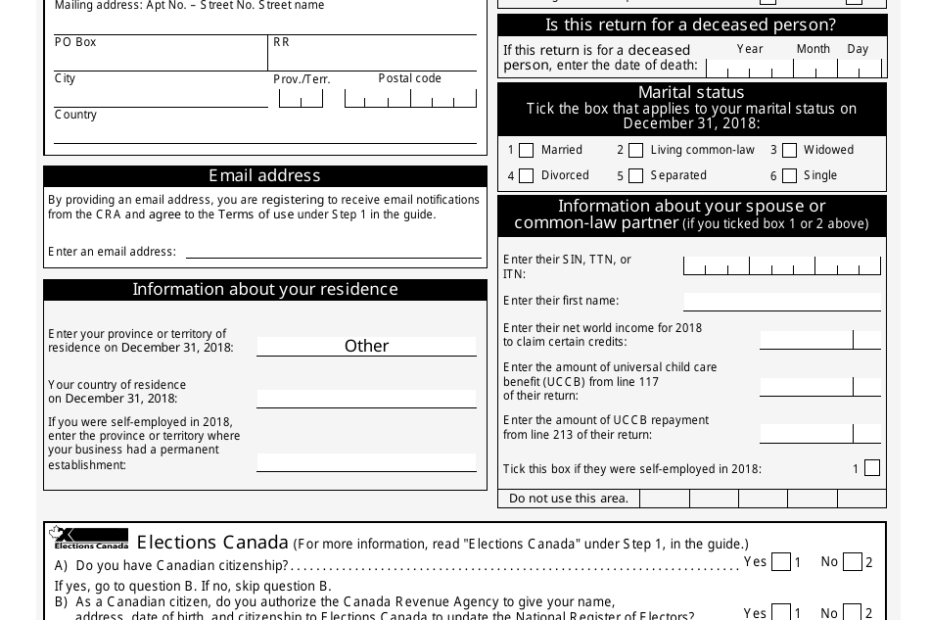

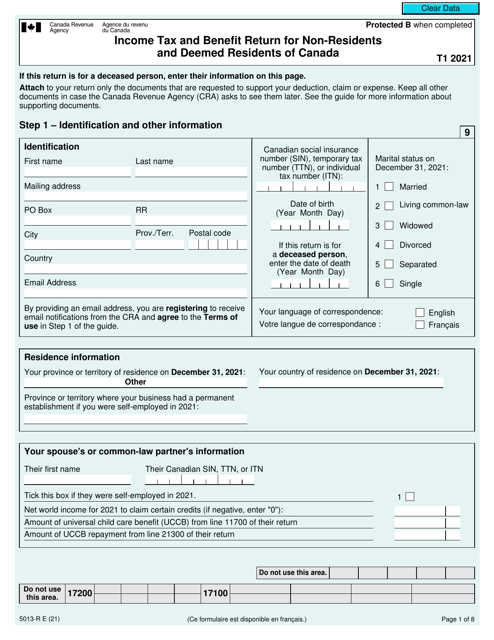

As the tax season approaches, Canadians are gearing up to file their income tax returns for the year 2020. It is essential to have the necessary forms and documents in place to accurately report your income and claim any deductions or credits you may be eligible for. The Canada Revenue Agency (CRA) provides printable 2020 Canadian income tax forms to make the process easier for taxpayers.

Whether you are a salaried employee, self-employed individual, or have other sources of income, having the right tax forms is crucial for filing your taxes accurately and on time. The printable 2020 Canadian income tax forms include T1 General, which is the main form for individuals to report their income, deductions, and credits. Additionally, there are specific forms for various tax credits, deductions, and schedules depending on your financial situation.

Printable 2020 Canadian Income Tax Forms

Printable 2020 Canadian Income Tax Forms

Easily Download and Print Printable 2020 Canadian Income Tax Forms

One of the most commonly used tax forms is the T1 General, which includes sections for personal information, income, deductions, and credits. It is important to fill out this form accurately to avoid any discrepancies in your tax return. The printable 2020 Canadian income tax forms can be downloaded from the CRA website or obtained from a local tax service office.

For individuals with self-employment income or rental income, additional forms such as the T2125 for Business or Professional Activities and T776 for Rental Income must be filled out. These forms require detailed information about your business income and expenses or rental property income. It is important to keep accurate records and receipts to support the information reported on these forms.

Before filing your taxes, it is advisable to review the printable 2020 Canadian income tax forms and instructions provided by the CRA. This will help ensure that you have all the necessary documents and information to complete your tax return accurately. Filing your taxes on time and accurately can help you avoid penalties and interest charges imposed by the CRA for late or incorrect filings.

In conclusion, having access to printable 2020 Canadian income tax forms is essential for individuals to file their taxes accurately and on time. It is important to familiarize yourself with the various forms and instructions provided by the CRA to ensure a smooth tax-filing process. By being prepared and organized, you can maximize any tax credits or deductions you are eligible for and avoid any potential penalties for non-compliance.