As tax season approaches, many Canadians are preparing to file their income taxes for the year 2019. One of the first steps in this process is to ensure you have the necessary forms to accurately report your income, deductions, and credits. The Canada Revenue Agency (CRA) provides a variety of printable forms that taxpayers can use to file their taxes.

Whether you are an individual or a business owner, it is essential to have the correct tax forms to avoid any delays or errors in your tax filing. By using the printable 2019 income tax forms provided by the CRA, you can ensure that you are reporting your income accurately and taking advantage of any eligible tax credits and deductions.

Printable 2019 Income Tax Forms Canada

Printable 2019 Income Tax Forms Canada

Easily Download and Print Printable 2019 Income Tax Forms Canada

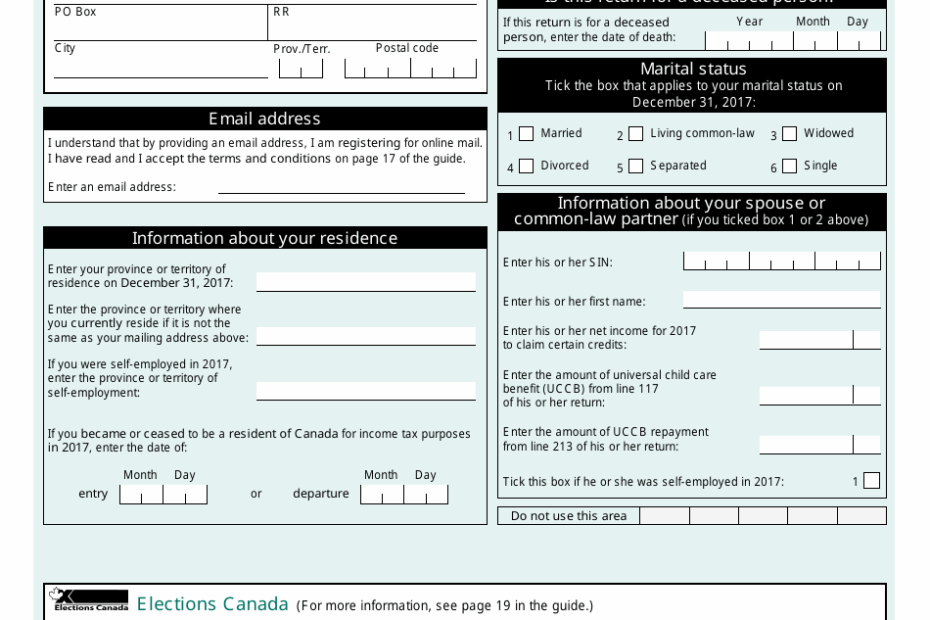

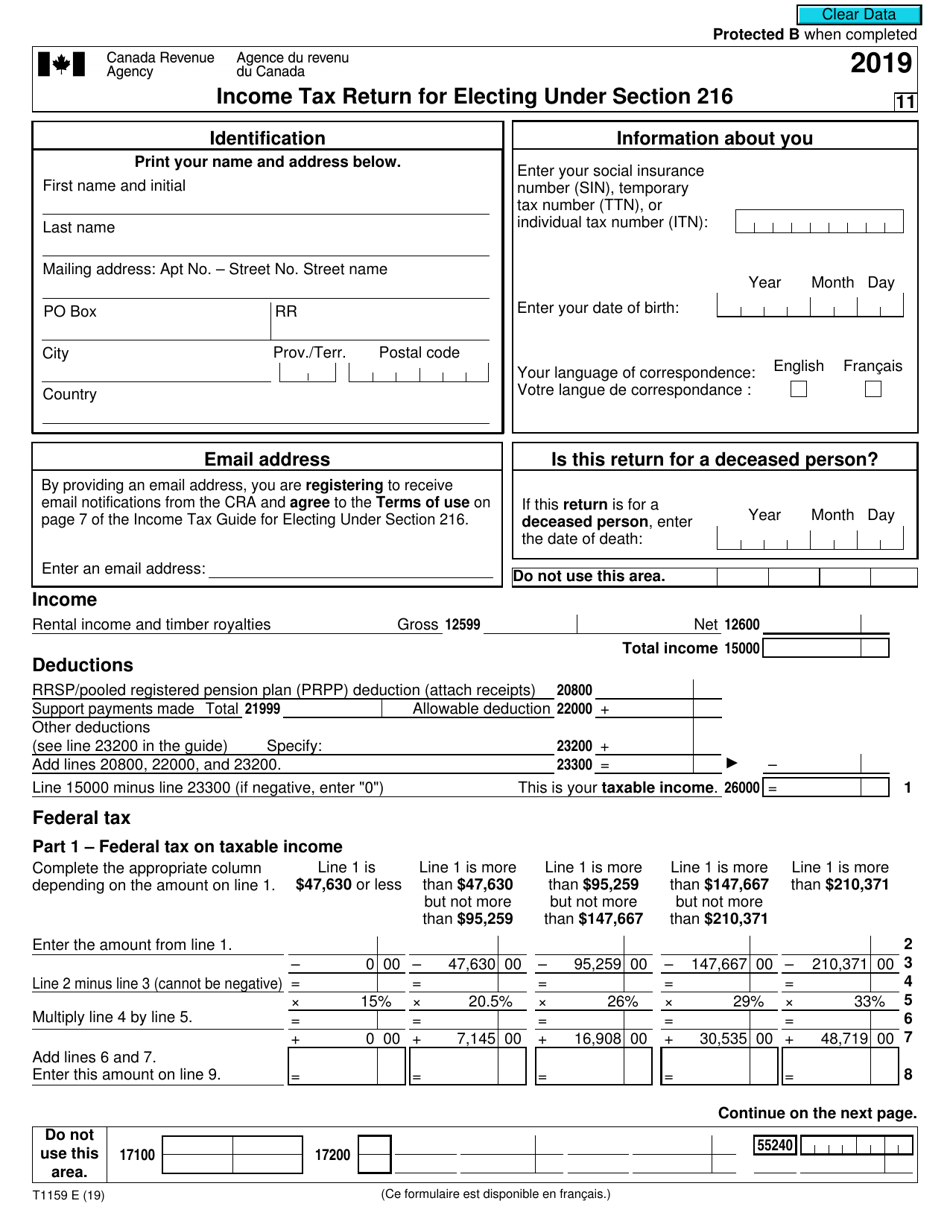

When it comes to filing your taxes, there are several key forms that you may need to complete, depending on your individual circumstances. Some of the most common forms include the T1 General Income Tax and Benefit Return for individuals, the T2 Corporation Income Tax Return for businesses, and various schedules and worksheets for reporting income from sources such as employment, investments, and rental properties.

It is important to carefully review each form and its instructions to ensure that you are providing accurate information and claiming all eligible deductions and credits. By using the printable 2019 income tax forms provided by the CRA, you can easily access and complete the necessary paperwork to file your taxes on time and accurately.

Additionally, the CRA offers online services for filing taxes, including the option to file electronically using certified tax software. However, if you prefer to file by mail or in person, having the printable 2019 income tax forms on hand can simplify the process and ensure that you have all the necessary documentation to support your tax return.

Overall, by utilizing the printable 2019 income tax forms provided by the CRA, you can streamline the tax filing process and ensure that you are compliant with Canadian tax laws. Remember to keep all receipts and supporting documentation for your tax return, and don’t hesitate to seek assistance from a tax professional if you have any questions or concerns.