As tax season approaches, many individuals are scrambling to gather all their documents and file their taxes on time. One crucial aspect of this process is obtaining the necessary tax forms to accurately report your income and deductions. Fortunately, there are printable 2017 income tax forms available online that can make this task easier for you.

These printable forms are essential for individuals who prefer to file their taxes on their own without the help of a tax professional. By having access to these forms, you can carefully review your financial information and ensure that everything is accurately reported to the IRS. This can help prevent any errors or discrepancies that may lead to penalties or audits.

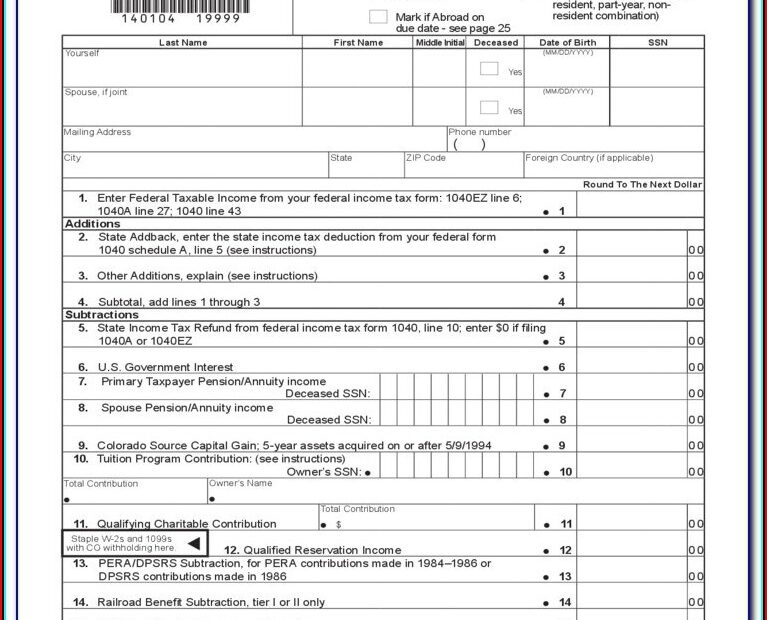

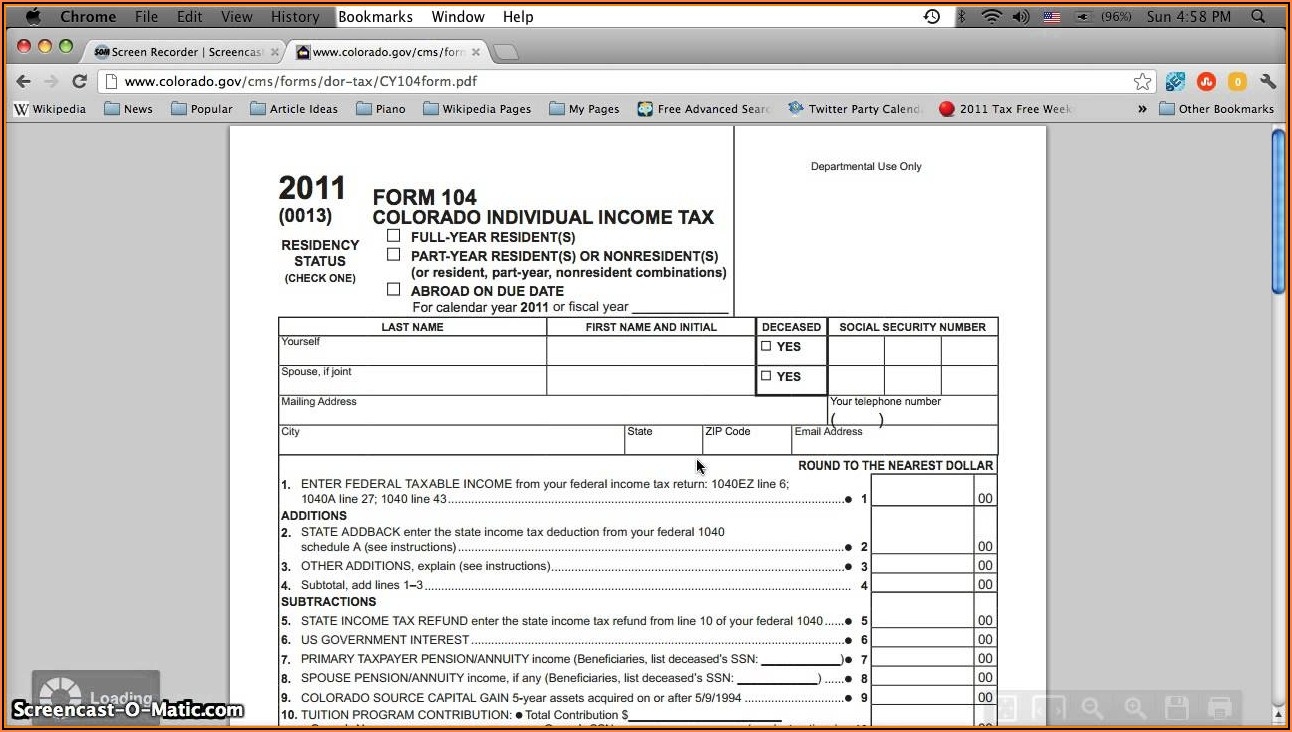

Printable 2017 Income Taxk Forms

Printable 2017 Income Taxk Forms

Get and Print Printable 2017 Income Taxk Forms

Printable 2017 Income Tax Forms

There are various types of income tax forms that you may need to file your taxes, depending on your financial situation. Some common forms include the 1040, 1040A, and 1040EZ forms, which are used by individuals to report their income, deductions, and credits. These forms can be easily found on the IRS website or other reputable tax preparation websites.

Additionally, if you have income from sources other than employment, such as investments or rental properties, you may need to file additional forms like the Schedule A, B, or C forms. These forms provide a detailed breakdown of your income and expenses, allowing you to accurately calculate your tax liability.

It is important to note that the deadline for filing your 2017 taxes is typically April 15th of the following year. By using printable income tax forms, you can start the filing process early and ensure that you have enough time to gather all the necessary documents and information. This can help you avoid the last-minute rush and potential mistakes in your tax return.

In conclusion, printable 2017 income tax forms are a valuable resource for individuals who want to file their taxes accurately and efficiently. By using these forms, you can take control of your financial situation and ensure that you are complying with IRS regulations. So, don’t wait until the last minute – start gathering your documents and fill out your tax forms today!