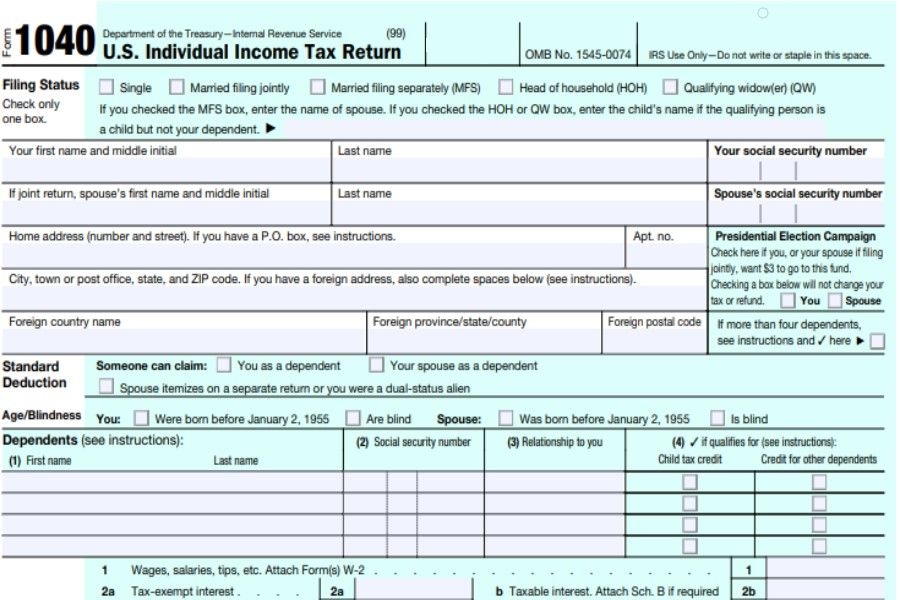

As tax season approaches, it’s important to have all the necessary forms ready to file your taxes accurately and on time. One of the most commonly used forms is the Federal Income Tax Form 1040, which is used by individuals to report their annual income to the IRS.

For the year 2014, taxpayers can find the printable version of the Federal Income Tax Form 1040 online, making it easy to download, print, and fill out at their convenience. This form includes sections for reporting income, deductions, credits, and any taxes owed or refunds due.

Printable 2014 Federal Income Tax Form 1040

Printable 2014 Federal Income Tax Form 1040

Easily Download and Print Printable 2014 Federal Income Tax Form 1040

When completing the 2014 Federal Income Tax Form 1040, taxpayers will need to gather documents such as W-2s, 1099s, and receipts for deductions. It’s important to double-check all information before submitting the form to avoid any errors that could delay the processing of your tax return.

One of the key changes to the 2014 tax form is the Affordable Care Act, which requires taxpayers to indicate whether they had health insurance coverage for the year. This information is used to determine if a taxpayer qualifies for certain tax credits or penalties related to healthcare coverage.

Once the 2014 Federal Income Tax Form 1040 is completed, taxpayers can either mail it to the IRS or file electronically for a faster processing time. It’s important to keep a copy of the completed form for your records and to follow up with the IRS if you have not received a refund or any correspondence within a reasonable timeframe.

Overall, having access to the printable 2014 Federal Income Tax Form 1040 makes it easier for taxpayers to fulfill their tax obligations and ensure compliance with federal tax laws. By accurately reporting their income and deductions, individuals can avoid potential penalties and maximize any refunds owed to them by the IRS.