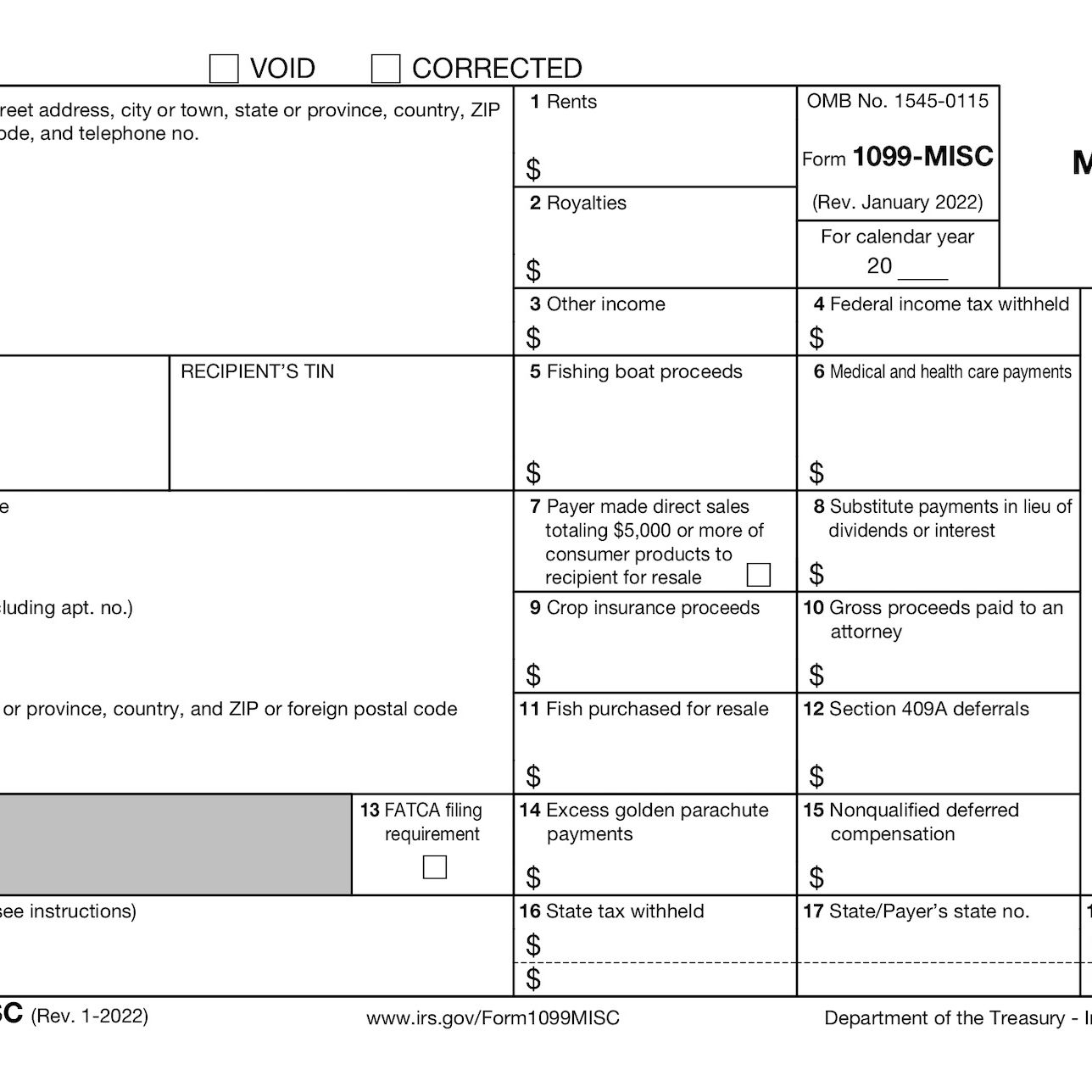

When it comes to tax season, it’s important for businesses and individuals to report any miscellaneous income they have received throughout the year. One common form used for this purpose is the 1099 Miscellaneous Income Form. This form is used to report income that is not considered salary or wages, such as freelance work, rental income, or prize winnings.

For those who need to report miscellaneous income, having a printable 1099 form can make the process much easier. By having a physical form that can be filled out and submitted, individuals and businesses can ensure that they are accurately reporting their income to the IRS.

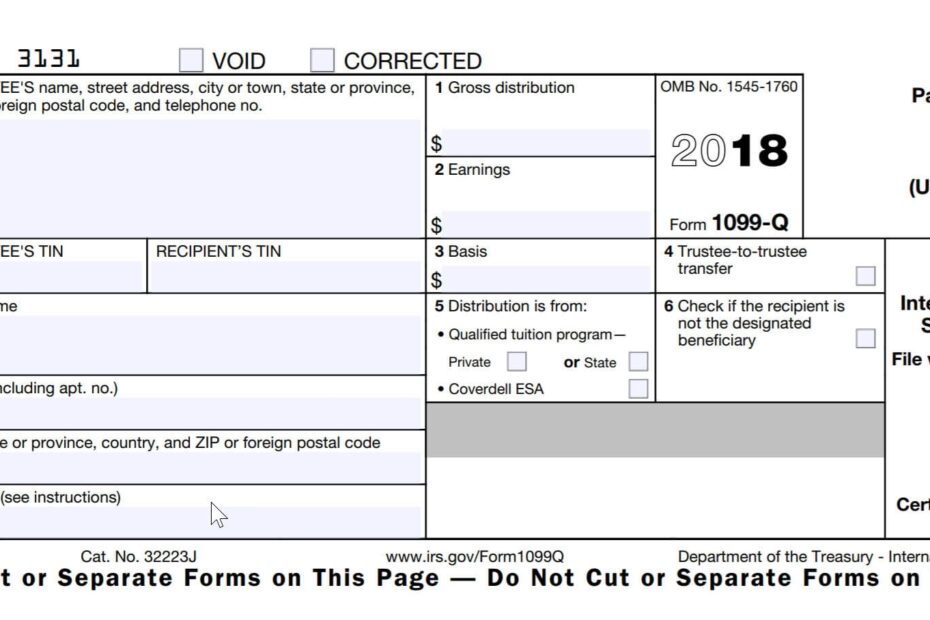

Printable 1099 Miscellaneous Income Form

Printable 1099 Miscellaneous Income Form

Quickly Access and Print Printable 1099 Miscellaneous Income Form

Printable 1099 Miscellaneous Income Forms are readily available online from various sources. These forms typically include fields for the payer’s information, the recipient’s information, and details about the income being reported. By filling out the form accurately and submitting it on time, individuals and businesses can avoid penalties and ensure compliance with tax laws.

It’s important to note that the deadline for filing 1099 forms varies depending on the type of income being reported. For example, forms reporting nonemployee compensation must be filed by January 31st, while other forms may have a later deadline. By staying informed about the requirements for filing 1099 forms, individuals and businesses can avoid any potential issues with the IRS.

In conclusion, printable 1099 Miscellaneous Income Forms are a valuable tool for reporting income that falls outside of traditional salary or wages. By utilizing these forms and filing them accurately and on time, individuals and businesses can ensure compliance with tax laws and avoid penalties. So, make sure to obtain the necessary forms and fill them out diligently to stay on the right side of the IRS.