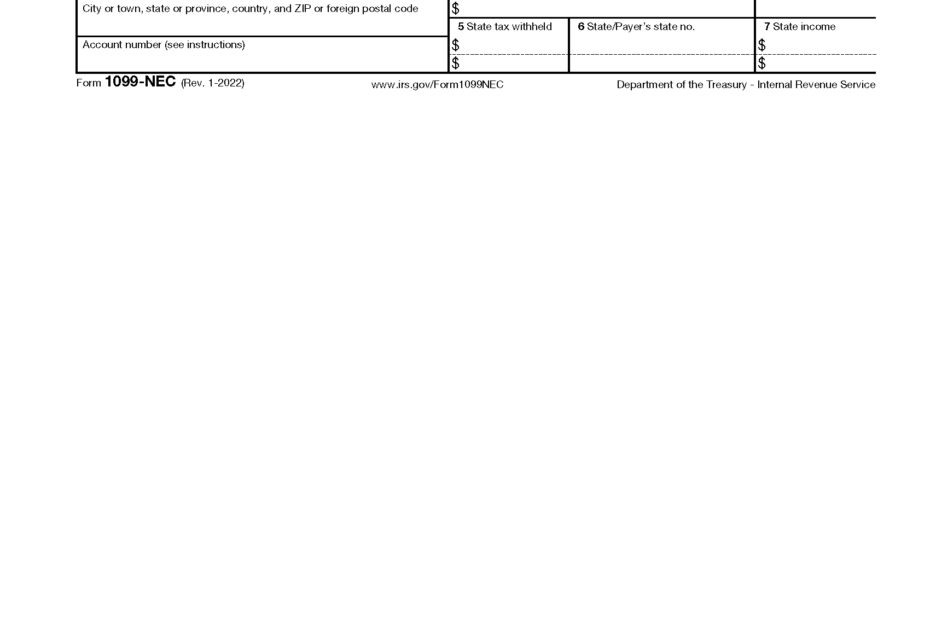

Independent contractors play a significant role in today’s workforce, providing specialized services to businesses without being considered employees. As a result, they are responsible for reporting their income to the IRS using a 1099 form. These forms are essential for tracking income and ensuring compliance with tax laws.

However, many independent contractors struggle to find the right resources to access and fill out these forms. This is where printable 1099 forms come in handy. By having access to printable forms, independent contractors can easily report their income and avoid potential penalties from the IRS for non-compliance.

Printable 1099 Forms For Independent Contractors

Printable 1099 Forms For Independent Contractors

Quickly Access and Print Printable 1099 Forms For Independent Contractors

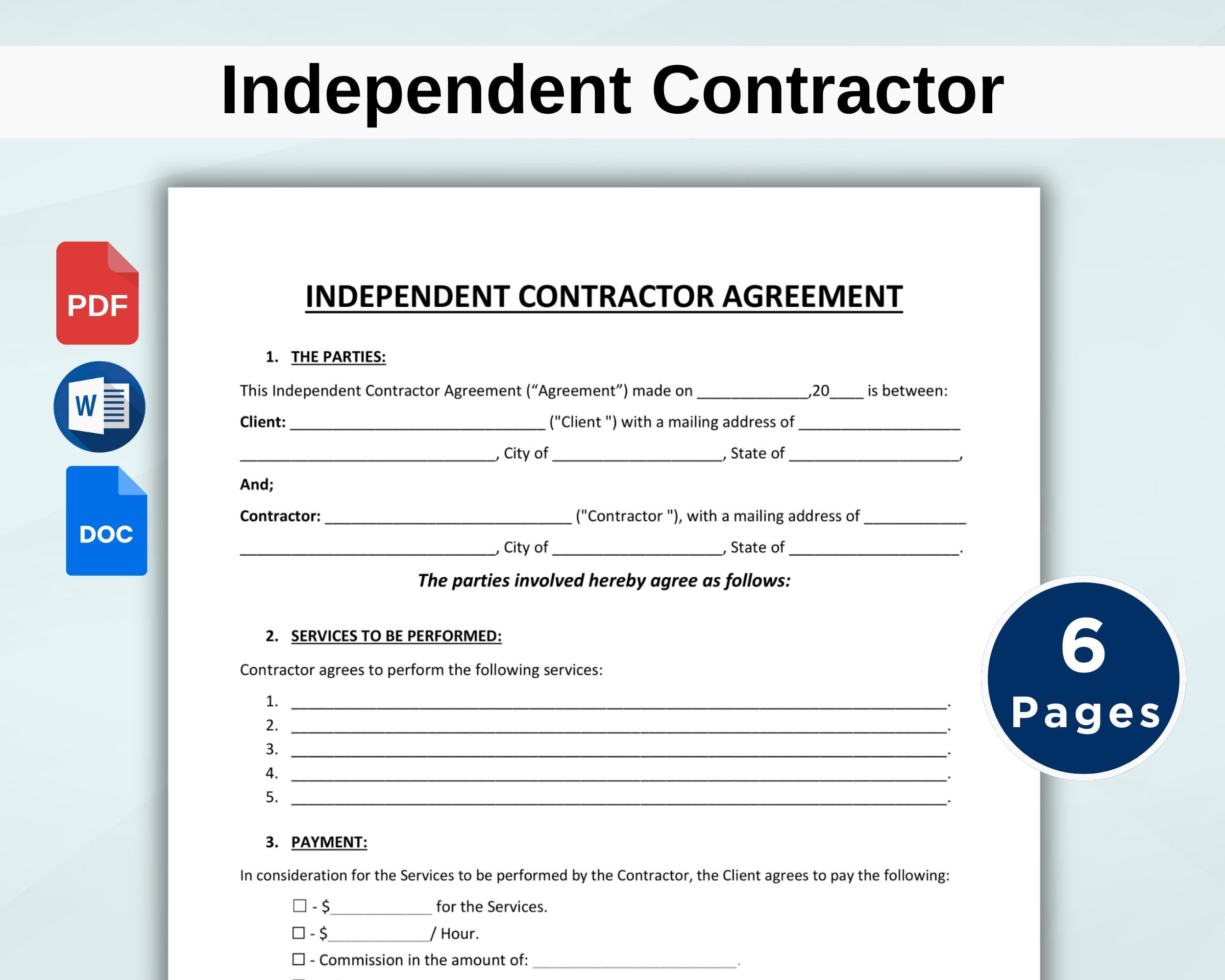

Independent Contractor Agreement Template Editable Business

Independent Contractor Agreement Template Editable Business

Printable 1099 forms are readily available online, making it convenient for independent contractors to access them at any time. These forms are typically in PDF format, allowing contractors to fill them out electronically or print them out for manual completion. This flexibility ensures that contractors can easily meet their tax reporting obligations without any hassle.

Additionally, printable 1099 forms often come with instructions on how to fill them out correctly. This can be especially helpful for contractors who are new to the process or are unsure about what information needs to be included. By following the instructions provided, contractors can ensure that their income is accurately reported to the IRS.

In conclusion, printable 1099 forms are a valuable resource for independent contractors who need to report their income to the IRS. These forms provide a convenient and accessible way for contractors to fulfill their tax obligations and avoid potential penalties. By utilizing printable forms, contractors can stay compliant with tax laws and focus on their work without worrying about tax-related issues.