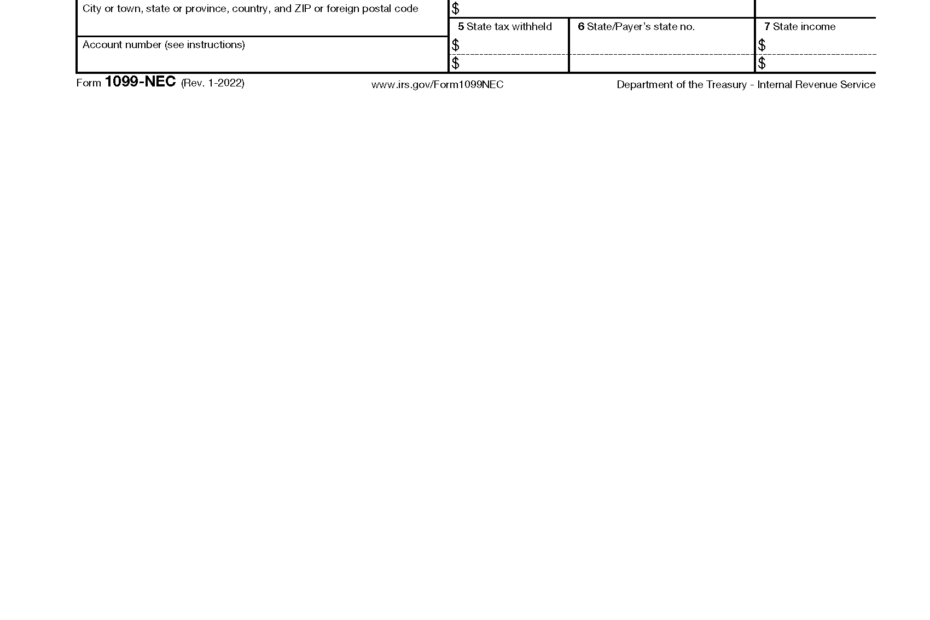

As tax season approaches, many individuals and businesses are preparing to file their taxes. One crucial form that needs to be filled out is the 1099 form, which is used to report various types of income to the IRS. For the year 2023, having a printable 1099 form can make the process much easier and more convenient.

Whether you are a freelancer, independent contractor, or small business owner, having the correct forms to report your income is essential. The 1099 form is used to report income from sources such as self-employment, rental income, dividends, and more. By having a printable 1099 form for the year 2023, you can ensure that you have the necessary documentation to accurately report your income to the IRS.

Easily Download and Print Printable 1099 Form 2023

How To Fill Out IRS 1099 MISC Form PDF 2025 PDF Expert

How To Fill Out IRS 1099 MISC Form PDF 2025 PDF Expert

Having a printable 1099 form for the year 2023 can save you time and hassle when it comes to filing your taxes. Instead of having to track down physical forms or wait for them to arrive in the mail, you can simply download and print the form from the comfort of your own home. This convenience can help streamline the tax filing process and ensure that you meet the deadline for submitting your forms.

Additionally, having a printable 1099 form for the year 2023 allows you to easily make any necessary corrections or changes to your form before submitting it to the IRS. If you make a mistake or need to update any information, you can simply reprint the form and make the changes without having to wait for a new form to be sent to you. This flexibility can help ensure that your tax return is accurate and complete.

Overall, having a printable 1099 form for the year 2023 is a valuable resource for individuals and businesses who need to report various types of income to the IRS. By having the form readily available, you can save time and effort when it comes to filing your taxes and ensure that your tax return is complete and accurate. Make sure to download and print your 1099 form for the year 2023 to stay organized and compliant with IRS regulations.