As tax season approaches, it’s important for businesses and individuals to stay organized and ensure that all necessary forms are filled out correctly. One such form that is commonly used is the 1099 form, which is used to report various types of income to the IRS. Having a printable 1099 form on hand can make the process much easier and more efficient.

With the availability of printable 1099 forms online, individuals and businesses can easily access and fill out the necessary information without the hassle of going to an office supply store or waiting for forms to arrive in the mail. This convenience allows for quicker preparation and submission of tax documents, saving time and reducing stress during tax season.

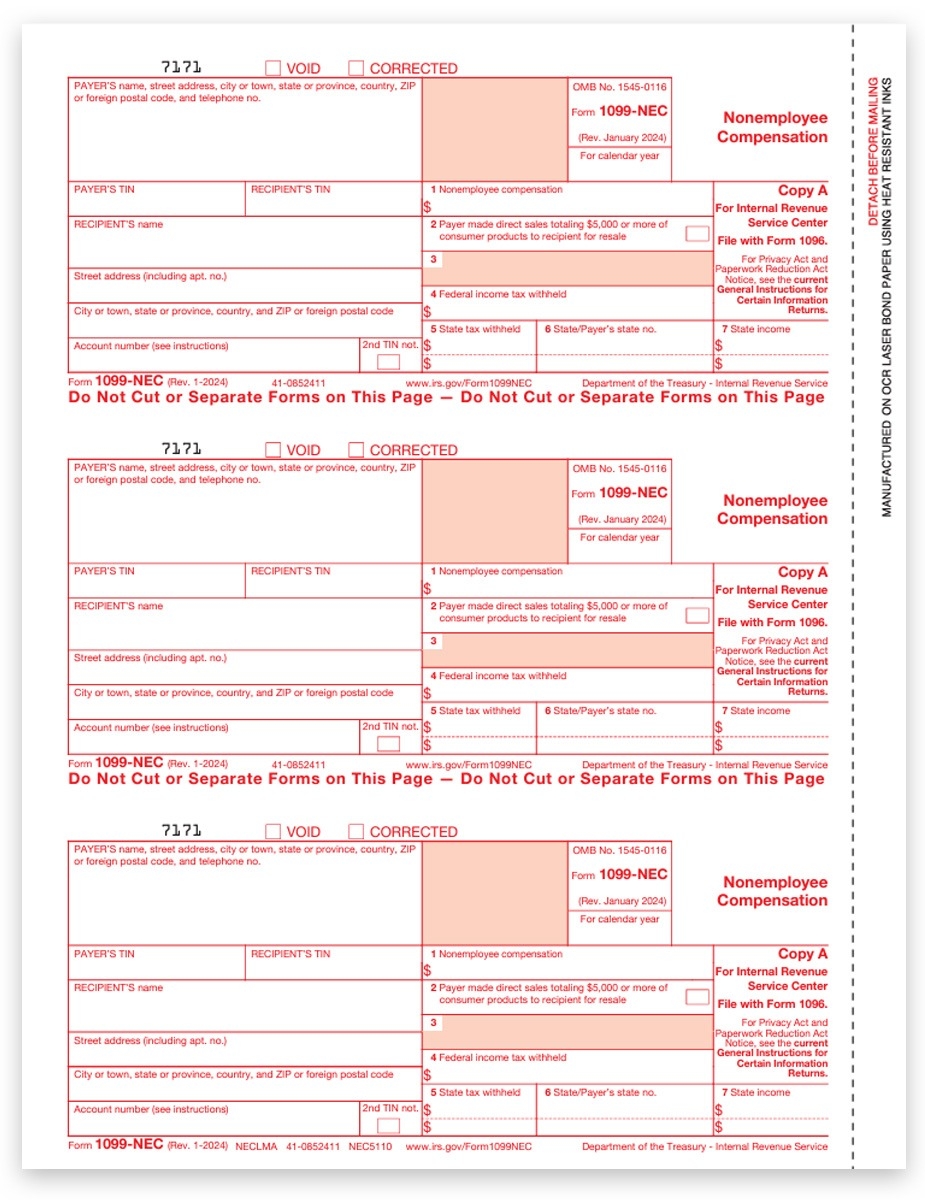

Quickly Access and Print Printable 1099 Form

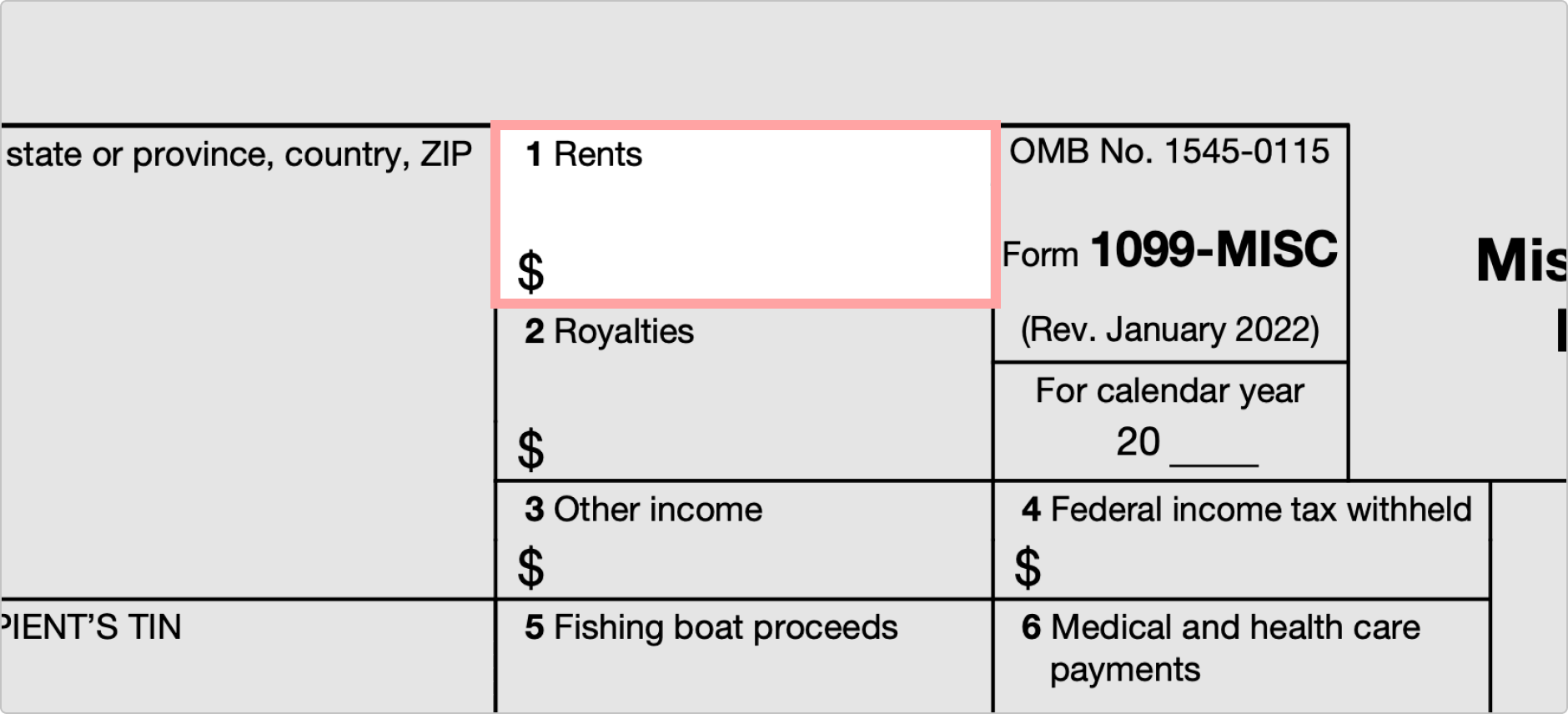

2024 1099 MISC Form Fillable Printable Download 2024 Instructions

2024 1099 MISC Form Fillable Printable Download 2024 Instructions

Printable 1099 forms typically include fields for information such as name, address, taxpayer identification number, and income amounts. By filling out these forms accurately and completely, taxpayers can ensure that they are in compliance with IRS regulations and avoid any potential penalties or fines. It’s important to double-check all information before submitting the form to avoid any errors or discrepancies.

Using a printable 1099 form also allows for easier record-keeping and organization of tax documents. By keeping digital copies of completed forms, individuals and businesses can easily access and reference them in the future if needed. This can be especially helpful in the event of an IRS audit or if there are any questions about the reported income.

In conclusion, having access to a printable 1099 form can greatly simplify the tax preparation process and help ensure compliance with IRS regulations. By taking advantage of this convenient option, taxpayers can save time and reduce stress during tax season. It’s important to fill out the form accurately and keep records of all submitted documents for future reference. Stay organized and prepared by utilizing printable 1099 forms for all your tax reporting needs.