As tax season approaches, it’s important for businesses and individuals to properly report their income to the IRS. One form that may be needed is the 1096 Form for Miscellaneous Income. This form is used to report various types of income that may not be covered by other specific forms, such as dividends, royalties, or rental income. It is important to accurately fill out this form to ensure compliance with IRS regulations and avoid any potential penalties.

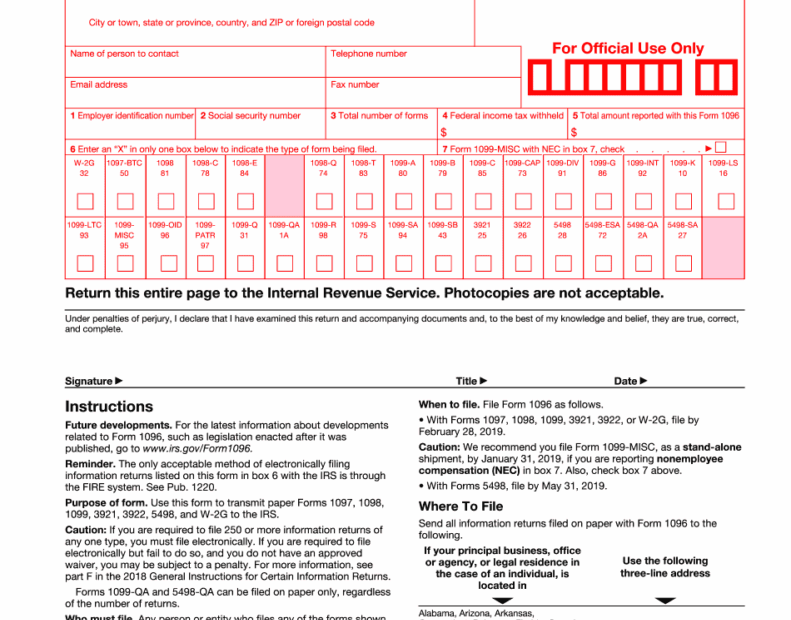

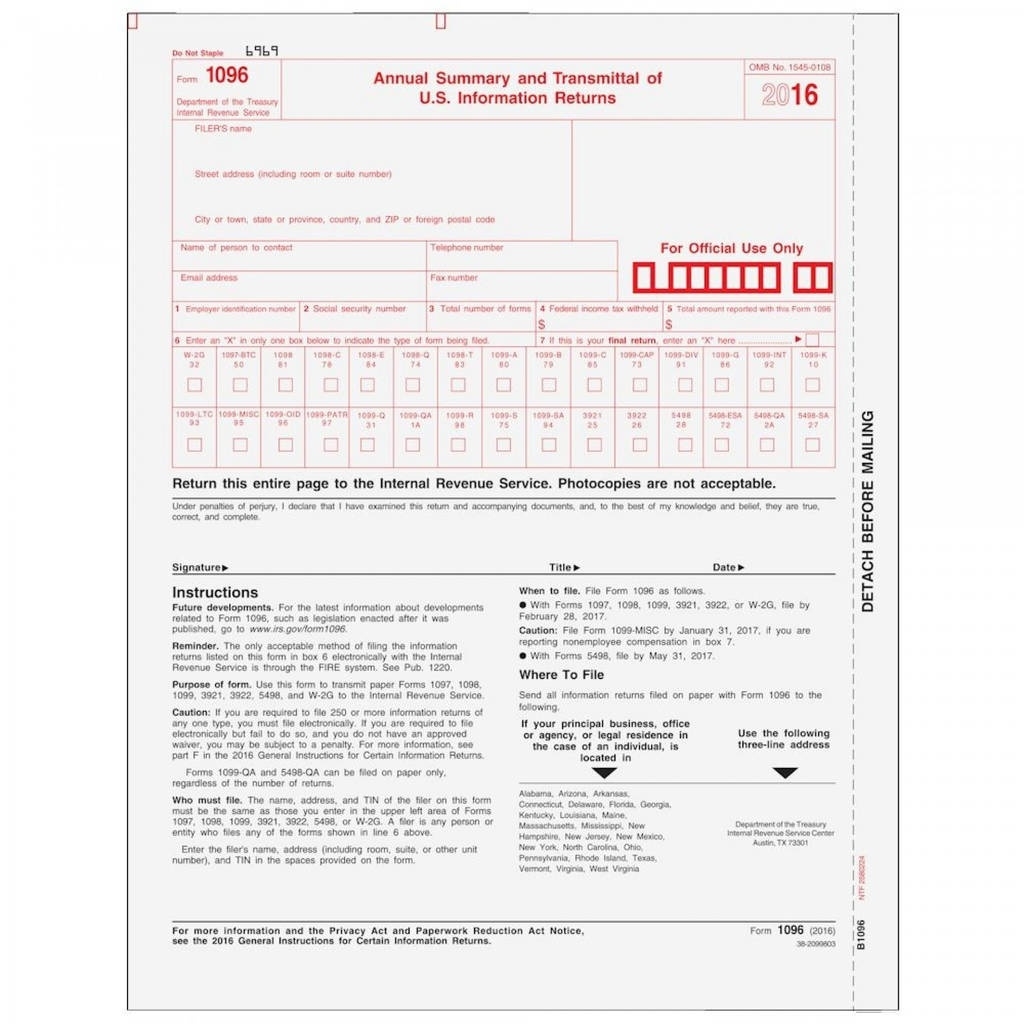

For the year 2018, businesses and individuals can easily access a printable version of the 1096 Form online. This makes it convenient for taxpayers to fill out the form and submit it to the IRS in a timely manner. The printable form includes all the necessary fields and instructions to guide users through the process of reporting their miscellaneous income. It is important to double-check all entries and calculations before submitting the form to ensure accuracy.

Printable 1096 Form 2018 Miscellaneous Income

Printable 1096 Form 2018 Miscellaneous Income

Download and Print Printable 1096 Form 2018 Miscellaneous Income

When filling out the Printable 1096 Form 2018 Miscellaneous Income, taxpayers will need to provide information such as their name, address, and taxpayer identification number. They will also need to report the total amount of miscellaneous income received during the tax year, as well as any federal income tax withheld. It is important to keep accurate records of all income sources and expenses to ensure that the information reported on the form is correct.

Once the form is completed, taxpayers will need to send it to the IRS along with any accompanying forms or documents, such as 1099 forms that detail specific types of income. It is important to keep copies of all forms and documents for your records in case of any discrepancies or audits. Filing taxes can be a complex process, so it may be helpful to consult with a tax professional or accountant for guidance.

In conclusion, the Printable 1096 Form 2018 Miscellaneous Income is a vital tool for businesses and individuals to accurately report their miscellaneous income to the IRS. By using the printable form, taxpayers can ensure that they are compliant with tax regulations and avoid any potential penalties. It is important to fill out the form accurately and submit it in a timely manner to avoid any issues with the IRS. With the right information and guidance, taxpayers can successfully navigate the tax filing process and stay on the right side of the law.