When tax season rolls around, one of the most important documents you’ll need to fill out is the 1040 tax form. This form is used by individuals to report their annual income and calculate the amount of tax they owe to the government. While many people choose to file their taxes online, some still prefer the traditional method of filling out a paper form. For those individuals, printable 1040 tax forms are a convenient option.

Printable 1040 tax forms can be easily found online on the IRS website or through other tax preparation websites. These forms are typically available in PDF format, making it easy to download and print them from the comfort of your own home. Having a physical copy of the form can be helpful for those who prefer to take their time and carefully go through each section.

Get and Print Printable 1040 Tax Forms

Once you have your printable 1040 tax form in hand, it’s important to gather all the necessary documents and information needed to fill it out accurately. This includes things like W-2 forms from your employer, 1099 forms for any additional income, and any receipts or records of deductible expenses. Taking the time to gather all this information beforehand can help streamline the tax filing process.

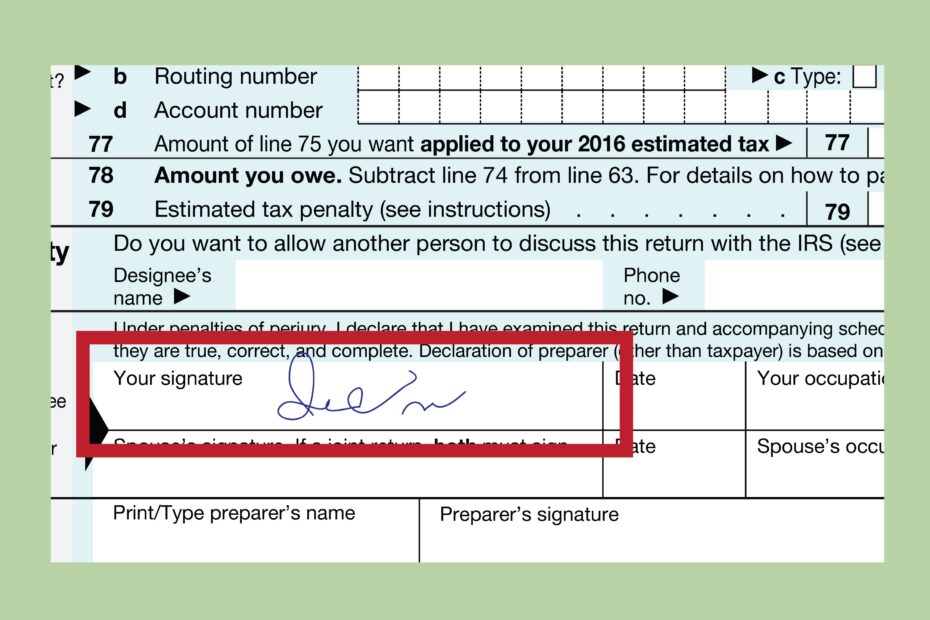

When filling out the 1040 tax form, be sure to double-check all calculations and information before submitting it to the IRS. Any errors or discrepancies can lead to delays in processing your return or even trigger an audit. If you’re unsure about how to fill out certain sections of the form, it may be helpful to seek assistance from a tax professional or use tax preparation software.

In conclusion, printable 1040 tax forms are a useful tool for individuals who prefer to file their taxes on paper. By downloading and printing these forms, you can take control of your tax filing process and ensure that all information is accurately reported. Whether you choose to file online or on paper, the most important thing is to file your taxes on time and accurately to avoid any penalties or fines.