When it comes to filing taxes, the process can often be overwhelming and confusing. However, with the help of the Printable 1040 Easy Form, taxpayers can simplify the process and ensure that they are accurately reporting their income and deductions.

The 1040 Easy Form is designed for individuals who have a straightforward tax situation, with no dependents and only a few sources of income. This form is a simplified version of the standard 1040 form, making it easier for taxpayers to fill out and submit to the IRS.

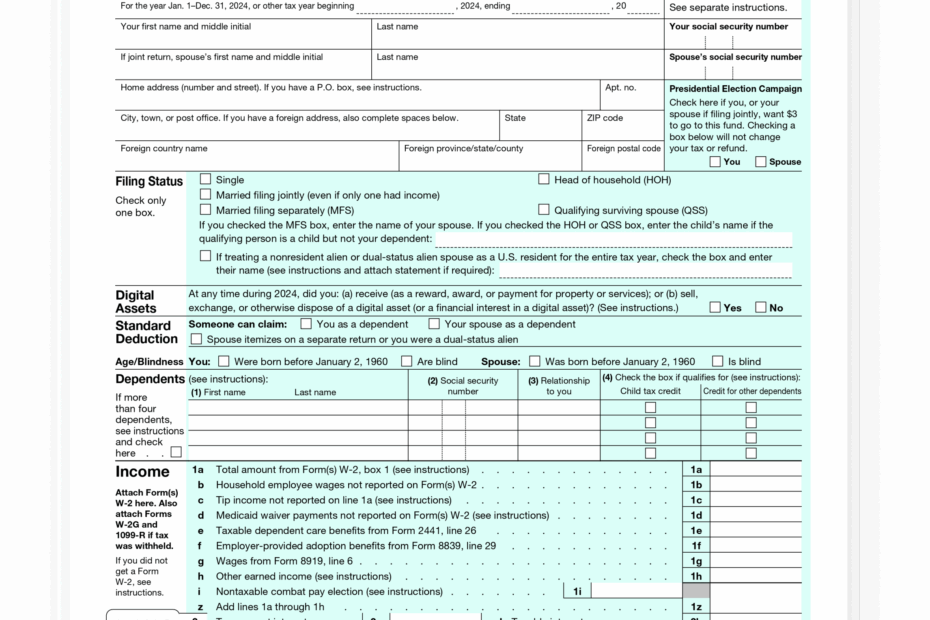

Get and Print Printable 1040 Easy Form

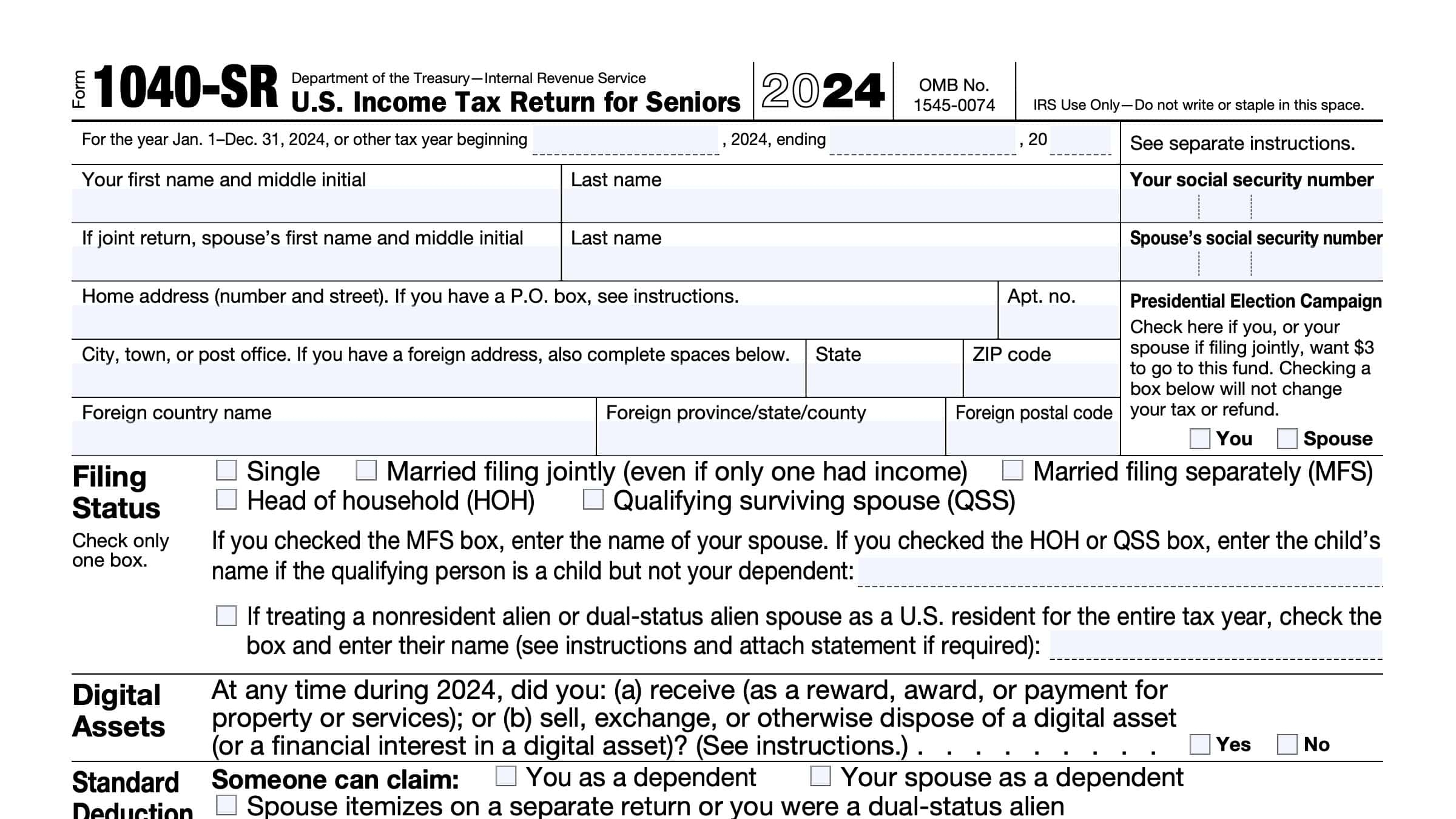

IRS Form 1040 SR Instructions Tax Return For Seniors

IRS Form 1040 SR Instructions Tax Return For Seniors

Printable 1040 Easy Form

The Printable 1040 Easy Form typically includes sections for reporting income, deductions, and tax credits. Taxpayers will need to provide information such as their wages, salaries, tips, and any other income received during the tax year. They will also need to report any deductions they are eligible for, such as student loan interest or contributions to retirement accounts.

One of the benefits of using the 1040 Easy Form is that it helps individuals to quickly calculate their tax liability and determine if they are eligible for a refund. The form also provides clear instructions on how to complete each section, making it easier for taxpayers to navigate the tax filing process.

It is important for taxpayers to carefully review the instructions provided with the Printable 1040 Easy Form to ensure that they are accurately reporting their income and deductions. Any errors or omissions could result in penalties or delays in processing their tax return.

In conclusion, the Printable 1040 Easy Form is a valuable tool for individuals with simple tax situations who are looking to streamline the tax filing process. By using this form, taxpayers can ensure that they are reporting their income and deductions accurately and avoid potential penalties from the IRS.