When tax season rolls around, it’s important to have all the necessary forms ready to ensure a smooth filing process. For Pennsylvania residents, this means having access to Pa Personal Income Tax Forms Printable. These forms are essential for accurately reporting your income and deductions to the state government.

Whether you’re a full-time employee, freelancer, or business owner, understanding the various personal income tax forms available in Pennsylvania is crucial. By having these forms on hand, you can make sure you’re meeting all your tax obligations and avoiding any potential penalties or fines.

Pa Personal Income Tax Forms Printable

Pa Personal Income Tax Forms Printable

Easily Download and Print Pa Personal Income Tax Forms Printable

Pa Personal Income Tax Forms Printable

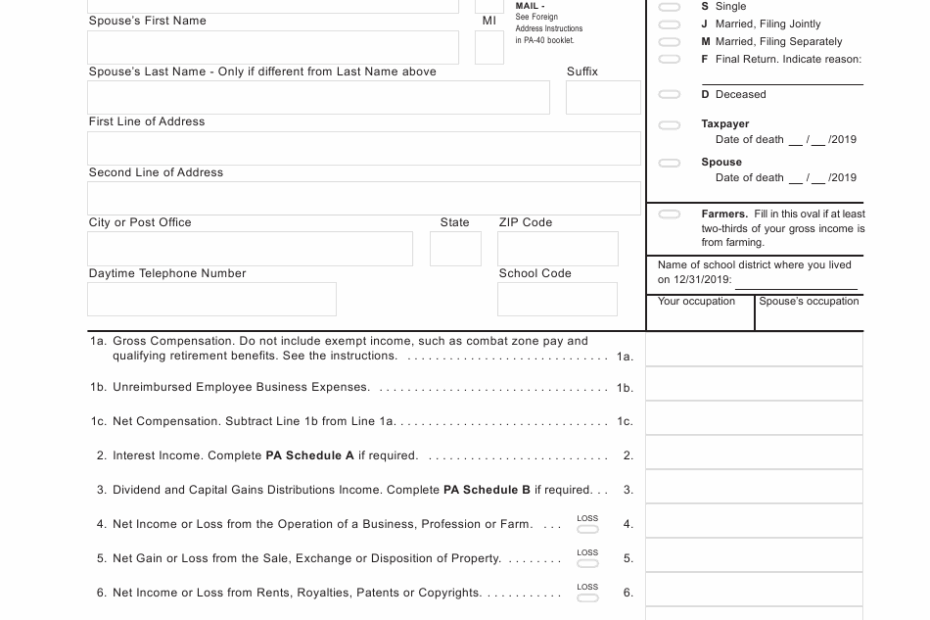

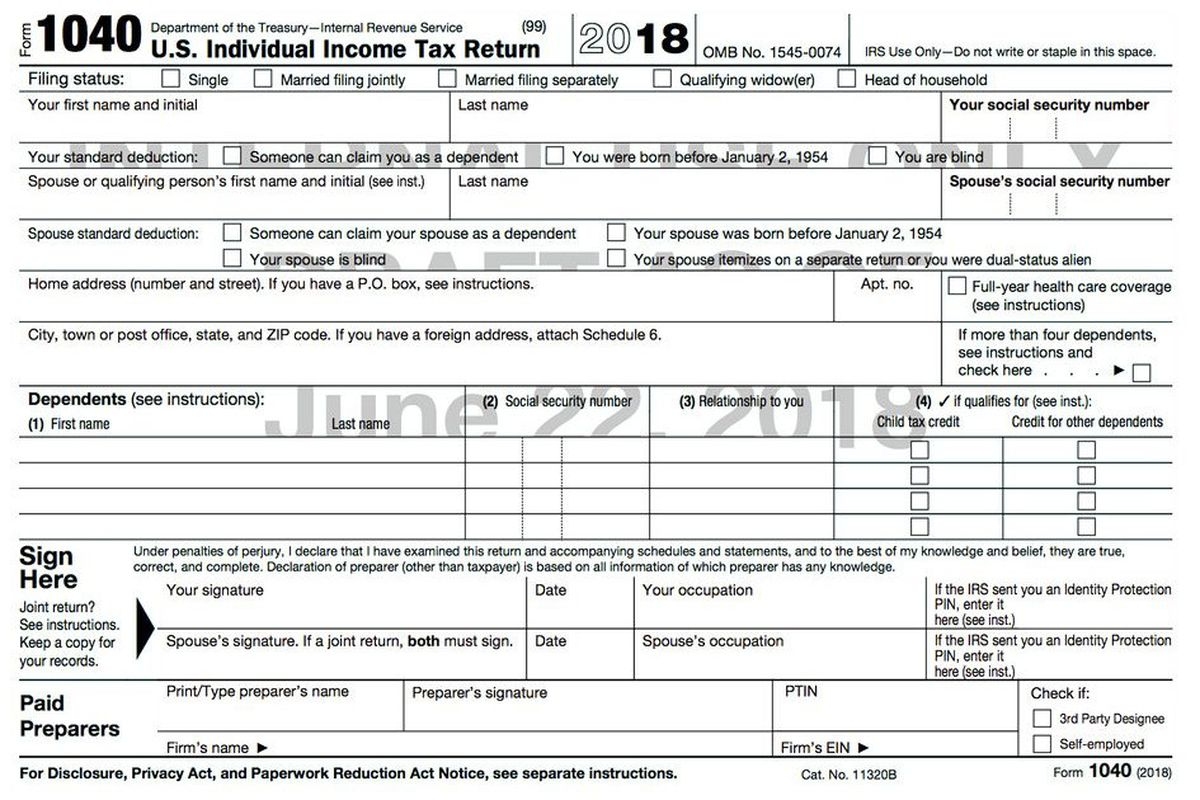

One of the most commonly used forms for Pennsylvania residents is the PA-40, which is the official tax return form for individuals. This form allows you to report your income, deductions, credits, and calculate any tax owed to the state. It’s important to accurately fill out this form to avoid any discrepancies or delays in processing your return.

In addition to the PA-40 form, there are various other schedules and worksheets that may need to be filled out depending on your individual tax situation. Some common additional forms include Schedule SP for reporting special tax credits, Schedule UE for reporting unemployment compensation, and Schedule NRK-1 for reporting nonresident individual partner or member share of PA taxable income.

For those who prefer to file their taxes online, the Pennsylvania Department of Revenue also offers an e-filing option. This allows you to submit your tax return electronically, which can often result in faster processing and quicker refunds. However, if you prefer to file by mail, you can easily download and print the necessary forms from the department’s website.

Overall, having access to Pa Personal Income Tax Forms Printable is essential for all Pennsylvania residents when tax season comes around. By familiarizing yourself with the various forms available and ensuring you have everything you need to accurately report your income, you can make the filing process much smoother and less stressful.

So, make sure you have all the necessary forms ready and don’t hesitate to reach out to the Pennsylvania Department of Revenue if you have any questions or need assistance with filing your taxes. With the right resources and information, you can ensure a successful tax season and avoid any potential issues down the road.