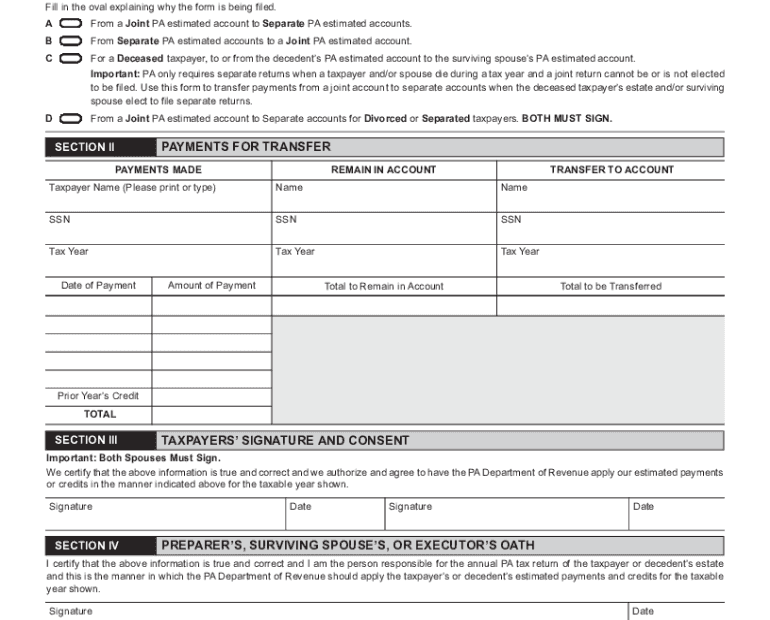

Filing taxes can be a daunting task, but having the necessary forms on hand can make the process much easier. In Oklahoma, residents are required to file state income taxes each year. The Oklahoma State Income Tax Form 2023 Printable is a helpful resource for individuals to accurately report their income and deductions.

The Oklahoma State Income Tax Form 2023 Printable is available online on the official website of the Oklahoma Tax Commission. This form includes sections for taxpayers to enter their personal information, income sources, deductions, and credits. It is important to fill out the form completely and accurately to avoid any delays or errors in processing.

Oklahoma State Income Tax Form 2023 Printable

Oklahoma State Income Tax Form 2023 Printable

Download and Print Oklahoma State Income Tax Form 2023 Printable

When completing the form, taxpayers should gather all necessary documents, such as W-2s, 1099s, and receipts for deductions. It is also important to double-check all entries before submitting the form to ensure accuracy. The Oklahoma State Income Tax Form 2023 Printable provides step-by-step instructions to guide taxpayers through the process.

Once the form is completed, taxpayers have the option to file electronically or mail it to the Oklahoma Tax Commission. Electronic filing is the preferred method as it is faster, more secure, and can help expedite any refunds. Taxpayers can also choose to have their refund directly deposited into their bank account for added convenience.

Individuals who need assistance with filling out the form or have questions about their taxes can contact the Oklahoma Tax Commission for support. Additionally, there are resources available online, such as tax preparation software and guides, to help taxpayers navigate the tax filing process.

In conclusion, the Oklahoma State Income Tax Form 2023 Printable is a valuable tool for residents to fulfill their tax obligations. By accurately completing the form and submitting it on time, individuals can ensure compliance with state tax laws and avoid any penalties. Remember to keep a copy of the form for your records and stay informed about any updates to tax laws that may affect your filing.