Ohio Printable Income Tax Forms are essential documents that residents of Ohio need to fill out and submit to the state’s tax department. These forms provide a way for individuals to report their income, deductions, and credits to determine how much tax they owe or if they are entitled to a refund.

It is important to use the correct forms when filing your income taxes in Ohio to ensure accuracy and compliance with state regulations. The Ohio Department of Taxation provides a variety of printable forms on their website for different types of income, deductions, and credits.

Ohio Printable Income Tax Forms

Ohio Printable Income Tax Forms

Save and Print Ohio Printable Income Tax Forms

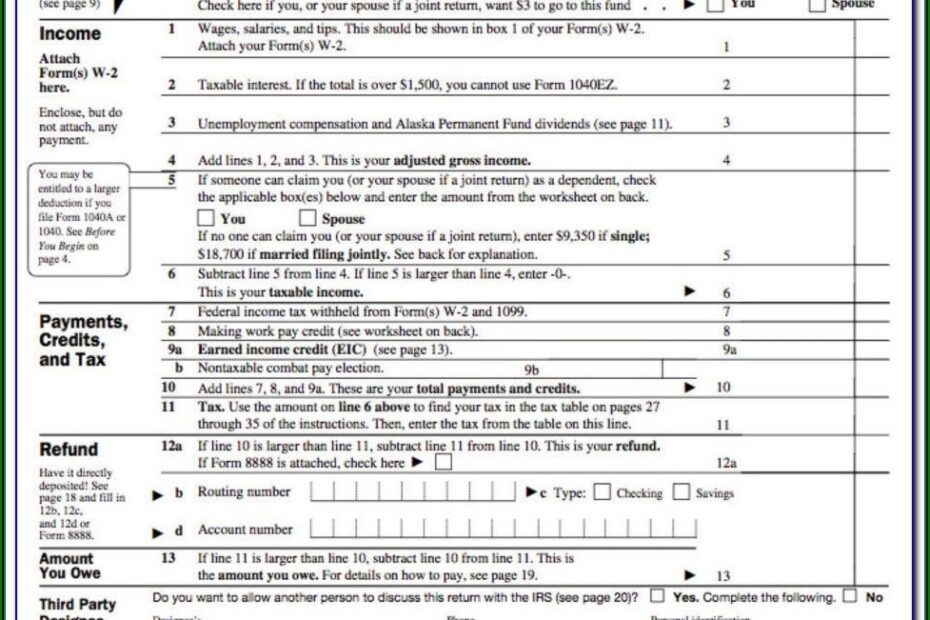

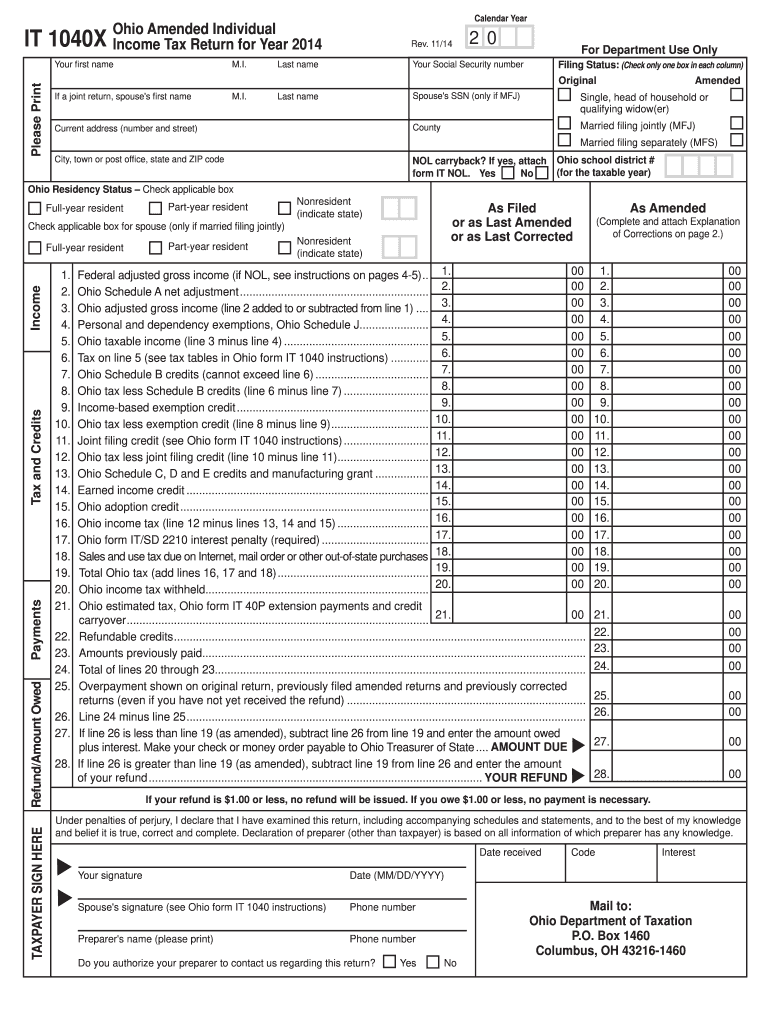

One of the most commonly used Ohio Printable Income Tax Forms is the IT 1040 form, which is the standard form for reporting individual income tax. This form requires you to provide information about your income, deductions, and credits to calculate your tax liability or refund. Additionally, there are supplemental schedules that may need to be attached depending on your specific tax situation.

Other Ohio Printable Income Tax Forms include forms for reporting business income, rental income, gambling winnings, and more. It is important to carefully review the instructions for each form to ensure you are providing accurate information and completing all necessary sections.

When filling out Ohio Printable Income Tax Forms, be sure to double-check all calculations and information before submitting them to the Ohio Department of Taxation. Any errors or omissions could result in delays in processing your return or even penalties for inaccuracies.

In conclusion, Ohio Printable Income Tax Forms are essential for residents of Ohio to accurately report their income, deductions, and credits to the state tax department. By using the correct forms and following instructions carefully, you can ensure that your tax return is filed accurately and on time.