New York State income tax forms are essential documents that residents must fill out and submit to the state government every year. These forms help determine how much income tax an individual owes based on their earnings, deductions, and credits. Filing taxes can be a complex process, but having access to printable forms can make it easier for taxpayers to complete their returns accurately.

By providing printable forms, the New York State Department of Taxation and Finance makes it convenient for taxpayers to access and complete their tax returns from the comfort of their own homes. This saves time and effort compared to visiting a tax office in person or requesting forms through the mail. With printable forms available online, individuals can easily download, print, and fill them out at their convenience.

New York State Income Tax Forms Printable

New York State Income Tax Forms Printable

Save and Print New York State Income Tax Forms Printable

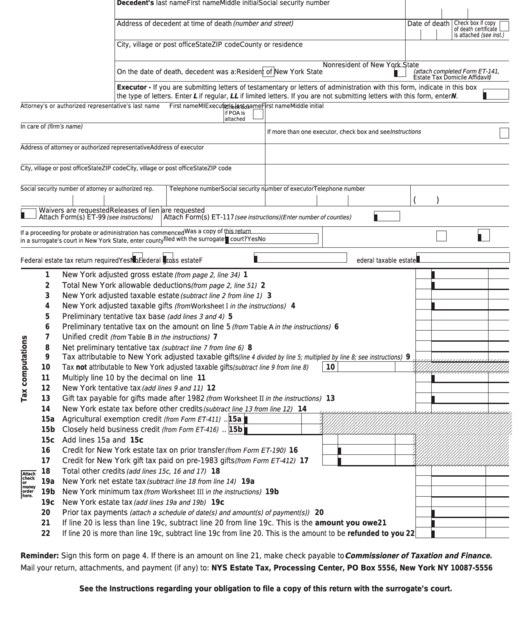

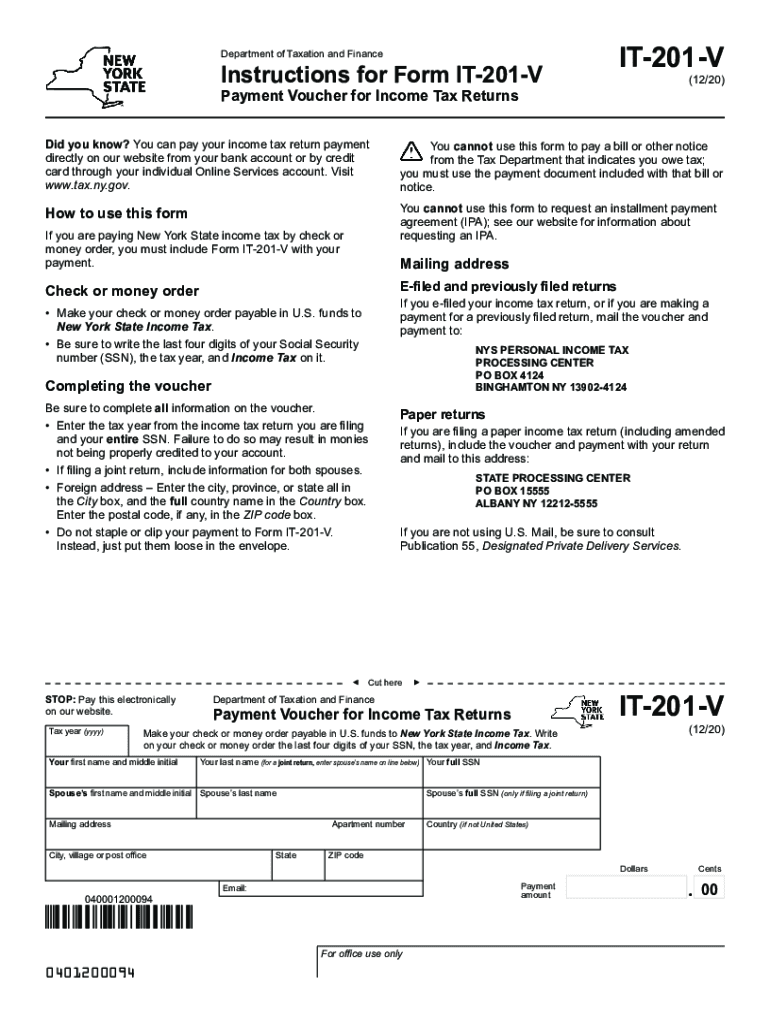

When preparing to file their state income taxes, residents of New York can find a variety of printable forms on the official website of the state’s Department of Taxation and Finance. These forms include the IT-201 Resident Income Tax Return, IT-203 Nonresident and Part-Year Resident Income Tax Return, and various schedules and instructions for different filing situations. Taxpayers should carefully review the instructions provided with each form to ensure they are completing them correctly.

It is important for taxpayers to gather all necessary documents, such as W-2 forms, 1099s, and receipts for deductions, before filling out their income tax forms. By having these documents on hand, individuals can accurately report their income and claim any eligible deductions or credits to reduce their tax liability. Filing taxes accurately and on time can help taxpayers avoid penalties and interest charges.

In conclusion, having access to New York State income tax forms printable can streamline the tax filing process for residents and make it easier to fulfill their tax obligations. By utilizing these forms and following the instructions provided, individuals can ensure that they are reporting their income accurately and taking advantage of all available tax benefits. Taxpayers should take advantage of printable forms to file their state income taxes efficiently and avoid potential issues with the tax authorities.