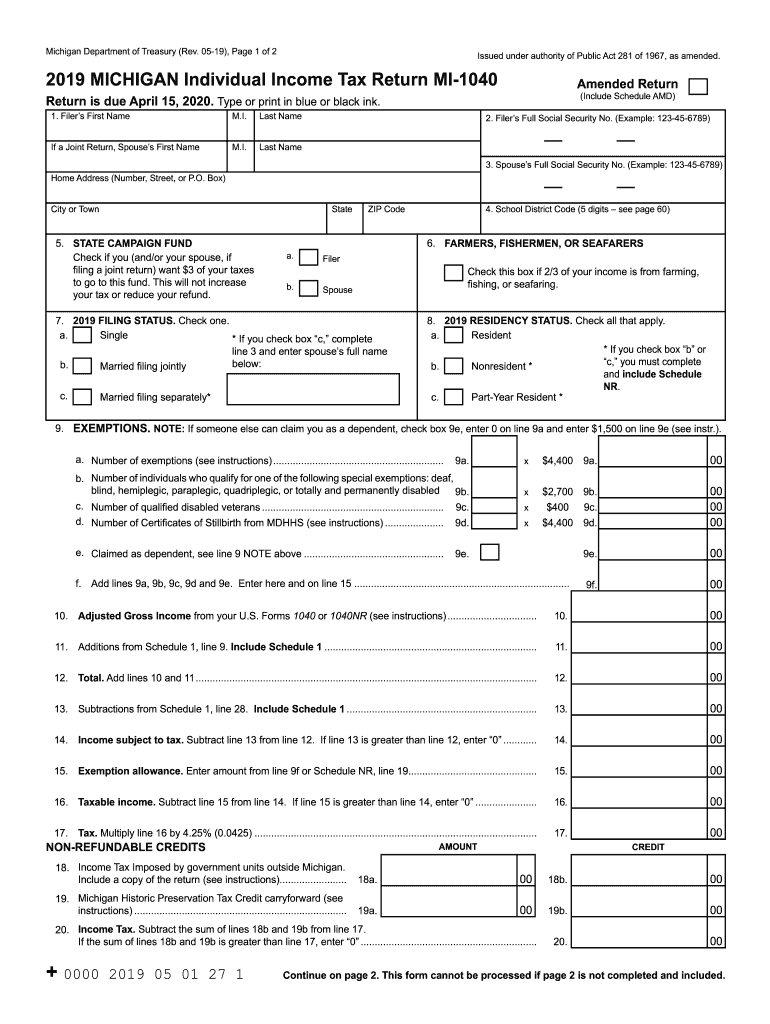

Michigan residents are required to file their state income taxes using Form 1040. This form is used to report income, deductions, and credits for the tax year. It is important to accurately fill out this form to ensure compliance with state tax laws and to avoid any penalties or fines.

Completing your Michigan 1040 Income Tax Printable Form is an essential part of fulfilling your tax obligations as a resident of the state. This form will help you determine how much you owe in state income taxes or if you are eligible for a refund.

Michigan 1040 Income Tax Printable Form

Michigan 1040 Income Tax Printable Form

Quickly Access and Print Michigan 1040 Income Tax Printable Form

Filing Your Michigan 1040 Form

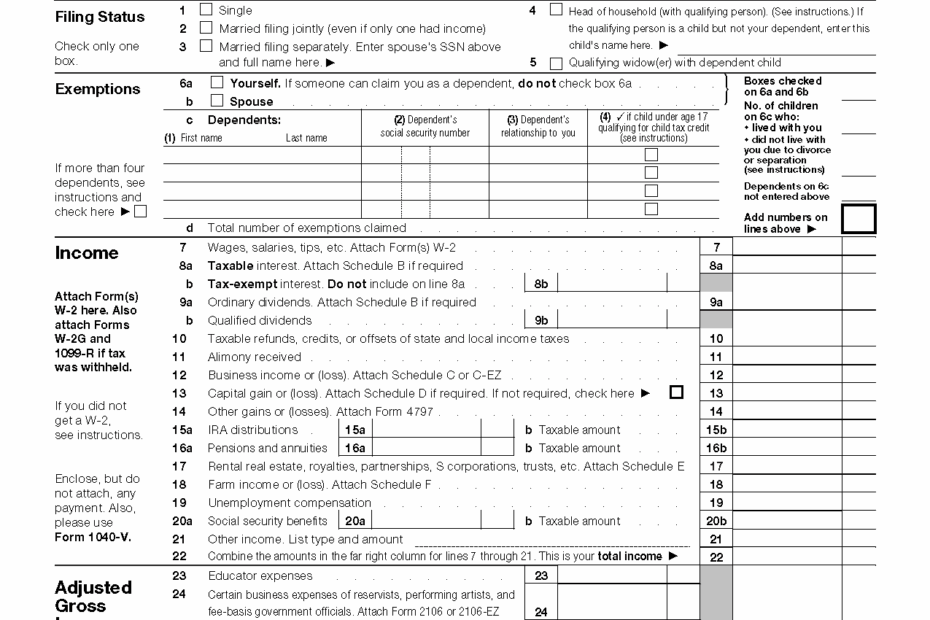

When filling out your Michigan 1040 form, you will need to gather all necessary documentation, including your W-2 forms, 1099 forms, and any other income statements. You will also need information on deductions and credits you may be eligible for, such as charitable contributions or education expenses.

Make sure to carefully follow the instructions provided on the form to ensure that you are reporting your income and deductions accurately. Any errors or omissions could result in delays in processing your return or even an audit by the Michigan Department of Treasury.

Once you have completed your Michigan 1040 form, you can file it electronically or by mail. If you choose to file by mail, make sure to include any additional documentation required and send it to the address provided on the form. If you file electronically, you will receive a confirmation that your return has been received.

After filing your Michigan 1040 form, you will need to wait for your refund, if applicable, or pay any taxes owed. Make sure to keep a copy of your completed form and any supporting documentation for your records. It is also a good idea to review your tax return for accuracy before submitting it to the state.

In conclusion, the Michigan 1040 Income Tax Printable Form is a crucial document for Michigan residents to fill out accurately and timely. By following the instructions provided and gathering all necessary documentation, you can ensure that you are in compliance with state tax laws and avoid any penalties. Remember to file your return on time and keep copies of all documentation for your records.