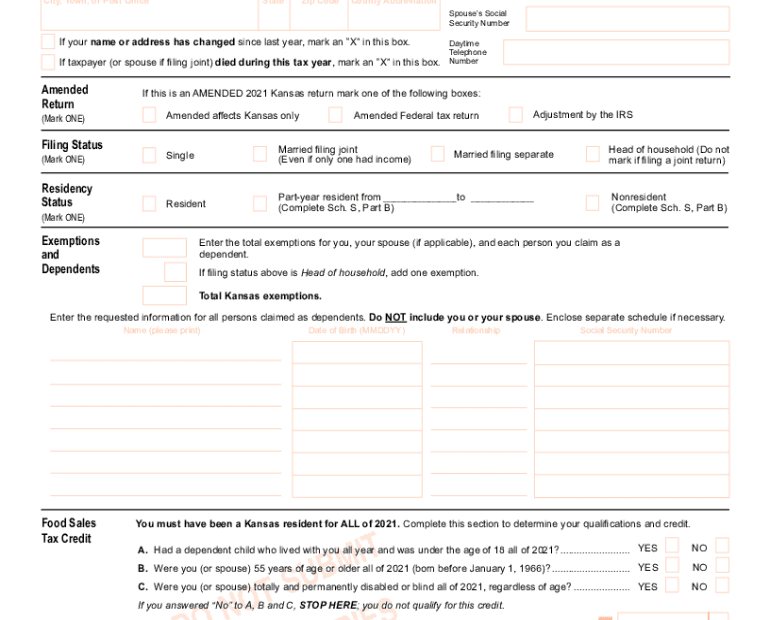

When it comes to filing your taxes in Kansas, it’s important to be aware of all the necessary forms and schedules that need to be completed. One such form is Schedule S, which is used to report certain income adjustments on your state tax return. This form is essential for ensuring that you are accurately reporting your income and taking advantage of any deductions or credits that you may be eligible for.

Completing Schedule S can be a crucial step in the tax-filing process, as it allows you to account for any income adjustments that may impact your overall tax liability. This form is particularly important if you have income from sources such as rental properties, partnerships, or S corporations. By carefully filling out Schedule S, you can ensure that you are complying with Kansas tax laws and maximizing your tax savings.

Kansas Income Ta Form Schedule S Printable

Kansas Income Ta Form Schedule S Printable

Easily Download and Print Kansas Income Ta Form Schedule S Printable

When filling out Schedule S, you will need to provide detailed information about the income adjustments that you are reporting. This may include details about rental income, partnership distributions, or any other sources of income that are not included on your regular tax return. By accurately reporting this information, you can avoid potential penalties or audits from the Kansas Department of Revenue.

It’s important to note that Schedule S is only one part of the overall tax-filing process in Kansas. You will also need to complete other forms and schedules, such as the Kansas Individual Income Tax Return (Form K-40), to ensure that your taxes are filed correctly. By carefully reviewing all of the necessary forms and instructions provided by the Kansas Department of Revenue, you can make sure that you are meeting all of your tax obligations.

Overall, Schedule S is a valuable tool for taxpayers in Kansas who have income adjustments that need to be reported on their state tax return. By accurately completing this form and submitting it along with your other tax documents, you can ensure that you are in compliance with state tax laws and maximizing your tax savings. Be sure to carefully review the instructions for Schedule S and reach out to a tax professional if you have any questions or concerns about your tax filing.