When working as an independent contractor or freelancer, it is essential to understand the importance of the IRS W9 form. This form is used by businesses to request taxpayer identification information from individuals or entities they plan to hire for freelance work. It is crucial for both parties to ensure tax compliance and accurate reporting of income.

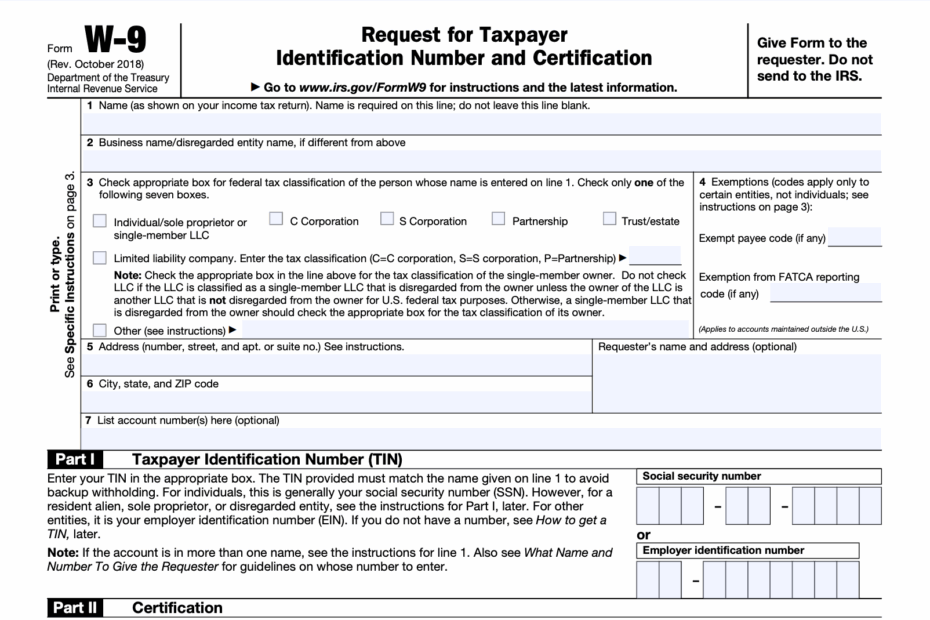

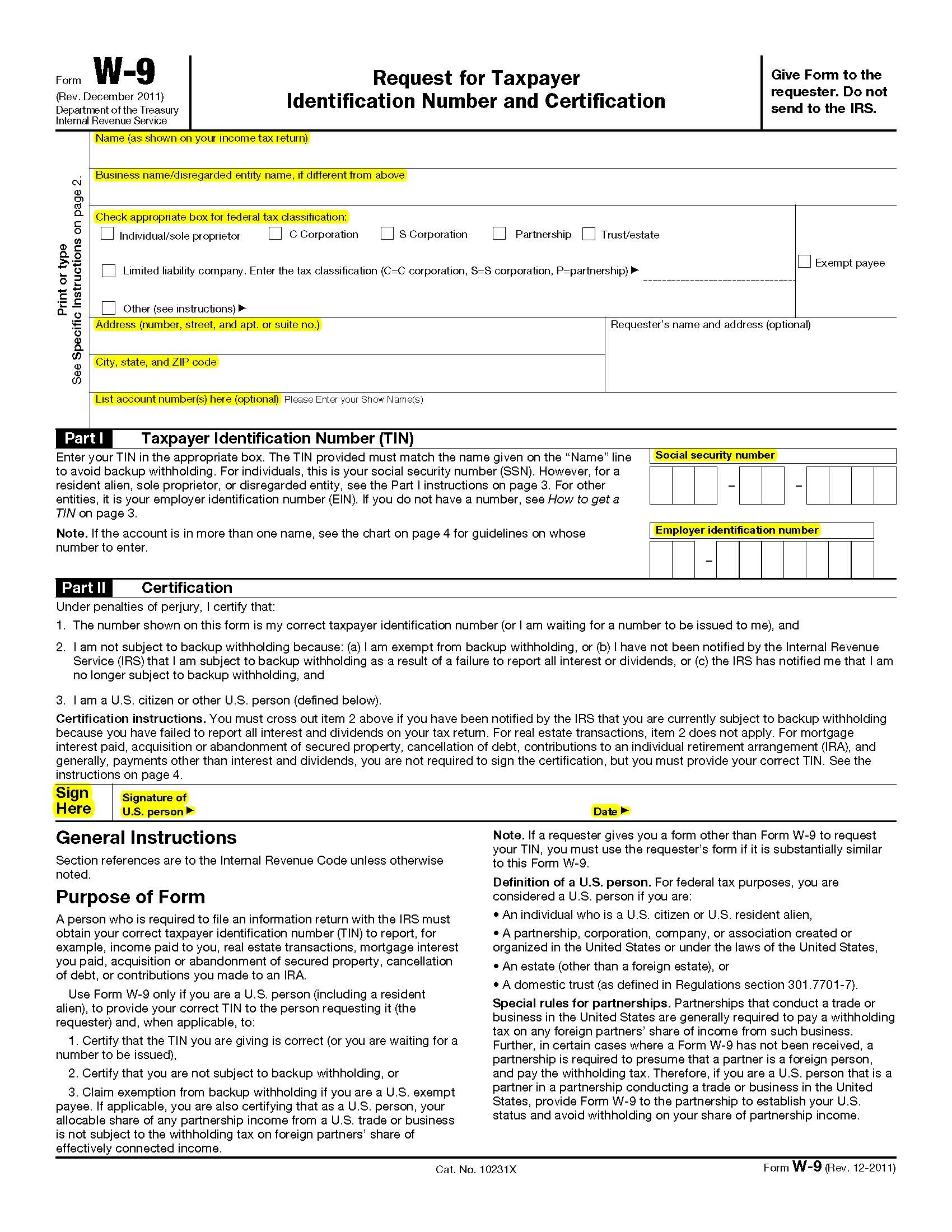

The IRS W9 form is a standard document that includes personal information such as your name, address, and taxpayer identification number (TIN). It is used by businesses to report payments made to independent contractors to the IRS, ensuring that the appropriate taxes are withheld and reported accurately.

Easily Download and Print Irs W9 Printable Form

Irs W9 Printable Form

Obtaining a printable version of the IRS W9 form is easy and convenient. You can download the form directly from the IRS website or various online platforms that offer printable tax forms. Once you have the form, simply fill in the required information and provide it to the business or client requesting it.

It is crucial to ensure that the information provided on the IRS W9 form is accurate and up to date. Any errors or discrepancies could lead to issues with tax reporting and compliance. Be sure to double-check all information before submitting the form to the requesting party.

By submitting the IRS W9 form, you are certifying that the information provided is accurate and that you are not subject to backup withholding. This form helps businesses report payments made to independent contractors and ensures that both parties are compliant with tax laws and regulations.

Overall, the IRS W9 form is a vital document for independent contractors and freelancers. It helps businesses report payments accurately and ensures tax compliance for all parties involved. By understanding the importance of this form and completing it accurately, you can avoid potential issues with tax reporting and compliance.

Thank you for reading our article on the IRS W9 Printable Form. We hope this information has been helpful in understanding the importance of this document for independent contractors and freelancers. Remember to always fill out the form accurately and submit it promptly to ensure tax compliance.