As we approach the year 2025, it is essential for businesses and individuals to stay informed about any updates or changes to tax forms. One crucial form that many will need to be familiar with is the IRS W9 form. This form is used to collect information from individuals or companies that are hired to provide services to a business. It is important for both parties to understand the purpose of the form and how to properly fill it out to ensure compliance with tax laws.

With the advancement of technology, many forms can now be filled out and submitted online. However, having a printable version of the IRS W9 form for 2025 is still necessary for those who prefer to fill out the form manually or for situations where an online submission is not possible. Having a printable version on hand can also be useful for record-keeping purposes.

Save and Print Irs W9 Form Printable 2025

IRS Form W 9 Changes And Their Impact On Trusts And Estates

IRS Form W 9 Changes And Their Impact On Trusts And Estates

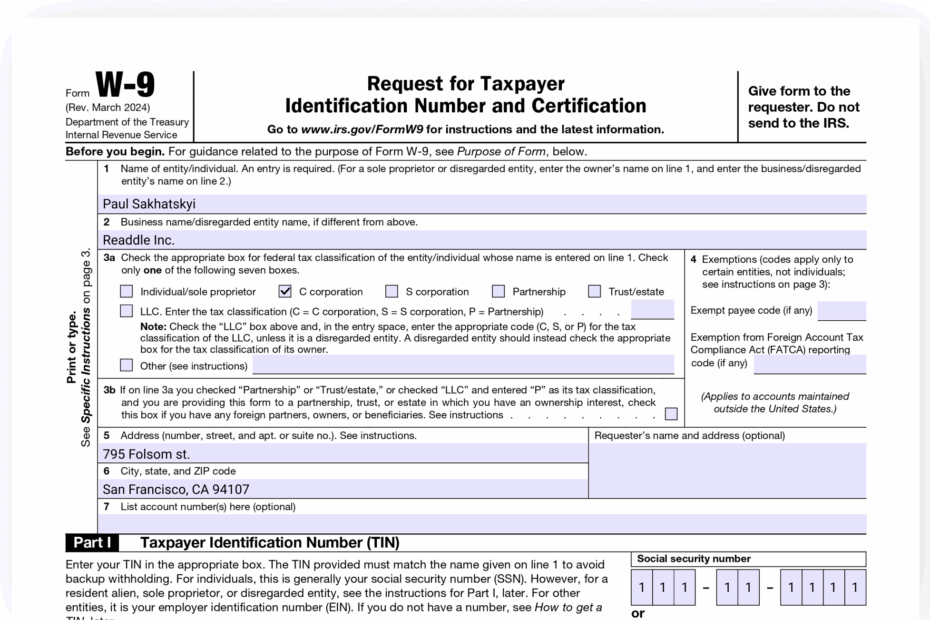

When filling out the IRS W9 form for 2025, it is important to provide accurate information to avoid any potential issues with the IRS. The form requires basic information such as the individual or company’s name, address, taxpayer identification number, and certification of their tax status. It is crucial to double-check all information before submitting the form to ensure accuracy.

Businesses that hire independent contractors or freelancers will often require them to fill out a W9 form before payments can be made. This is to ensure that the business has the necessary information to report payments to the IRS accurately. Having a printable version of the form readily available can streamline this process and make it easier for both parties involved.

As the year 2025 approaches, it is essential for businesses and individuals to familiarize themselves with the IRS W9 form and its requirements. By having a printable version of the form on hand, individuals and businesses can ensure that they are compliant with tax laws and avoid any potential issues with the IRS. Stay informed and prepared by obtaining a copy of the IRS W9 form for 2025.