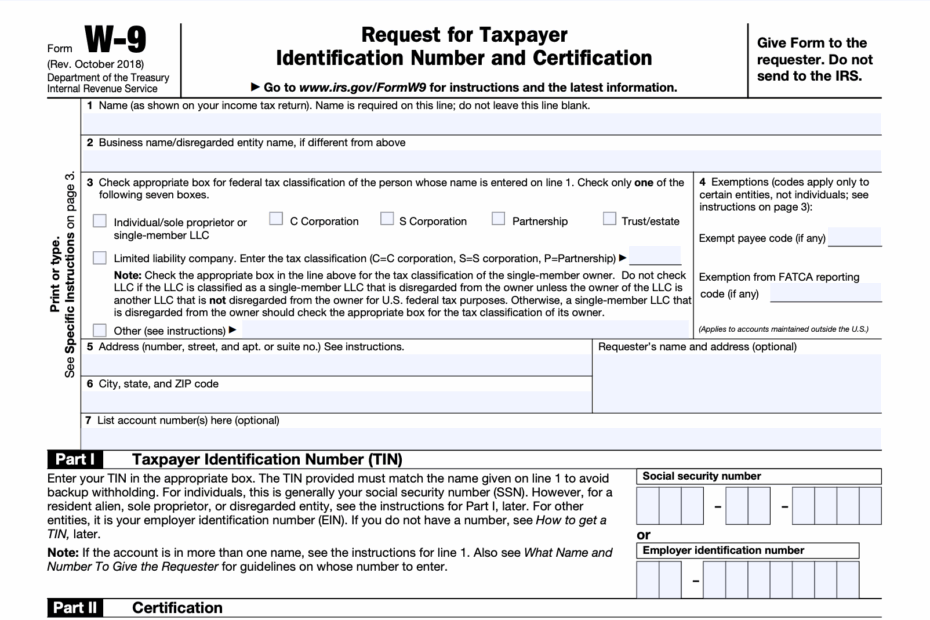

When it comes to tax documentation, the IRS W9 form is an essential tool for businesses and individuals alike. This form is used to gather information from vendors, independent contractors, and freelancers who are paid for their services. It helps ensure that the proper amount of taxes are withheld and reported to the IRS.

Having a printable version of the IRS W9 form is convenient for both parties involved in a transaction. It allows for easy access to the necessary information and can be completed quickly and efficiently. This helps to streamline the process and ensures that all necessary details are captured accurately.

Get and Print Irs W9 Form Printable

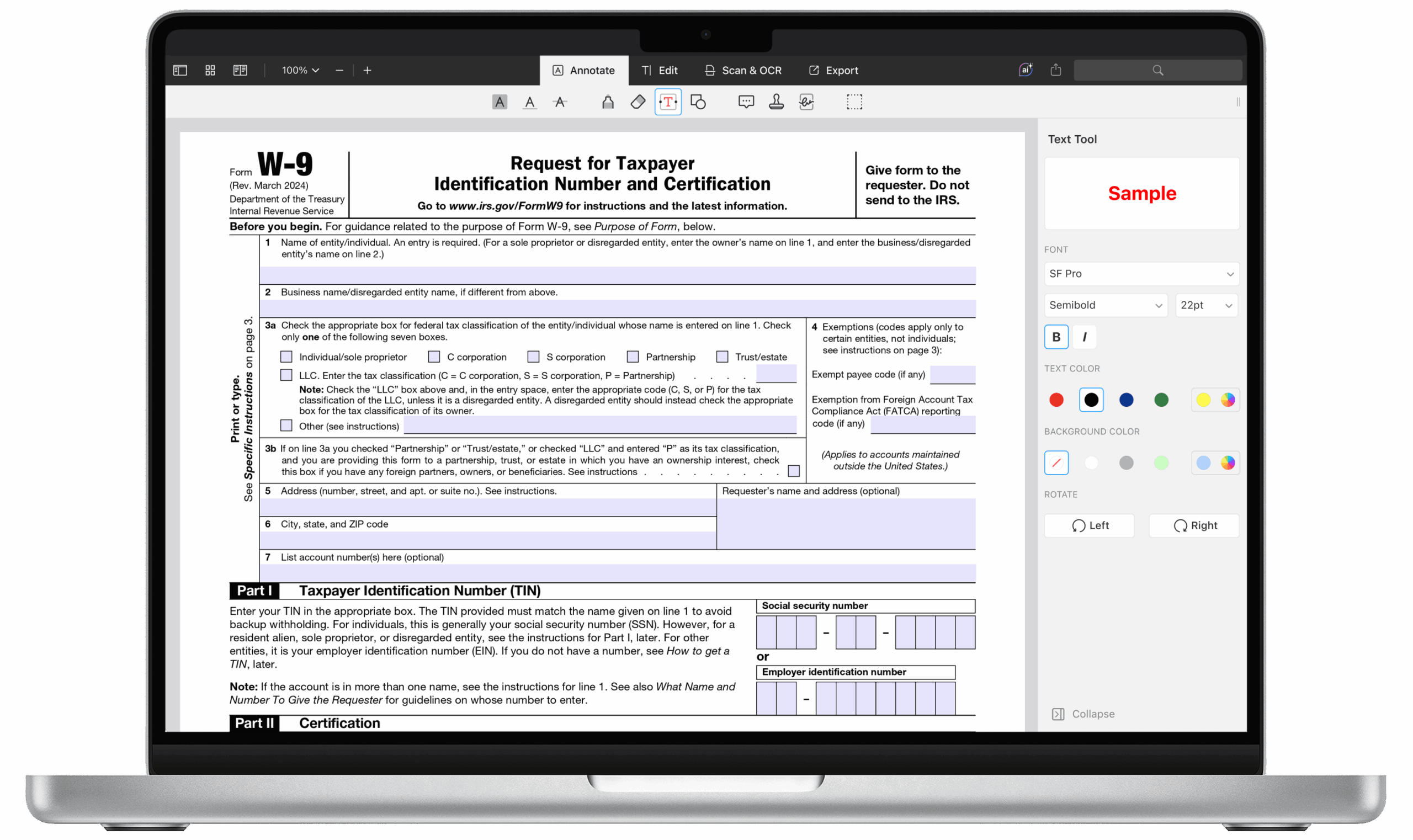

How To Fill Out IRS W9 Form 2024 2025 PDF PDF Expert

How To Fill Out IRS W9 Form 2024 2025 PDF PDF Expert

Completing the IRS W9 Form

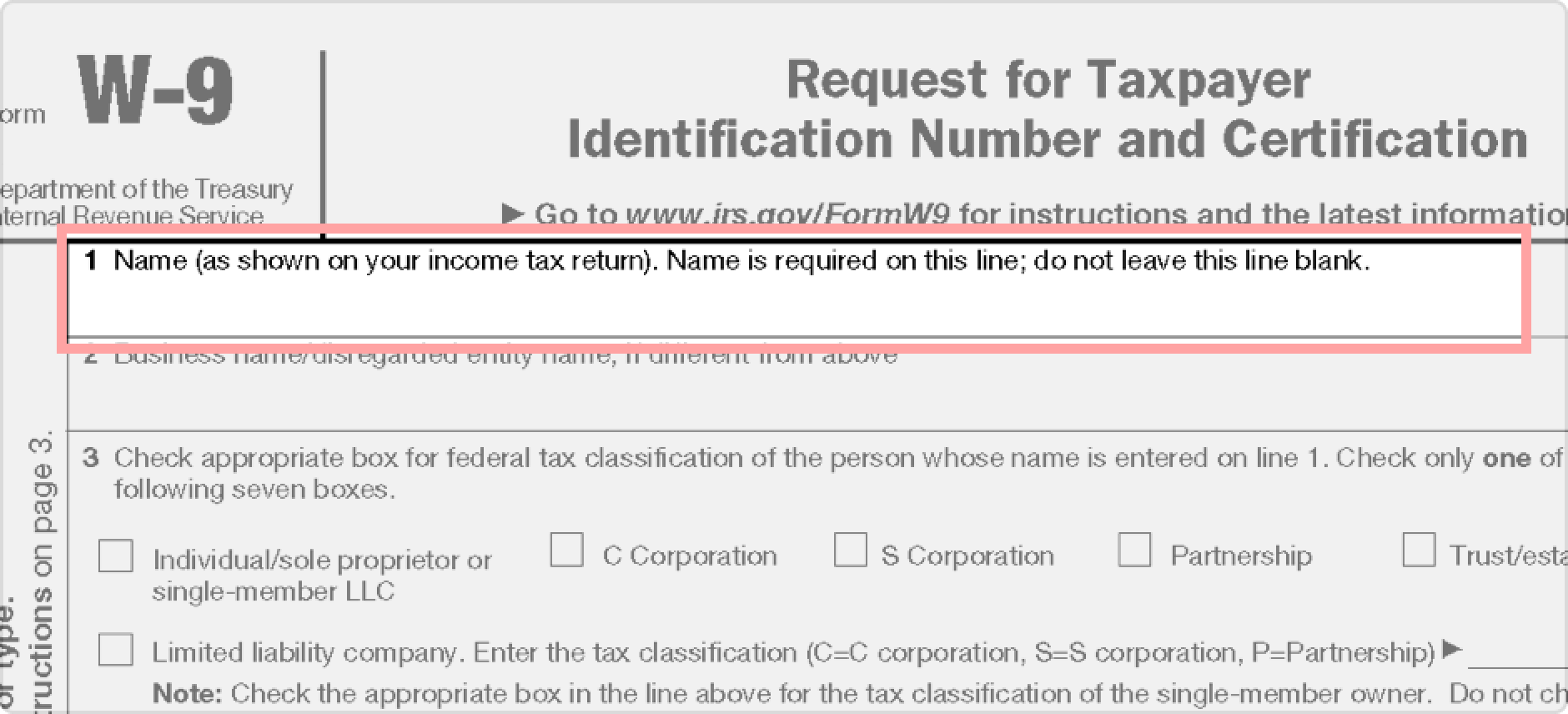

When filling out the IRS W9 form, individuals will need to provide their name, address, taxpayer identification number (usually a Social Security number), and certification of their tax status. This information is crucial for businesses to report payments to the IRS and issue the necessary tax forms at the end of the year.

For businesses, having a completed W9 form on file for each vendor or contractor is essential for compliance with tax laws. It helps to avoid penalties and ensures that all required information is readily available for tax reporting purposes. Keeping track of these forms in a printable format makes it easy to access when needed.

By utilizing the IRS W9 form printable version, businesses can stay organized and compliant with tax regulations. This simple document plays a significant role in the financial operations of a business and helps to maintain transparency and accuracy in tax reporting.

In conclusion, the IRS W9 form printable version is a valuable tool for businesses and individuals to ensure proper tax reporting and compliance. By utilizing this form, both parties can streamline the process of gathering and reporting necessary information for tax purposes. Having a printable version of the form makes it convenient and easy to access when needed, helping to maintain efficiency and accuracy in financial operations.